- Taiwan

- /

- Consumer Durables

- /

- TWSE:2488

3 Dividend Stocks Offering Yields Up To 4.7%

Reviewed by Simply Wall St

In a week marked by mixed performances across major global indices, with the S&P 500 and Nasdaq hitting record highs while the Russell 2000 saw declines, investors are closely monitoring economic indicators and central bank policies for future market direction. Amidst these conditions, dividend stocks can offer a measure of stability and income potential, making them an attractive option for those seeking to navigate the current landscape.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.98% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.60% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.50% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.98% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.49% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.71% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.33% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.41% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.41% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.81% | ★★★★★★ |

Click here to see the full list of 1928 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

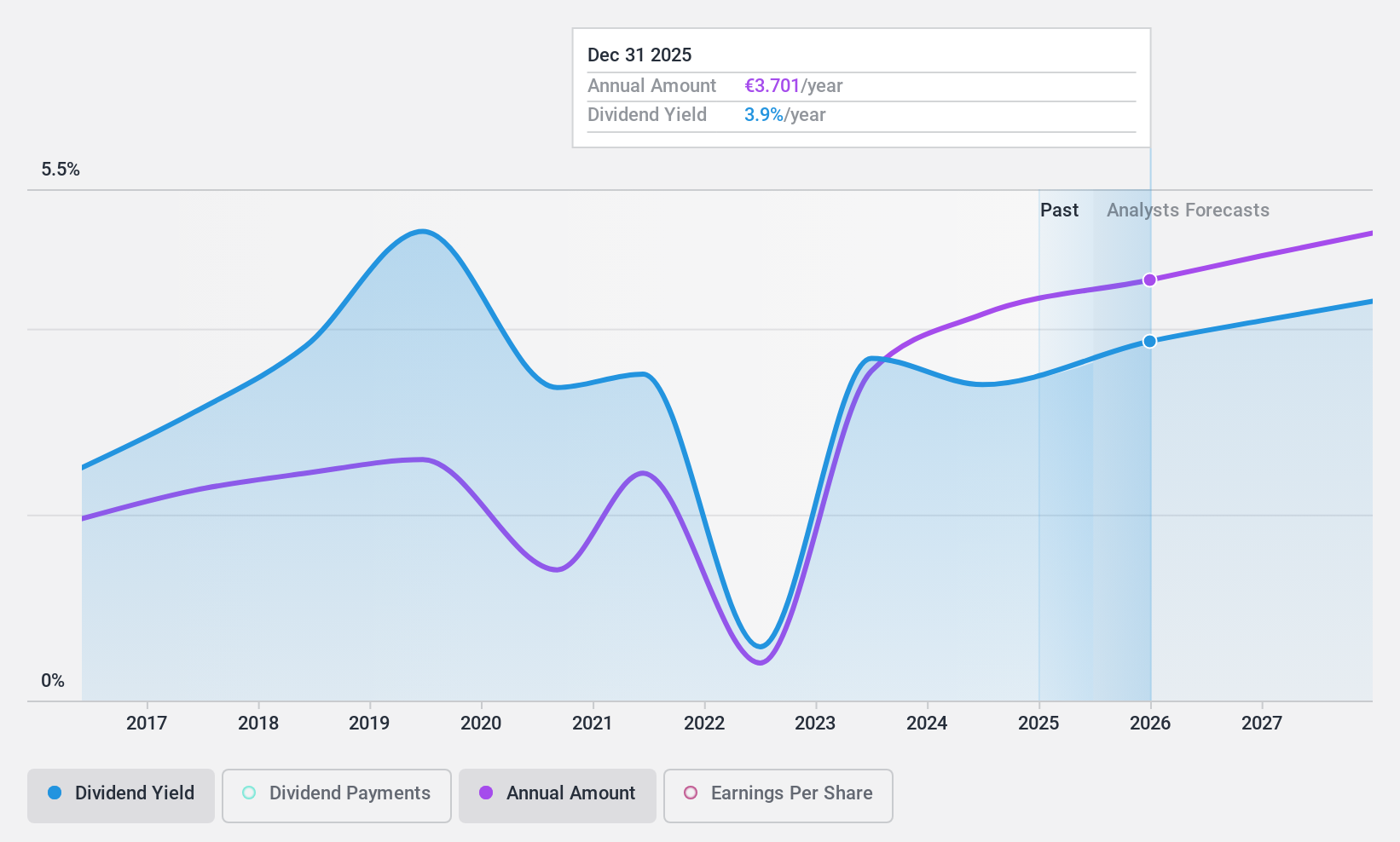

Publicis Groupe (ENXTPA:PUB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Publicis Groupe S.A. is a global company offering marketing, communications, and digital business transformation services across various regions including North America, Europe, the Asia Pacific, Latin America, Africa, and the Middle East with a market cap of €25.85 billion.

Operations: Publicis Groupe S.A. generates revenue from its Advertising and Communication Services segment, which amounts to €15.35 billion.

Dividend Yield: 3.2%

Publicis Groupe's dividend yield of 3.18% is modest compared to top French market payers, and its track record has been unstable with volatility over the past decade. However, dividends are covered by earnings (payout ratio of 54.7%) and cash flows (cash payout ratio of 64.2%). Recent expansions, such as LePub's global growth and strategic partnerships like Mondelez’s AI platform, may influence future financial stability and dividend sustainability despite current challenges in maintaining consistent payouts.

- Click here to discover the nuances of Publicis Groupe with our detailed analytical dividend report.

- Our valuation report unveils the possibility Publicis Groupe's shares may be trading at a discount.

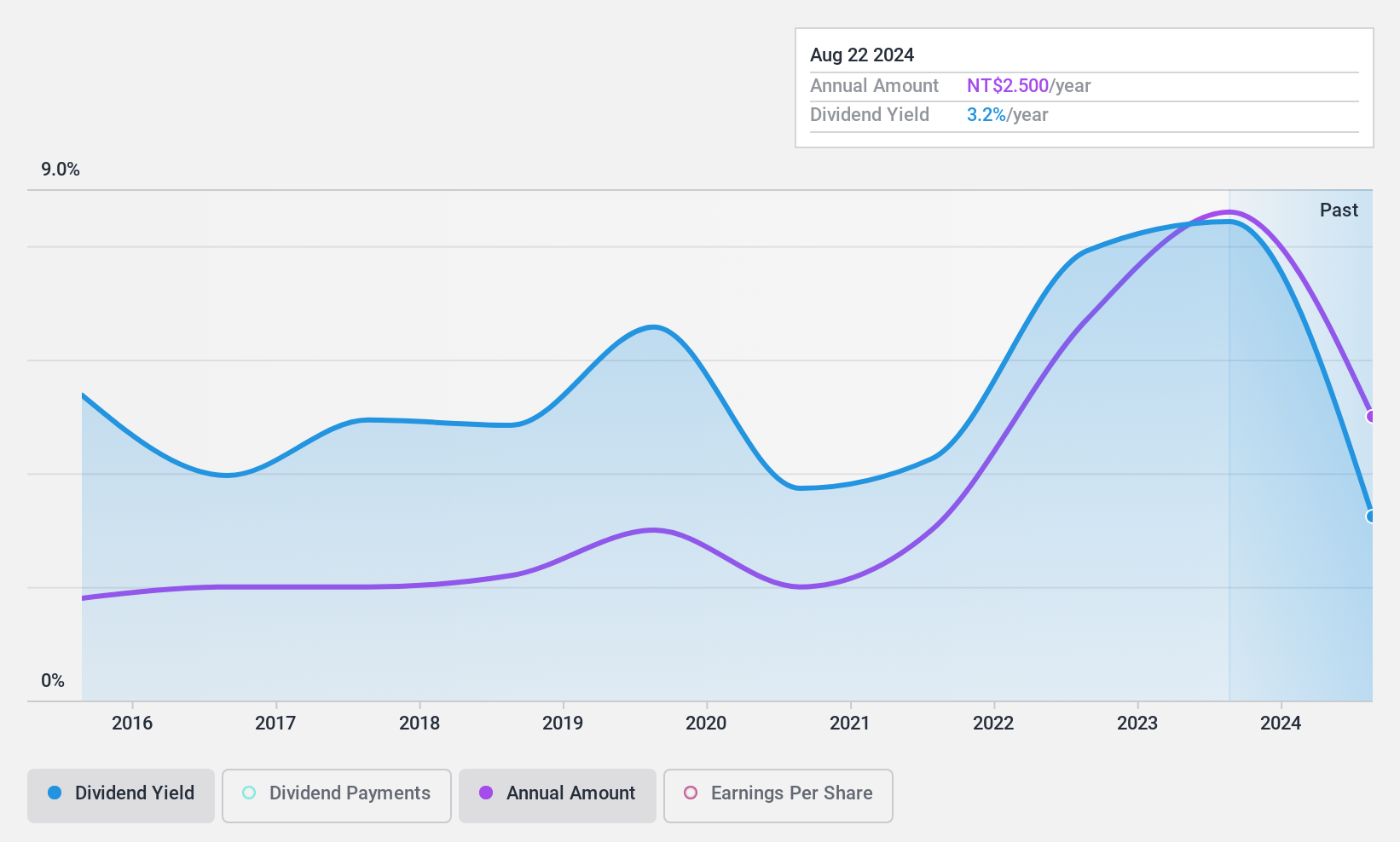

Macnica Galaxy (TPEX:6227)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Macnica Galaxy Inc., along with its subsidiaries, operates in the agency trading and technical service of semiconductor electronic components across Taiwan, the rest of Asia, and internationally, with a market cap of NT$5.88 billion.

Operations: Macnica Galaxy Inc.'s revenue segments include NT$10.72 billion from Macnica Galaxy Inc. and NT$1.34 billion from Macnica Galaxy International.

Dividend Yield: 3.2%

Macnica Galaxy's dividend yield of 3.23% is modest compared to Taiwan's top payers, and its track record shows volatility over the past decade. Despite this, dividends are well-covered by earnings with a payout ratio of 48.3% and cash flows with a cash payout ratio of 7.2%. Recent financials reveal stable net income despite declining sales, indicating potential for future dividend sustainability if earnings growth continues at the previous rate of 18.4% annually over five years.

- Dive into the specifics of Macnica Galaxy here with our thorough dividend report.

- Our valuation report here indicates Macnica Galaxy may be undervalued.

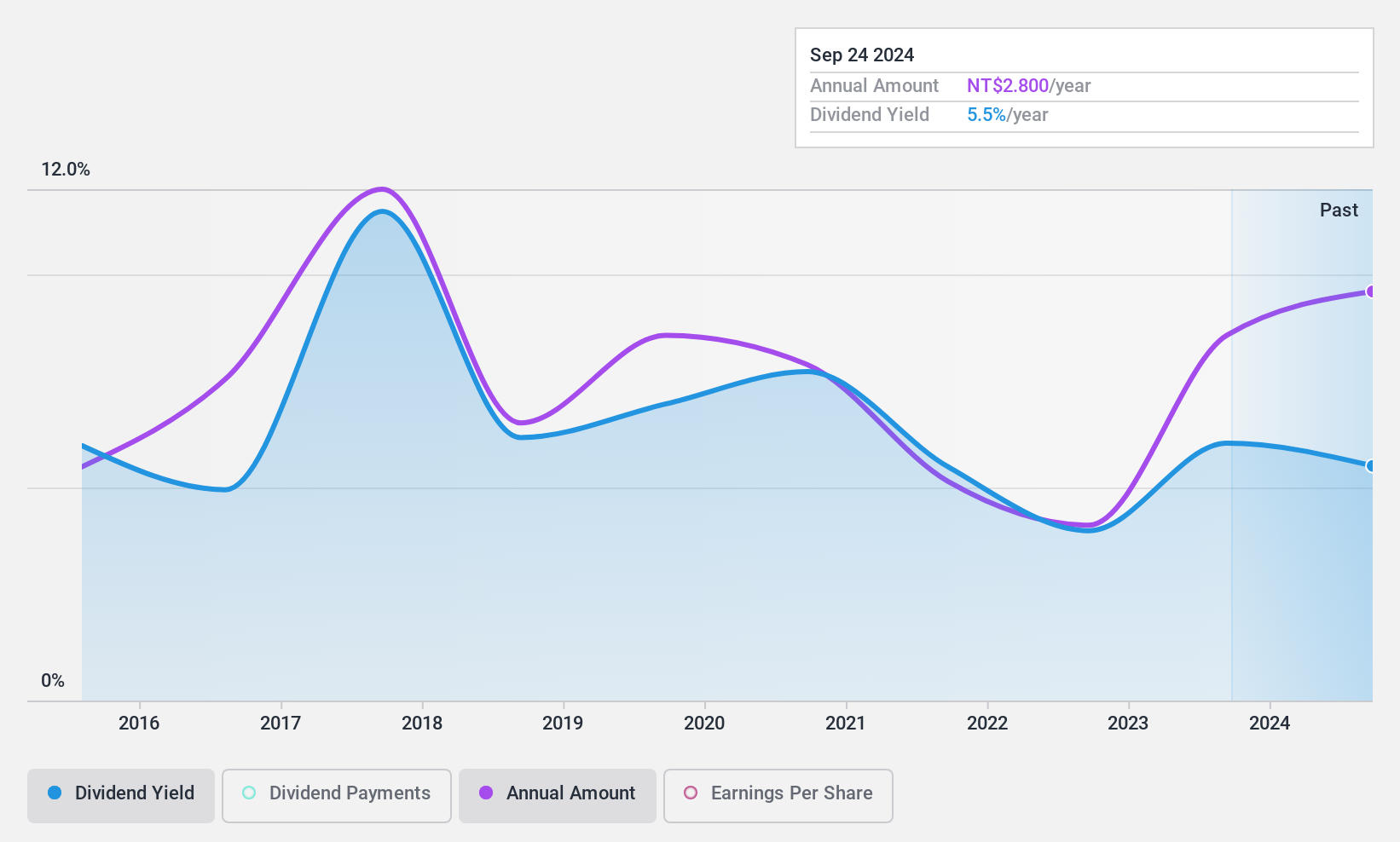

Hanpin Electron (TWSE:2488)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Hanpin Electron Co., Ltd. designs, manufactures, and sells electronic consumer products, professional audio products, and professional DJ equipment in Taiwan, China, Hong Kong, and Singapore with a market cap of NT$4.68 billion.

Operations: Hanpin Electron Co., Ltd. generates revenue primarily from its Audio Department, which reported NT$2.76 billion.

Dividend Yield: 4.8%

Hanpin Electron's dividend yield of 4.79% ranks in the top 25% of Taiwan's market, but its dividend history is marked by volatility and unreliability over the past decade. Despite this, dividends are well-covered by both earnings and cash flows, with a payout ratio of 60.1% and a cash payout ratio of 24.7%. Recent financials show increased sales but declining quarterly net income, suggesting potential challenges for consistent future dividend growth despite overall profit growth.

- Get an in-depth perspective on Hanpin Electron's performance by reading our dividend report here.

- The analysis detailed in our Hanpin Electron valuation report hints at an deflated share price compared to its estimated value.

Turning Ideas Into Actions

- Embark on your investment journey to our 1928 Top Dividend Stocks selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hanpin Electron might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2488

Hanpin Electron

Designs, manufactures, and sells electronic consumer products, professional audio products, and professional DJ equipment in Taiwan, China, Hong Kong, and Singapore.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives