A Look at Eutelsat (ENXTPA:ETL) Valuation Following Sébastien Rouge’s CFO Appointment and Leadership Transition

Reviewed by Simply Wall St

Eutelsat Communications (ENXTPA:ETL) is preparing for a leadership transition and has appointed Sébastien Rouge as Chief Financial Officer, effective February 2026. Rouge’s deep experience across global industrial and technology sectors stands out in this move.

See our latest analysis for Eutelsat Communications.

Eutelsat’s recent CFO appointment comes as the stock recovers some ground, with a 5.6% share price return over the past quarter and a remarkable 48.7% gain year-to-date. However, momentum has not fully reversed longer-term trends. The one-year total shareholder return remains negative at -12.5%, highlighting that confidence in a sustained turnaround is still building.

If executive shakeups like this have you watching for potential rebounds, it might be a great moment to broaden your search and discover fast growing stocks with high insider ownership

But with the shares rallying this year and trading just below analysts’ target price, investors must now ask whether Eutelsat remains undervalued or if the stock is already factoring in any future growth potential.

Most Popular Narrative: 3.2% Undervalued

The prevailing narrative implies Eutelsat’s fair value is slightly above the last close, hinting at a modest undervaluation and forward-looking optimism in its fundamentals. Context for this view centers around recent moves to invest in new technology and shift resources for future growth, setting up stronger long-term prospects.

The planned procurement of 100 LEO satellites by the end of 2026 and the expected financing plan for further expansion reflect a forward-looking strategic positioning that anticipates market demand shifts towards LEO solutions. This approach suggests the potential for long-term revenue growth and improved competitive positioning.

Ever wondered what bold bets are driving Eutelsat’s future value? This narrative leans on ambitious satellite rollouts and a dramatic strategic shift, banking on numbers you might not expect. The assumptions behind the fair value could surprise you. Uncover the figures and projections powering this story.

Result: Fair Value of €3.39 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing competition in GEO satellites and slower recovery in video services could present challenges for Eutelsat’s long-term revenue growth, despite these bold expansion plans.

Find out about the key risks to this Eutelsat Communications narrative.

Another View: Looking at Price Ratios

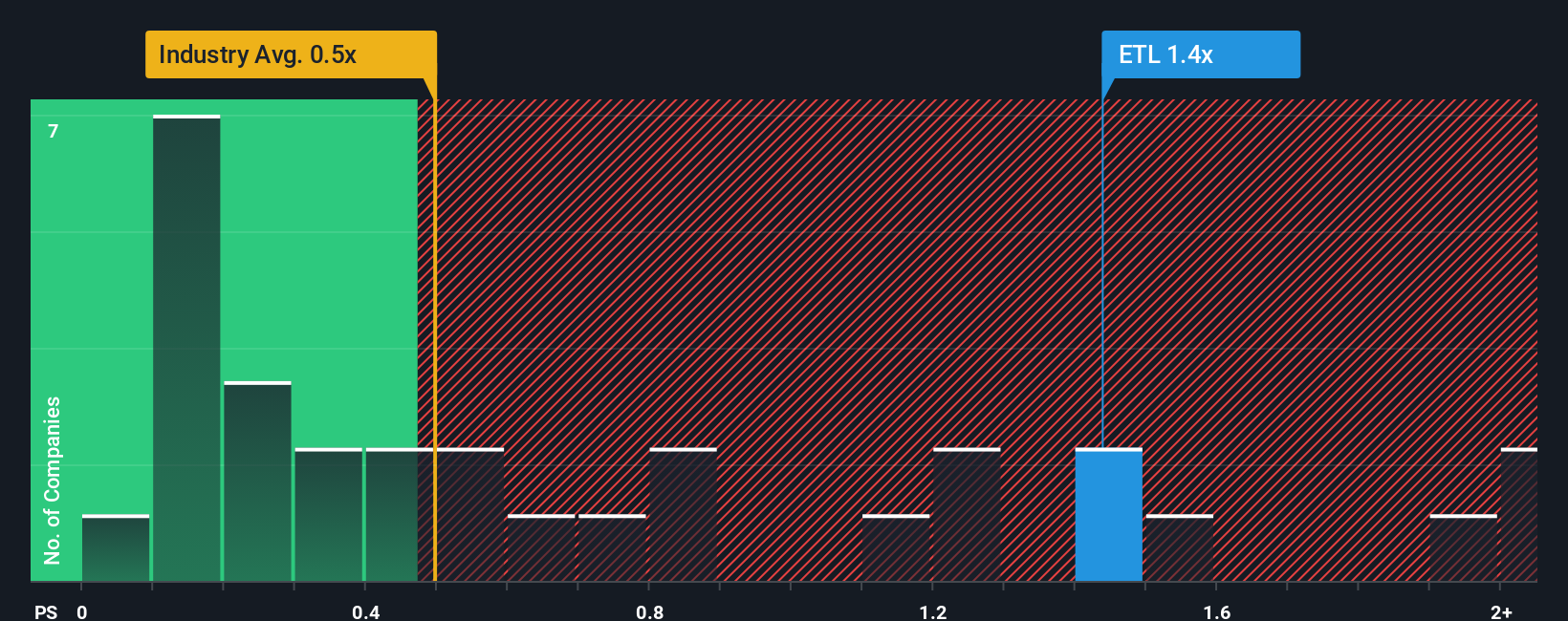

Switching gears to look at price ratios, Eutelsat’s current price-to-sales ratio is 1.3x. This makes the stock appear more expensive than both its French media peers (average 0.7x) and the broader industry (0.5x). However, it is still trading below its fair ratio of 1.8x, which hints at a mixed valuation picture that could swing either way depending on how sentiment shifts.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Eutelsat Communications Narrative

If you see things differently or want to dig into the numbers yourself, it only takes a few minutes to develop your own perspective. Do it your way

A great starting point for your Eutelsat Communications research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Act now to find your next standout investment. Simply Wall St's powerful screeners surface proven opportunities you won't want to miss while others hesitate.

- Tap into tomorrow’s leaders by reviewing these 27 AI penny stocks making breakthroughs in artificial intelligence, automation, and machine learning applications.

- Secure consistent income and grow your portfolio by exploring reliable dividend payers. Start with these 15 dividend stocks with yields > 3% for strong yields and financial strength.

- Position yourself early in the digital transformation by evaluating these 82 cryptocurrency and blockchain stocks powering innovations in decentralized platforms and blockchain ecosystems.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eutelsat Communications might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ETL

Fair value with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives