- Finland

- /

- Life Sciences

- /

- HLSE:NANOFH

June 2025's European Penny Stocks To Watch

Reviewed by Simply Wall St

As European markets navigate through a period of heightened global uncertainty and persistent inflation pressures, investors are increasingly seeking opportunities beyond traditional blue-chip stocks. Penny stocks, often smaller or newer companies, continue to capture attention for their potential to offer a mix of affordability and growth. Despite the term feeling somewhat outdated, these stocks remain relevant as they can provide compelling opportunities when backed by strong financials.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Mistral Iberia Real Estate SOCIMI (BME:YMIB) | €1.03 | €19.6M | ✅ 2 ⚠️ 4 View Analysis > |

| KebNi (OM:KEBNI B) | SEK1.976 | SEK535.8M | ✅ 3 ⚠️ 4 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.77 | SEK282.69M | ✅ 4 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €2.91 | €61.38M | ✅ 4 ⚠️ 2 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.41 | €16.49M | ✅ 2 ⚠️ 3 View Analysis > |

| Libertas 7 (BME:LIB) | €1.83 | €39M | ✅ 3 ⚠️ 4 View Analysis > |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.37 | SEK2.27B | ✅ 4 ⚠️ 1 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.74 | SEK227.54M | ✅ 2 ⚠️ 2 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.065 | €285.1M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.976 | €32.91M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 456 stocks from our European Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

MotorK (ENXTAM:MTRK)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: MotorK plc, with a market cap of €185.81 million, offers software-as-a-service solutions for the automotive retail industry across Italy, Spain, France, Germany, and the Benelux Union.

Operations: The company's revenue is primarily derived from its Software & Programming segment, which generated €40.33 million.

Market Cap: €185.81M

MotorK plc, with a market cap of €185.81 million, is navigating the penny stock landscape with a focus on strategic growth and operational restructuring. Despite being unprofitable and having high volatility, it has managed to reduce its debt significantly over five years and maintain stable share prices recently. Recent leadership changes aim to enhance strategic positioning in the EMEA market, with Co-Founder Marco Marlia transitioning to President to drive business development while Amir Rosentuler steps in as interim CEO. The company has raised additional capital through private placements, indicating efforts to bolster financial stability amidst short-term liabilities challenges.

- Click to explore a detailed breakdown of our findings in MotorK's financial health report.

- Review our growth performance report to gain insights into MotorK's future.

Reworld Media Société Anonyme (ENXTPA:ALREW)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Reworld Media Société Anonyme operates in the thematic media sector in France and has a market cap of €88.25 million.

Operations: Reworld Media generates its revenue from two main segments: B to B, contributing €308.6 million, and B to C, accounting for €226.1 million.

Market Cap: €88.25M

Reworld Media Société Anonyme, with a market cap of €88.25 million, presents a mixed picture in the penny stock arena. The company has stable revenue streams from its B to B and B to C segments but faces challenges like declining earnings forecasts and high volatility compared to most French stocks. Despite these hurdles, Reworld Media's management is experienced, and its debt levels have improved over time. However, short-term liabilities exceed assets, posing financial risks. Recent announcements include an annual dividend of €0.02 per share and full-year 2024 results showing slight declines in sales and net income compared to the previous year.

- Navigate through the intricacies of Reworld Media Société Anonyme with our comprehensive balance sheet health report here.

- Learn about Reworld Media Société Anonyme's future growth trajectory here.

Nanoform Finland Oyj (HLSE:NANOFH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Nanoform Finland Oyj provides nanotechnology and drug particle engineering services to the pharma and biotech industries in Europe and the United States, with a market cap of €99.22 million.

Operations: The company generates revenue of €3.94 million from its expert services in nanotechnology and drug particle engineering.

Market Cap: €99.22M

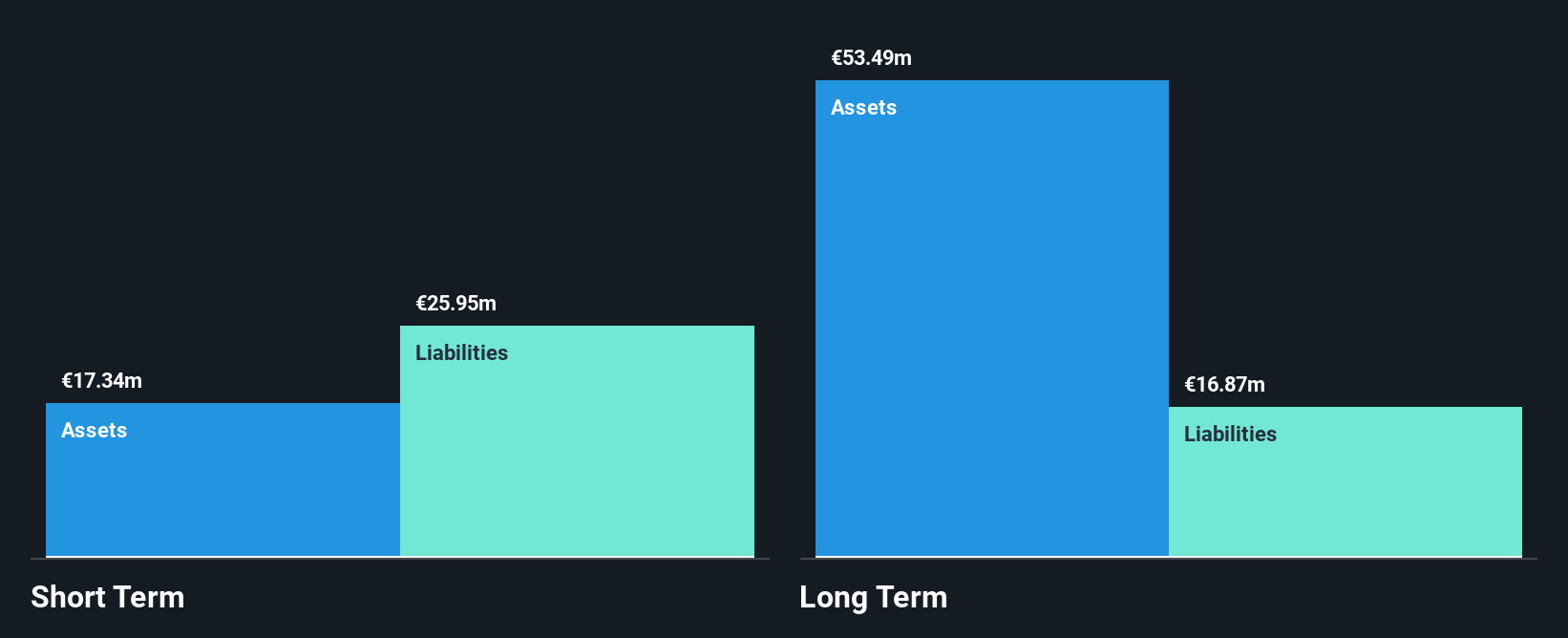

Nanoform Finland Oyj, with a market cap of €99.22 million, is navigating the penny stock landscape with a focus on innovative nanotechnology solutions for the pharma and biotech sectors. Despite generating €3.94 million in revenue, the company remains pre-revenue and unprofitable, with no profitability expected in the next three years. However, Nanoform's debt-free status and seasoned management team provide some stability amidst high share price volatility. Recent developments include securing a €5 million R&D loan for nanoapalutamide clinical trials and initiating pivotal bioequivalence studies for Nanoenzalutamide, aiming to enhance patient treatment options in prostate cancer therapy.

- Take a closer look at Nanoform Finland Oyj's potential here in our financial health report.

- Gain insights into Nanoform Finland Oyj's future direction by reviewing our growth report.

Where To Now?

- Investigate our full lineup of 456 European Penny Stocks right here.

- Seeking Other Investments? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 24 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nanoform Finland Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:NANOFH

Nanoform Finland Oyj

Engages in the provision of nanotechnology and drug particle engineering services for the pharma and biotech industries in Europe and the United States.

Flawless balance sheet low.

Market Insights

Community Narratives