Investors five-year losses continue as Eutelsat Group (EPA:ETL) dips a further 3.6% this week, earnings continue to decline

We think intelligent long term investing is the way to go. But no-one is immune from buying too high. Zooming in on an example, the Eutelsat Group (EPA:ETL) share price dropped 76% in the last half decade. That's an unpleasant experience for long term holders. We also note that the stock has performed poorly over the last year, with the share price down 54%. Shareholders have had an even rougher run lately, with the share price down 30% in the last 90 days.

After losing 3.6% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

View our latest analysis for Eutelsat Group

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

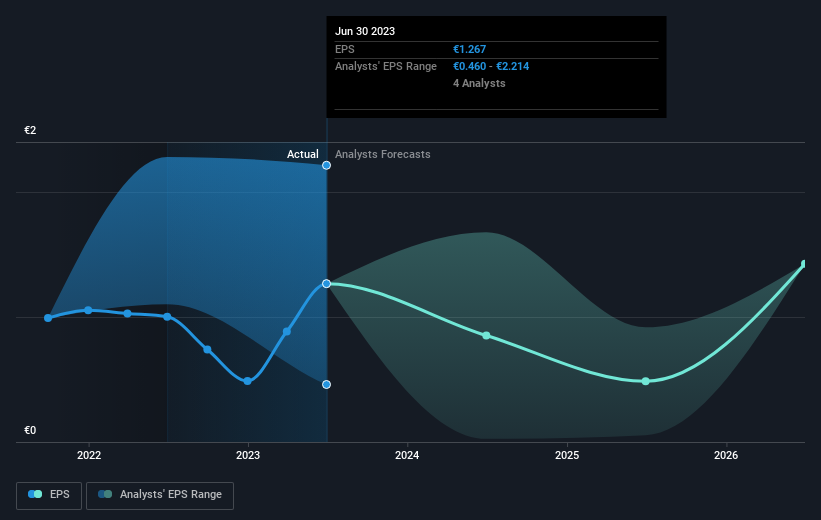

During the five years over which the share price declined, Eutelsat Group's earnings per share (EPS) dropped by 12% each year. Readers should note that the share price has fallen faster than the EPS, at a rate of 25% per year, over the period. This implies that the market is more cautious about the business these days. The low P/E ratio of 6.50 further reflects this reticence.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We know that Eutelsat Group has improved its bottom line lately, but is it going to grow revenue? If you're interested, you could check this free report showing consensus revenue forecasts.

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Eutelsat Group's total shareholder return (TSR) and its share price change, which we've covered above. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Its history of dividend payouts mean that Eutelsat Group's TSR, which was a 64% drop over the last 5 years, was not as bad as the share price return.

A Different Perspective

While the broader market gained around 9.1% in the last year, Eutelsat Group shareholders lost 49%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 10% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Eutelsat Group is showing 3 warning signs in our investment analysis , and 1 of those shouldn't be ignored...

But note: Eutelsat Group may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on French exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Eutelsat Communications might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ETL

Fair value with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives