It's Down 30% But NetMedia Group société anonyme (EPA:ALNMG) Could Be Riskier Than It Looks

Unfortunately for some shareholders, the NetMedia Group société anonyme (EPA:ALNMG) share price has dived 30% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 67% loss during that time.

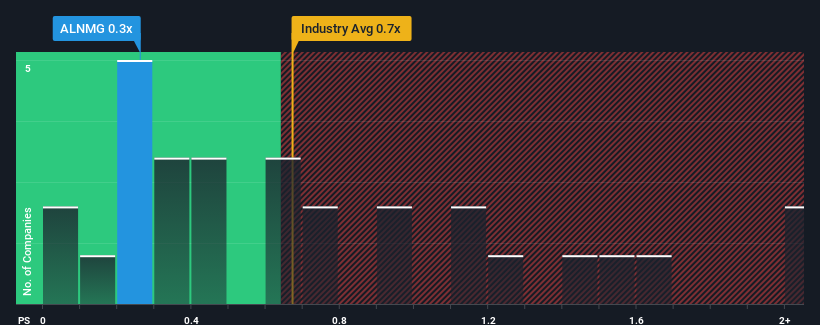

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about NetMedia Group société anonyme's P/S ratio of 0.3x, since the median price-to-sales (or "P/S") ratio for the Media industry in France is also close to 0.7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for NetMedia Group société anonyme

What Does NetMedia Group société anonyme's Recent Performance Look Like?

NetMedia Group société anonyme certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. Perhaps the market is expecting future revenue performance to taper off, which has kept the P/S from rising. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on NetMedia Group société anonyme will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like NetMedia Group société anonyme's is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company grew revenue by an impressive 149% last year. Pleasingly, revenue has also lifted 136% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that to the industry, which is only predicted to deliver 3.9% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

In light of this, it's curious that NetMedia Group société anonyme's P/S sits in line with the majority of other companies. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Bottom Line On NetMedia Group société anonyme's P/S

Following NetMedia Group société anonyme's share price tumble, its P/S is just clinging on to the industry median P/S. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

To our surprise, NetMedia Group société anonyme revealed its three-year revenue trends aren't contributing to its P/S as much as we would have predicted, given they look better than current industry expectations. It'd be fair to assume that potential risks the company faces could be the contributing factor to the lower than expected P/S. It appears some are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

Having said that, be aware NetMedia Group société anonyme is showing 4 warning signs in our investment analysis, and 3 of those are potentially serious.

If these risks are making you reconsider your opinion on NetMedia Group société anonyme, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if NetMedia Group société anonyme might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALNMG

NetMedia Group société anonyme

NetMedia Group société anonyme imagines, optimizes, organizes, and deploys communication devices in digital platforms, social media, brand content, marketing activations, and print and video.

Slight risk and slightly overvalued.

Market Insights

Community Narratives