Do JCDecaux’s Recent Sales Figures Reveal Shifting Revenue Momentum for ENXTPA:DEC?

Reviewed by Sasha Jovanovic

- JCDecaux SE recently announced its third quarter 2025 sales, reporting €926.1 million in revenue, compared to €948.2 million during the same period last year, and €2.79 billion for the first nine months of 2025.

- This sales update gives investors a detailed view of recent operational performance, highlighting trends in the company's revenue momentum throughout the year.

- We'll explore how the recent quarterly sales figures may influence JCDecaux's future revenue expectations and core investment themes.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

JCDecaux Investment Narrative Recap

JCDecaux’s investment appeal hinges on confidence in a structural digital transformation of out-of-home advertising, strong municipal partnerships, and continued urbanization trends. The recent third-quarter sales dip, €926.1 million from €948.2 million in the prior year, does not appear to materially affect the near-term catalyst of digital growth, but keeps pressure on execution and market recovery, while ongoing underperformance in key markets like China remains a significant risk that could weigh on future profitability if trends persist.

Among recent announcements, the exclusive 10-year contract for Barcelona’s bus shelters and city panels stands out, especially given its plan to add 300 new digital screens, showing material progress on JCDecaux’s digital and sustainability ambitions. In the context of soft overall sales, such client wins reinforce the central investment thesis of digital expansion, though investors should remain attentive to execution risks in challenging regions.

By contrast, potential regulatory hurdles for digitizing inventory in core European markets remain a crucial risk investors should not overlook if...

Read the full narrative on JCDecaux (it's free!)

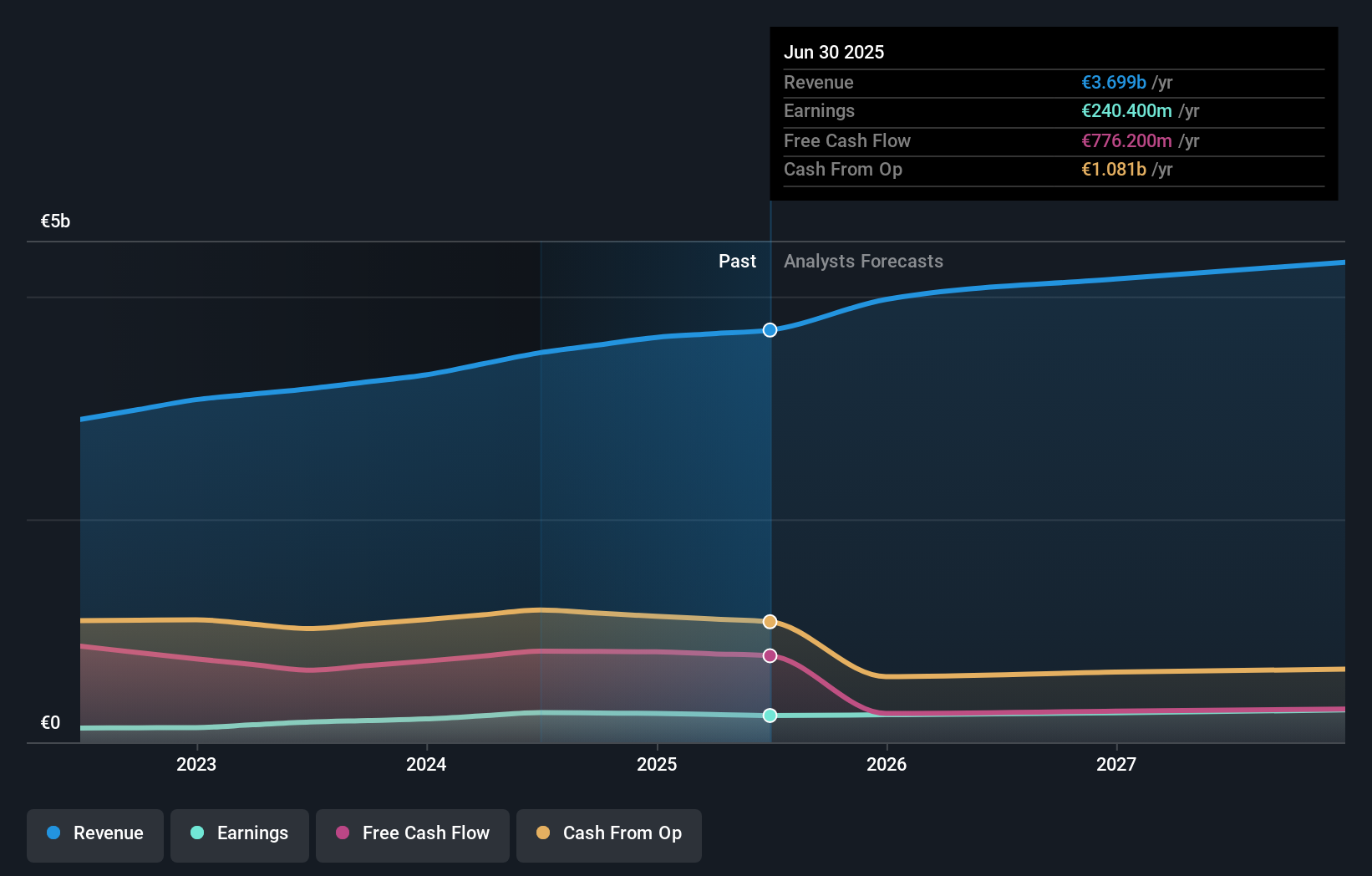

JCDecaux's narrative projects €4.4 billion revenue and €306.8 million earnings by 2028. This requires 5.9% yearly revenue growth and a €66.4 million earnings increase from €240.4 million today.

Uncover how JCDecaux's forecasts yield a €18.75 fair value, a 23% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members’ fair value estimates span from €11.18 to €18.75 based on two independent analyses. While many are optimistic about digital programmatic growth, ongoing softness in key markets could temper performance well beyond quarter-to-quarter sales fluctuations, explore these alternative views to broaden your understanding.

Explore 2 other fair value estimates on JCDecaux - why the stock might be worth as much as 23% more than the current price!

Build Your Own JCDecaux Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your JCDecaux research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free JCDecaux research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate JCDecaux's overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:DEC

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives