Assessing Verallia (ENXTPA:VRLA) Valuation as Recent Trading Reveals Shifting Investor Sentiment

Reviewed by Simply Wall St

See our latest analysis for Verallia Société Anonyme.

After a choppy ride in recent months, Verallia Société Anonyme’s year-to-date share price return of -5.69% reflects persistent investor caution. Longer-term total shareholder returns have also trailed at -7.6% over the past year. While short-term sentiment remains mixed, some investors see current levels as a recalibration of risk and growth expectations.

If this shifting momentum has you wondering what else is on the move, it could be the perfect time to discover fast growing stocks with high insider ownership.

As Verallia’s performance flattens this year, the key question for investors becomes clear: is there tempting value to be found at today’s levels or is the market already factoring in all future growth?

Most Popular Narrative: 20.5% Undervalued

Compared to the latest close price of €22.54, the most followed narrative suggests Verallia Société Anonyme is trading well below its estimated fair value of €28.37. This highlights a notable difference between what the market is willing to pay today and what analysts think the shares are truly worth.

Ongoing product innovation, such as the launch of lightweight "Air range" bottles and jars, and the My Air single-serve solution, directly addresses changing consumer preferences for premium, convenient, safely packaged products and for sustainable packaging. This strengthens Verallia's ability to capture premium pricing, defend market share, and support both top-line and margin expansion.

Curious what powers this bullish view? The main story is ambitious growth in future earnings, targeted margin gains, and an expected shift in valuation multiples, which is not a typical scenario. The most notable points are in the quantitative changes behind that fair value—want to find out how it all adds up?

Result: Fair Value of €28.37 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent pricing pressures and slow growth in the European market could challenge the optimistic outlook and put pressure on Verallia’s profitability in the coming years.

Find out about the key risks to this Verallia Société Anonyme narrative.

Another View: Looking Through the Lens of Earnings

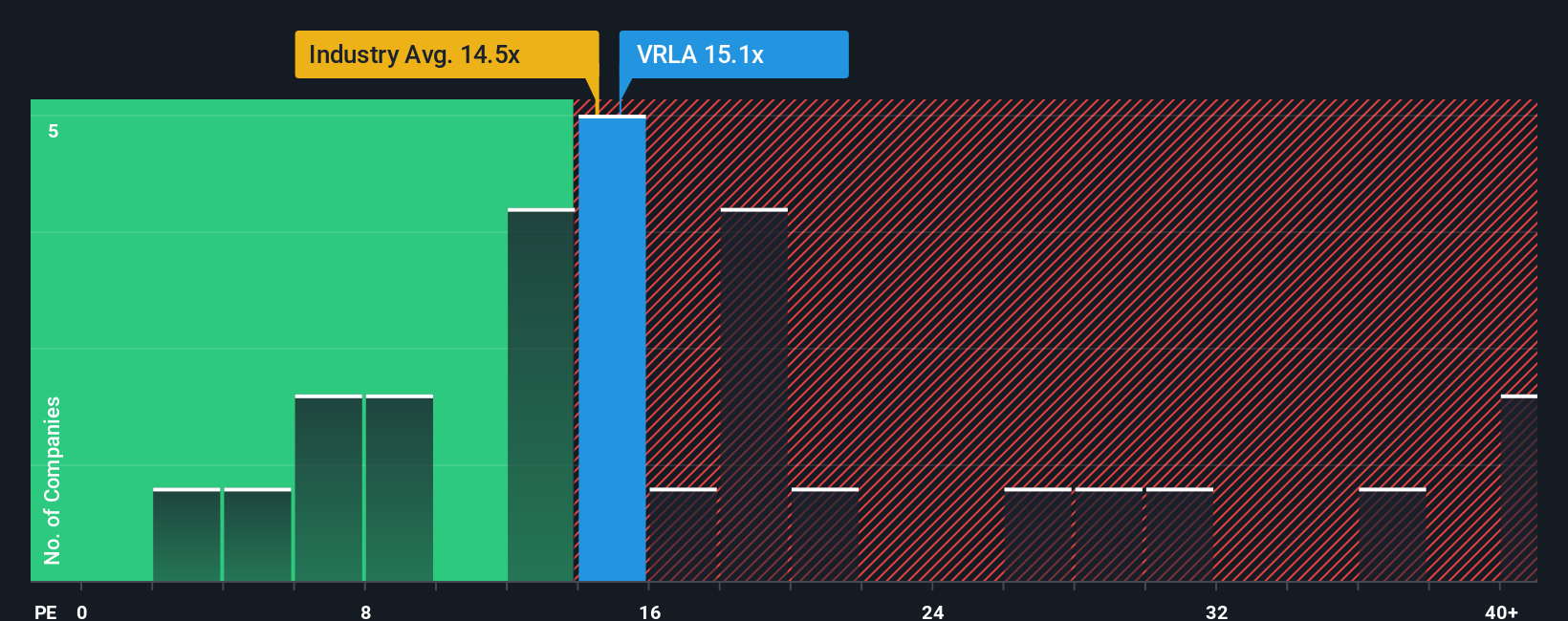

While fair value estimates suggest Verallia Société Anonyme is undervalued, our comparison using the price-to-earnings ratio tells a more nuanced story. The company's ratio of 14.8x sits slightly above the European Packaging industry average of 14.4x, but well below its peer average of 17.6x and the fair ratio of 20.5x. This creates a mixed picture. Are shares reasonably priced, or could the market adjust to close this gap?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Verallia Société Anonyme Narrative

If you see the story differently or want to dig into the numbers yourself, it’s quick and easy to craft your own perspective in just a few minutes. Do it your way.

A great starting point for your Verallia Société Anonyme research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Ready to supercharge your portfolio? Don’t let opportunity pass you by. Use these powerful tools to uncover stocks that match your boldest ambitions today.

- Tap into high-yield potential and get ahead with these 15 dividend stocks with yields > 3% offering stellar return prospects backed by attractive yields.

- Uncover tomorrow’s tech leaders by browsing these 27 AI penny stocks filled with innovation-driven businesses on the cutting edge of artificial intelligence.

- Add a spark of excitement with these 81 cryptocurrency and blockchain stocks where blockchain and digital currency companies are building new opportunities beyond traditional markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:VRLA

Verallia Société Anonyme

Manufactures and sells glass packaging products for beverages and food products worldwide.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives