- France

- /

- Entertainment

- /

- ENXTPA:ALPUL

After Leaping 28% Pullup Entertainment Société anonyme (EPA:ALPUL) Shares Are Not Flying Under The Radar

Pullup Entertainment Société anonyme (EPA:ALPUL) shareholders would be excited to see that the share price has had a great month, posting a 28% gain and recovering from prior weakness. But the last month did very little to improve the 62% share price decline over the last year.

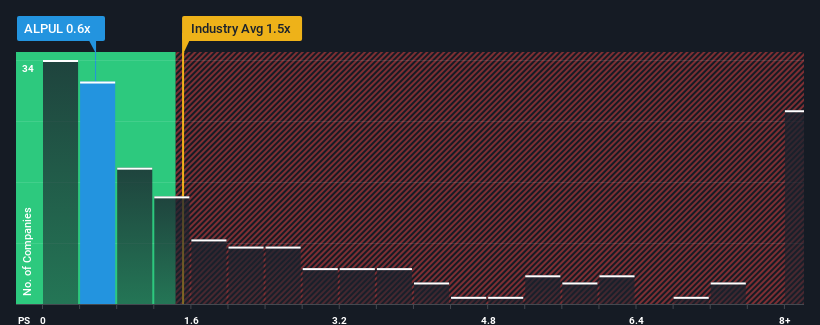

Although its price has surged higher, there still wouldn't be many who think Pullup Entertainment Société anonyme's price-to-sales (or "P/S") ratio of 0.6x is worth a mention when the median P/S in France's Entertainment industry is similar at about 0.9x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Pullup Entertainment Société anonyme

How Has Pullup Entertainment Société anonyme Performed Recently?

With only a limited decrease in revenue compared to most other companies of late, Pullup Entertainment Société anonyme has been doing relatively well. Perhaps the market is expecting future revenue performance fall back in line with the poorer industry performance, which has kept the P/S contained. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. In saying that, existing shareholders probably aren't too pessimistic about the share price if the company's revenue continues outplaying the industry.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Pullup Entertainment Société anonyme.Is There Some Revenue Growth Forecasted For Pullup Entertainment Société anonyme?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Pullup Entertainment Société anonyme's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 3.5% decrease to the company's top line. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 9.6% in total. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 10% per year over the next three years. With the industry predicted to deliver 9.1% growth each year, the company is positioned for a comparable revenue result.

With this information, we can see why Pullup Entertainment Société anonyme is trading at a fairly similar P/S to the industry. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

What Does Pullup Entertainment Société anonyme's P/S Mean For Investors?

Its shares have lifted substantially and now Pullup Entertainment Société anonyme's P/S is back within range of the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

A Pullup Entertainment Société anonyme's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Entertainment industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

Before you settle on your opinion, we've discovered 3 warning signs for Pullup Entertainment Société anonyme (1 is a bit unpleasant!) that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALPUL

Pullup Entertainment Société anonyme

Develops, publishes, and distributes games worldwide.

Undervalued with slight risk.

Similar Companies

Market Insights

Community Narratives