- Germany

- /

- Entertainment

- /

- XTRA:VXT

European Market Insights: Qwamplify And 2 Promising Penny Stocks To Watch

Reviewed by Simply Wall St

Amid renewed uncertainty surrounding U.S. trade policy and escalating geopolitical tensions in the Middle East, European markets have experienced a downturn, with major indexes like Germany's DAX and Italy's FTSE MIB seeing significant declines. For investors willing to explore beyond well-known names, penny stocks—often representing smaller or newer companies—remain an intriguing segment of the market. Although the term "penny stocks" might seem outdated, these investments continue to offer potential for growth when supported by strong financials.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Angler Gaming (NGM:ANGL) | SEK3.68 | SEK275.94M | ✅ 4 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €3.07 | €64.75M | ✅ 4 ⚠️ 2 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.42 | €16.53M | ✅ 2 ⚠️ 3 View Analysis > |

| Abak (WSE:ABK) | PLN4.20 | PLN11.32M | ✅ 2 ⚠️ 4 View Analysis > |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.385 | SEK2.28B | ✅ 4 ⚠️ 1 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.60 | SEK219.02M | ✅ 2 ⚠️ 2 View Analysis > |

| Nurminen Logistics Oyj (HLSE:NLG1V) | €1.068 | €86.18M | ✅ 3 ⚠️ 3 View Analysis > |

| High (ENXTPA:HCO) | €3.71 | €72.9M | ✅ 1 ⚠️ 4 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.14 | €295.46M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.972 | €32.78M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 454 stocks from our European Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Qwamplify (ENXTPA:ALQWA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Qwamplify provides digital and data marketing solutions in France and has a market cap of €11.73 million.

Operations: The company's revenue is generated from two main segments: Media, contributing €20 million, and Activation marketing, accounting for €13.52 million.

