- France

- /

- Entertainment

- /

- ENXTPA:ALDNE

Don't Nod Entertainment S.A.'s (EPA:ALDNE) Popularity With Investors Under Threat As Stock Sinks 25%

Unfortunately for some shareholders, the Don't Nod Entertainment S.A. (EPA:ALDNE) share price has dived 25% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 54% share price decline.

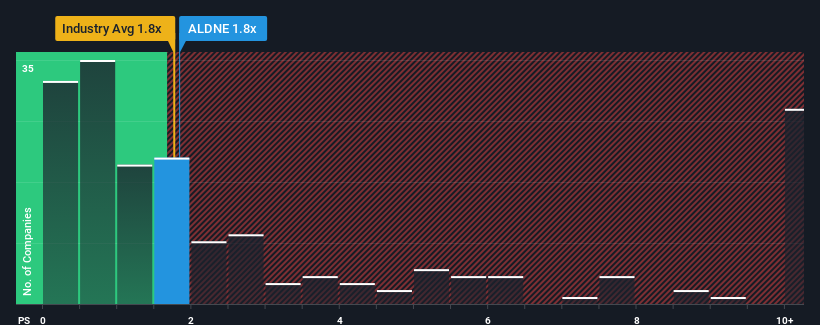

In spite of the heavy fall in price, there still wouldn't be many who think Don't Nod Entertainment's price-to-sales (or "P/S") ratio of 1.8x is worth a mention when the median P/S in France's Entertainment industry is similar at about 1.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Don't Nod Entertainment

What Does Don't Nod Entertainment's P/S Mean For Shareholders?

Don't Nod Entertainment could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Don't Nod Entertainment's future stacks up against the industry? In that case, our free report is a great place to start.How Is Don't Nod Entertainment's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Don't Nod Entertainment's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a decent 9.7% gain to the company's revenues. The latest three year period has also seen an excellent 59% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should bring plunging returns, with revenue decreasing 46% as estimated by the three analysts watching the company. Meanwhile, the broader industry is forecast to moderate by 13%, which indicates the company should perform poorly indeed.

With this in mind, we find it intriguing that Don't Nod Entertainment's P/S is similar to its industry peers. When revenue shrink rapidly the P/S often shrinks too, which could set up shareholders for future disappointment. Maintaining these prices will be difficult to achieve as the weak outlook is likely to weigh down the shares eventually.

The Final Word

Don't Nod Entertainment's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Don't Nod Entertainment currently trades on a higher P/S than expected based on revenue decline, even more so since its revenue forecast is even worse than the struggling industry. Even though the company's P/S is on par with the rest of the industry, the fact that it's revenue outlook is poorer than an already struggling industry suggests that the P/S isn't justified. We also have our reservations about the company's ability to sustain this level of performance amidst the challenging industry conditions. A positive change is needed in order to justify the current price-to-sales ratio.

Having said that, be aware Don't Nod Entertainment is showing 8 warning signs in our investment analysis, and 4 of those are a bit unpleasant.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALDNE

Excellent balance sheet with low risk.

Market Insights

Community Narratives