As European markets grapple with concerns over inflated AI stock valuations and shifting expectations for U.S. interest rate policies, investors are seeking stability in dividend stocks. In such a climate, identifying stocks with strong fundamentals and consistent dividend payouts can offer a measure of resilience amid market volatility.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.44% | ★★★★★★ |

| Sulzer (SWX:SUN) | 3.22% | ★★★★★☆ |

| Sonae SGPS (ENXTLS:SON) | 4.03% | ★★★★★☆ |

| Holcim (SWX:HOLN) | 4.29% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.99% | ★★★★★★ |

| freenet (XTRA:FNTN) | 6.71% | ★★★★★☆ |

| Evolution (OM:EVO) | 4.83% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.25% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.68% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.66% | ★★★★★★ |

Click here to see the full list of 222 stocks from our Top European Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

Piquadro (BIT:PQ)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Piquadro S.p.A. designs, produces, and markets leather goods and accessories in Italy, Europe, and worldwide with a market cap of €110.99 million.

Operations: Piquadro's revenue is segmented into Lancel (€70.14 million), Piquadro (€80.14 million), and The Bridge (€36.57 million).

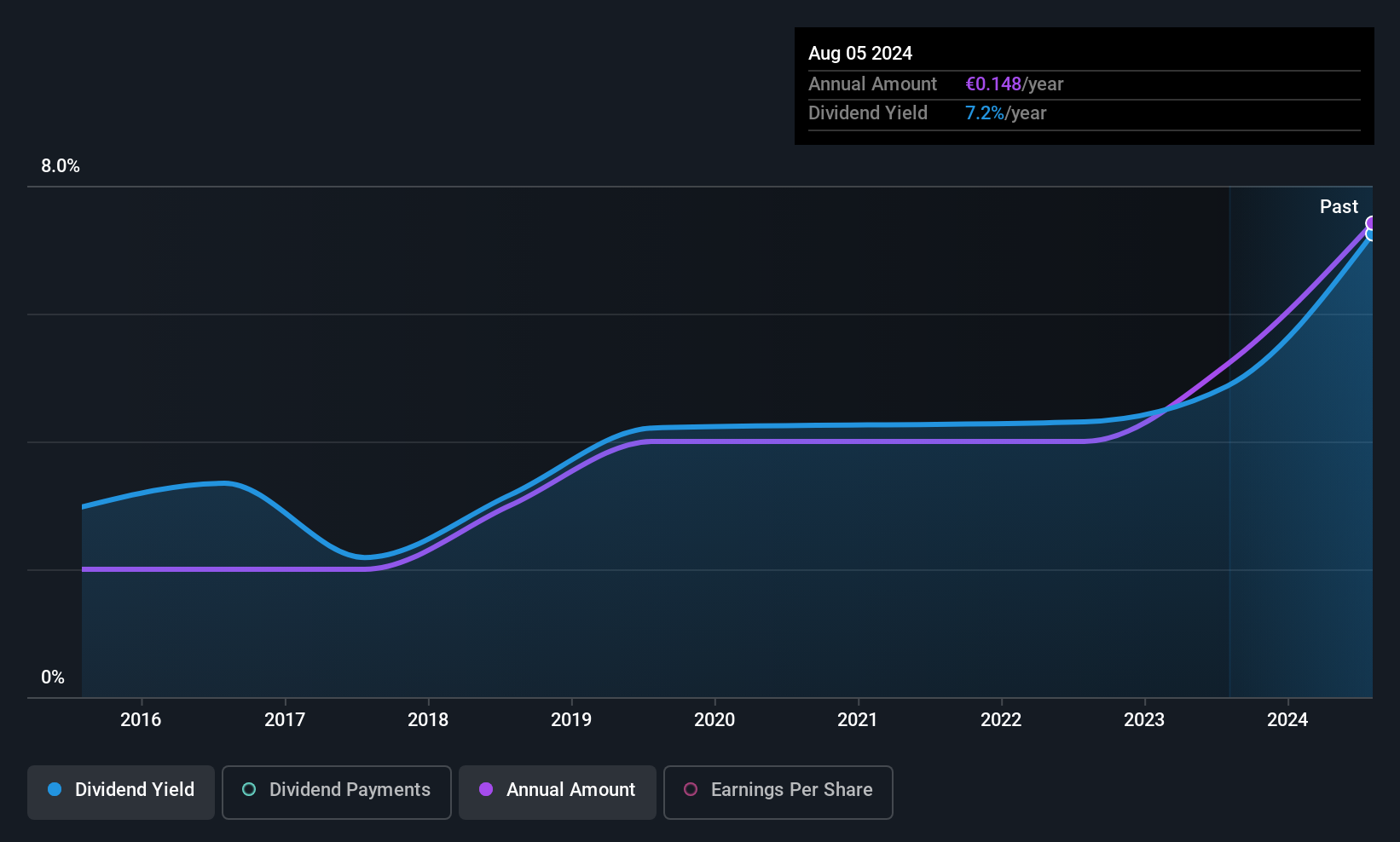

Dividend Yield: 6.3%

Piquadro offers an attractive dividend yield, ranking in the top 25% of Italian market payers. Its price-to-earnings ratio of 9.6x suggests good value compared to the broader Italian market. While dividend payments have grown over the past decade, they have been volatile and unreliable at times. Nevertheless, dividends are well-covered by both earnings and cash flows with payout ratios of 60.4% and 45.4%, respectively, supported by a recent earnings growth of 10%.

- Unlock comprehensive insights into our analysis of Piquadro stock in this dividend report.

- The valuation report we've compiled suggests that Piquadro's current price could be inflated.

JCDecaux (ENXTPA:DEC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: JCDecaux SE is a global outdoor advertising company with a market cap of €3.19 billion.

Operations: JCDecaux SE's revenue is primarily derived from three segments: Street Furniture (€2.03 billion), Transport (€1.41 billion), and Billboard (€548.70 million).

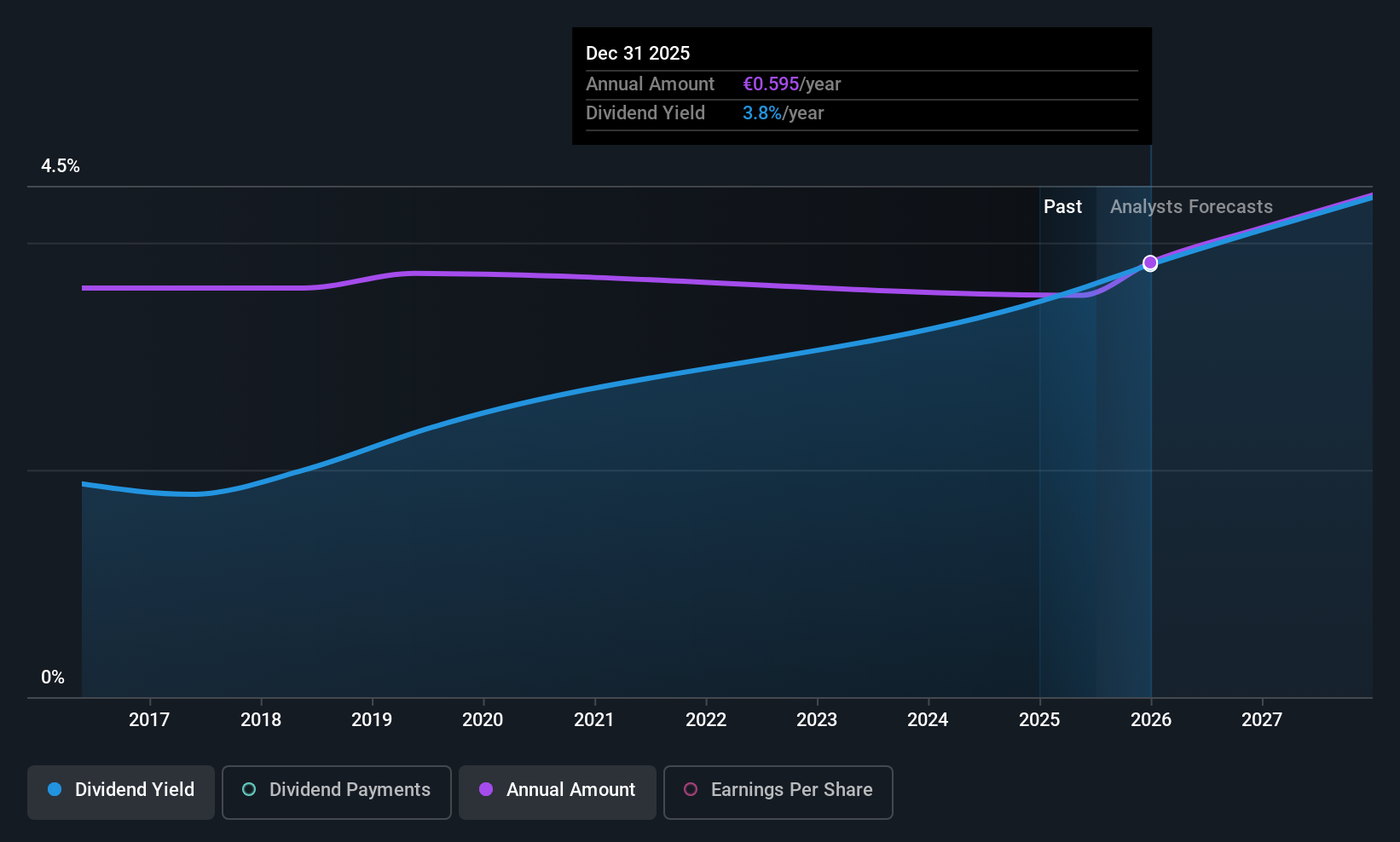

Dividend Yield: 3.7%

JCDecaux's dividend yield is modest compared to top French payers, but dividends are well-covered by earnings and cash flows, with payout ratios of 49% and 15.1%, respectively. Despite a history of volatility in payments, dividends have grown over the past decade. The company trades at a favorable price-to-earnings ratio of 13.3x against the French market average. Recent contract wins in Brussels and Sao Paulo enhance revenue potential but high debt levels remain a concern.

- Click here to discover the nuances of JCDecaux with our detailed analytical dividend report.

- Our expertly prepared valuation report JCDecaux implies its share price may be lower than expected.

Wacker Neuson (XTRA:WAC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Wacker Neuson SE manufactures and distributes light and compact equipment in Germany, Austria, the United States, and internationally, with a market cap of €1.27 billion.

Operations: Wacker Neuson SE generates its revenue through the manufacturing and distribution of light and compact equipment across various international markets, including Germany, Austria, and the United States.

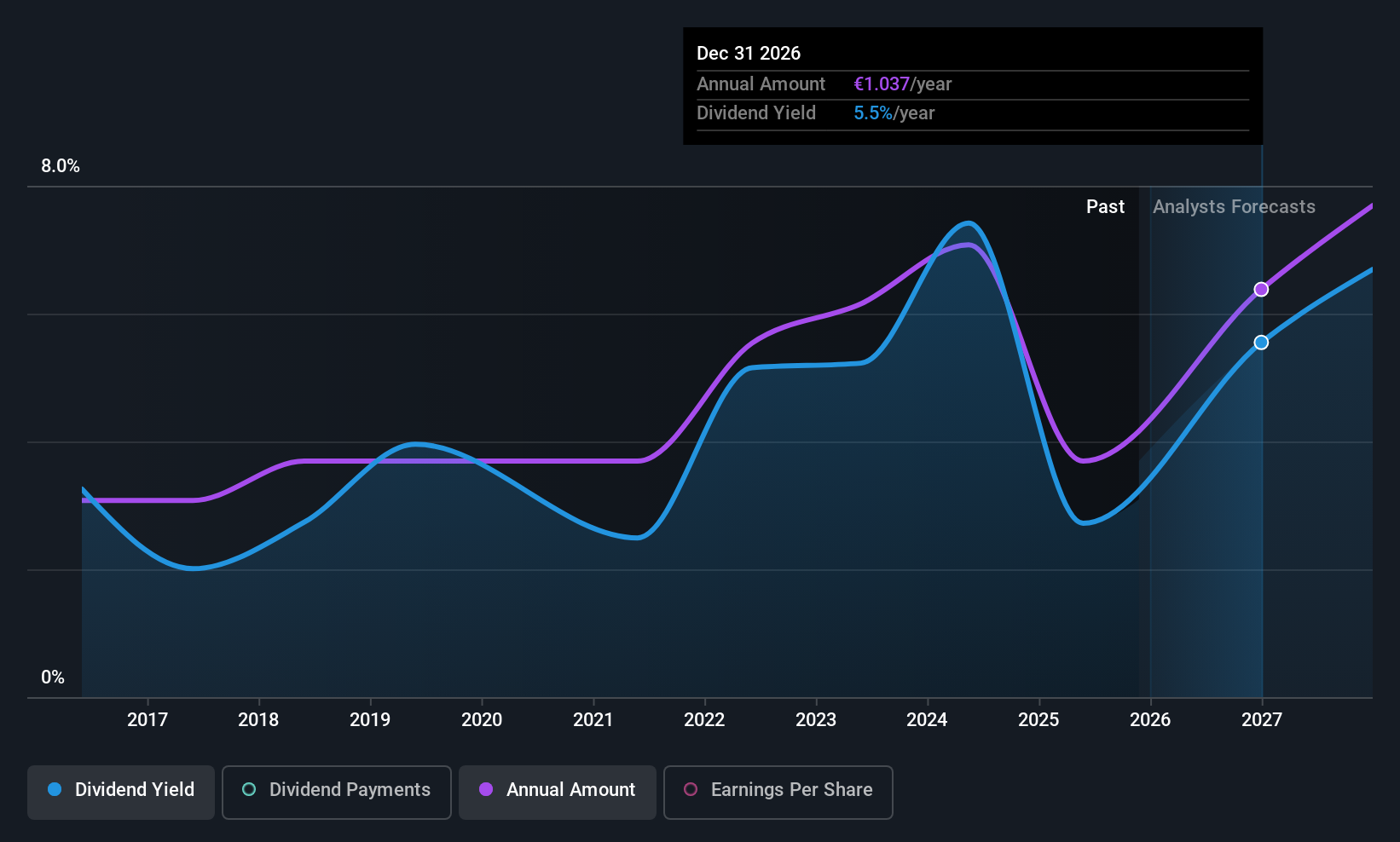

Dividend Yield: 3.2%

Wacker Neuson's dividend yield is lower than Germany's top payers, yet dividends are well-supported by earnings and cash flow, with payout ratios of 66% and 19.1%, respectively. Despite past volatility, dividends have grown over the last decade. Recent guidance narrowed due to weaker US demand and higher tariffs, though Q3 earnings showed improvement with net income rising to €26.7 million from €9.7 million year-over-year, reflecting resilience amidst market challenges.

- Get an in-depth perspective on Wacker Neuson's performance by reading our dividend report here.

- According our valuation report, there's an indication that Wacker Neuson's share price might be on the cheaper side.

Next Steps

- Unlock our comprehensive list of 222 Top European Dividend Stocks by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:DEC

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

The AI Infrastructure Giant Grows Into Its Valuation

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success