Market Cap: €11.73M

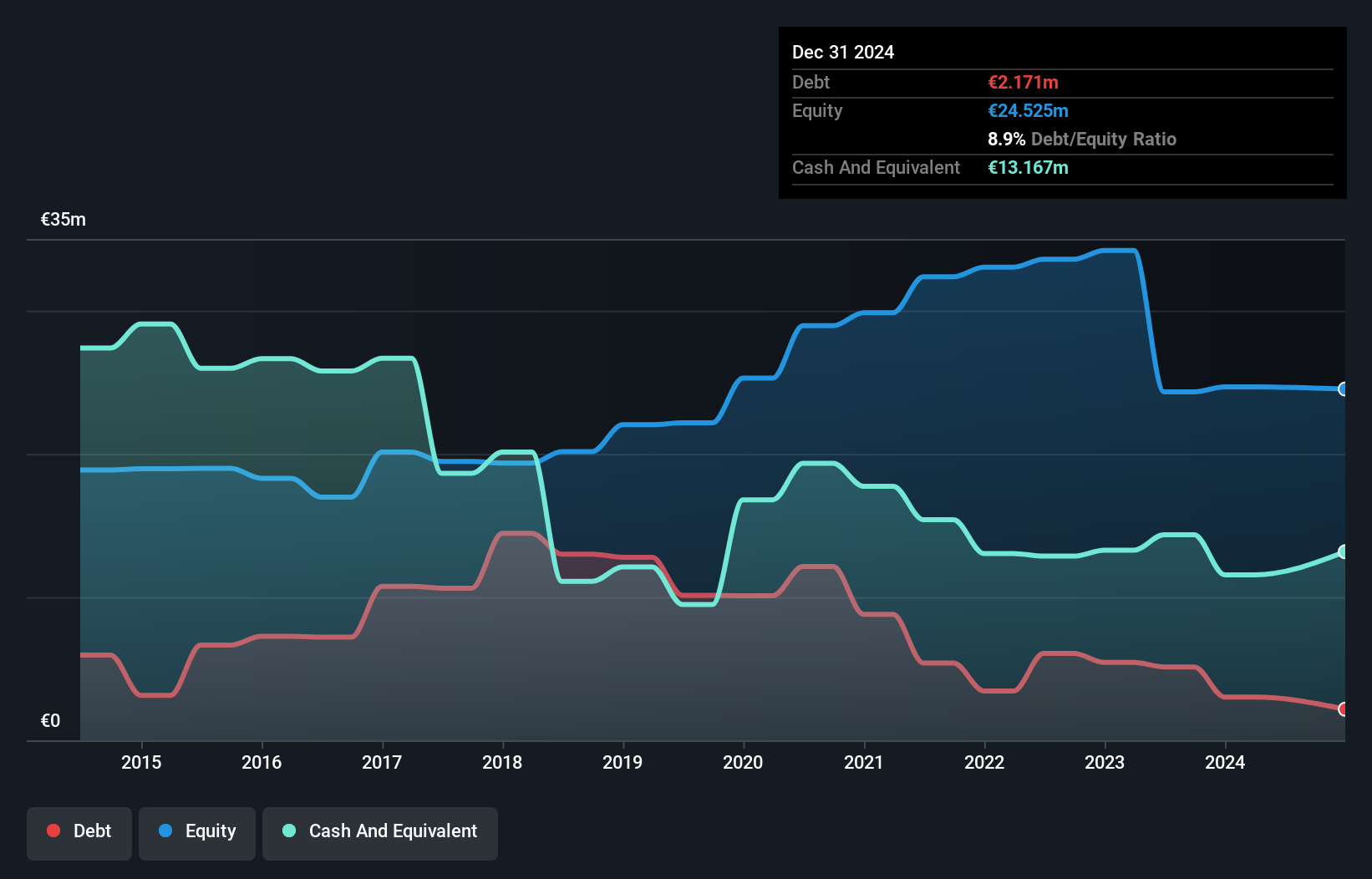

Qwamplify, with a market cap of €11.73 million, has shown financial resilience by becoming profitable in the last year, reporting a net income of €1.22 million for the fifteen months ending December 31, 2024. The company's revenue streams from Media (€20 million) and Activation marketing (€13.52 million) highlight its operational focus. Despite historical earnings declines averaging 52.6% annually over five years, recent profitability and high-quality earnings indicate potential stability for investors interested in European penny stocks. Additionally, Qwamplify's debt management is robust with cash exceeding total debt and short-term assets covering liabilities effectively.

- Navigate through the intricacies of Qwamplify with our comprehensive balance sheet health report here.

- Examine Qwamplify's past performance report to understand how it has performed in prior years.

High (ENXTPA:HCO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: High Co. SA offers consumer engagement chain solutions in France, Belgium, and Spain with a market cap of €72.90 million.

Operations: The company generates €146.38 million in revenue from its advertising segment.

Market Cap: €72.9M

High Co. SA, with a market cap of €72.90 million, operates in the advertising sector across France, Belgium, and Spain. The company reported €146.38 million in revenue for 2024 but experienced a decline in net income to €7.46 million from the previous year’s €11.12 million, reflecting challenges in earnings growth and profit margins which dropped from 7.3% to 5.3%. Despite these setbacks, High Co.'s debt management is strong with cash exceeding total debt and operating cash flow significantly covering its obligations; however, its share price remains highly volatile recently amidst an unstable dividend history despite recent increases and special payouts.

- Dive into the specifics of High here with our thorough balance sheet health report.

- Examine High's earnings growth report to understand how analysts expect it to perform.

tmc Content Group (XTRA:ERO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: tmc Content Group AG is a media company operating in Germany and Austria with a market capitalization of €6.42 million.

Operations: The company's revenue is primarily generated from Pay and Free TV, which accounts for CHF 4.27 million, followed by Audiotex at CHF 1.28 million and Internet and New Media excluding Audiotex contributing CHF 0.46 million.

Market Cap: €6.42M

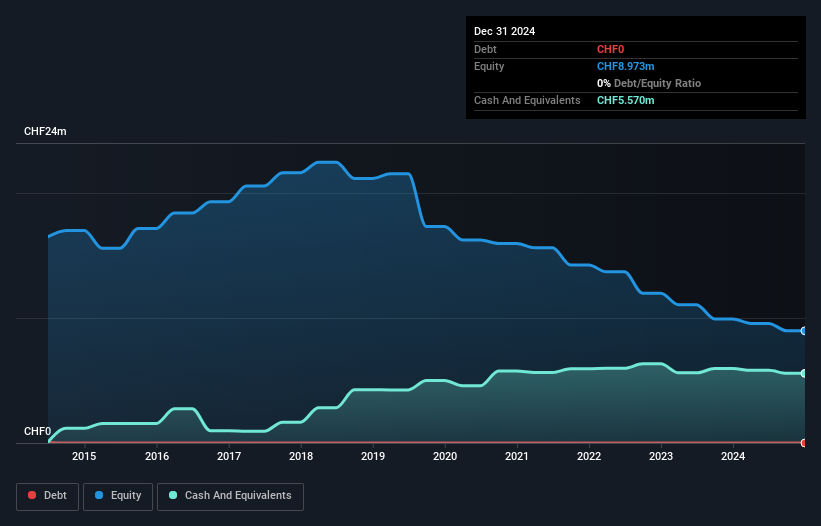

tmc Content Group AG, with a market cap of €6.42 million, operates primarily in Pay and Free TV, generating CHF 4.27 million in revenue. Despite being unprofitable with a net loss of CHF 0.88 million for 2024, the company has reduced its losses by 18.2% annually over five years and maintains a strong cash position covering liabilities without debt reliance. Recent proposals to amend its Articles of Association include capital restructuring initiatives aimed at enhancing financial flexibility amid high share price volatility and negative return on equity (-9.77%). The board is experienced with an average tenure of 6.2 years.

- Unlock comprehensive insights into our analysis of tmc Content Group stock in this financial health report.

- Learn about tmc Content Group's historical performance here.

Next Steps

- Get an in-depth perspective on all 454 European Penny Stocks by using our screener here.

- Ready For A Different Approach? The latest GPUs need a type of rare earth metal called Dysprosium and there are only 24 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:VXT

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives