Prismaflex International (EPA:ALPRI) May Have Issues Allocating Its Capital

When it comes to investing, there are some useful financial metrics that can warn us when a business is potentially in trouble. More often than not, we'll see a declining return on capital employed (ROCE) and a declining amount of capital employed. Basically the company is earning less on its investments and it is also reducing its total assets. So after glancing at the trends within Prismaflex International (EPA:ALPRI), we weren't too hopeful.

What Is Return On Capital Employed (ROCE)?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. To calculate this metric for Prismaflex International, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

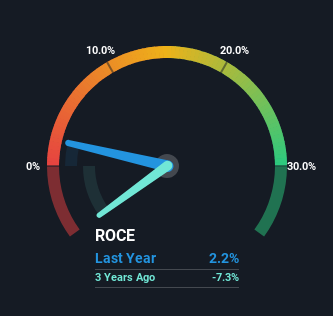

0.022 = €381k ÷ (€40m - €23m) (Based on the trailing twelve months to September 2023).

Therefore, Prismaflex International has an ROCE of 2.2%. Ultimately, that's a low return and it under-performs the Media industry average of 10%.

See our latest analysis for Prismaflex International

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you're interested in investigating Prismaflex International's past further, check out this free graph of past earnings, revenue and cash flow.

How Are Returns Trending?

The trend of returns that Prismaflex International is generating are raising some concerns. Unfortunately, returns have declined substantially over the last five years to the 2.2% we see today. What's equally concerning is that the amount of capital deployed in the business has shrunk by 28% over that same period. When you see both ROCE and capital employed diminishing, it can often be a sign of a mature and shrinking business that might be in structural decline. If these underlying trends continue, we wouldn't be too optimistic going forward.

While on the subject, we noticed that the ratio of current liabilities to total assets has risen to 57%, which has impacted the ROCE. If current liabilities hadn't increased as much as they did, the ROCE could actually be even lower. What this means is that in reality, a rather large portion of the business is being funded by the likes of the company's suppliers or short-term creditors, which can bring some risks of its own.

The Key Takeaway

In short, lower returns and decreasing amounts capital employed in the business doesn't fill us with confidence. It should come as no surprise then that the stock has fallen 38% over the last five years, so it looks like investors are recognizing these changes. Unless there is a shift to a more positive trajectory in these metrics, we would look elsewhere.

Since virtually every company faces some risks, it's worth knowing what they are, and we've spotted 4 warning signs for Prismaflex International (of which 2 are concerning!) that you should know about.

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALPRI

Prismaflex International

Designs, manufactures, and sells various advertising supports and wide format digital printing products and solutions worldwide.

Solid track record with adequate balance sheet.

Market Insights

Community Narratives