Why Investors Shouldn't Be Surprised By Eutelsat Group's (EPA:ETL) 106% Share Price Surge

Eutelsat Group (EPA:ETL) shares have had a really impressive month, gaining 106% after a shaky period beforehand. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 2.1% over the last year.

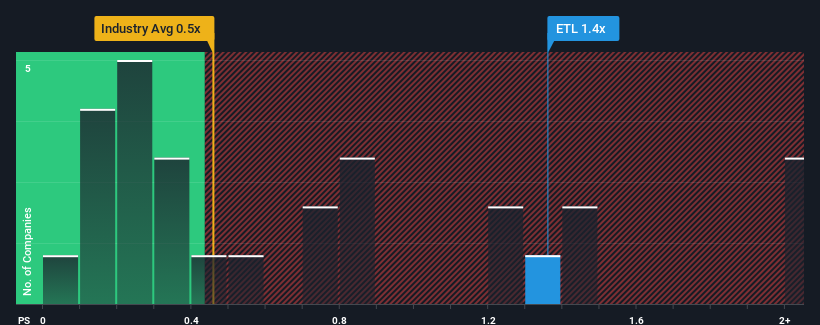

Following the firm bounce in price, given close to half the companies operating in France's Media industry have price-to-sales ratios (or "P/S") below 0.5x, you may consider Eutelsat Group as a stock to potentially avoid with its 1.4x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Eutelsat Group

What Does Eutelsat Group's P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, Eutelsat Group has been relatively sluggish. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. If not, then existing shareholders may be very nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Eutelsat Group.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Eutelsat Group would need to produce impressive growth in excess of the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 10%. The solid recent performance means it was also able to grow revenue by 5.9% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 6.3% each year during the coming three years according to the nine analysts following the company. That's shaping up to be materially higher than the 2.3% per annum growth forecast for the broader industry.

In light of this, it's understandable that Eutelsat Group's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Eutelsat Group's P/S

Eutelsat Group's P/S is on the rise since its shares have risen strongly. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look into Eutelsat Group shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

Having said that, be aware Eutelsat Group is showing 2 warning signs in our investment analysis, you should know about.

If you're unsure about the strength of Eutelsat Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Eutelsat Communications might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ETL

Good value with imperfect balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026