3 Euronext Paris Dividend Stocks To Consider With Up To 4.4% Yield

Reviewed by Simply Wall St

The European economy has recently seen a boost from activities in Paris, with France's CAC 40 Index gaining 1.71% amid growing hopes for interest rate cuts by the Federal Reserve and the European Central Bank. As investors navigate these dynamic market conditions, dividend stocks can offer a stable income stream and potential growth opportunities. When considering dividend stocks, it's crucial to look at companies with strong fundamentals and consistent payout histories, particularly in an environment where economic policies are shifting.

Top 10 Dividend Stocks In France

| Name | Dividend Yield | Dividend Rating |

| Vicat (ENXTPA:VCT) | 6.37% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 6.83% | ★★★★★★ |

| CBo Territoria (ENXTPA:CBOT) | 6.80% | ★★★★★★ |

| Samse (ENXTPA:SAMS) | 6.13% | ★★★★★☆ |

| Arkema (ENXTPA:AKE) | 4.27% | ★★★★★☆ |

| VIEL & Cie société anonyme (ENXTPA:VIL) | 4.01% | ★★★★★☆ |

| Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative (ENXTPA:CRLA) | 5.73% | ★★★★★☆ |

| Exacompta Clairefontaine (ENXTPA:ALEXA) | 4.65% | ★★★★★☆ |

| Piscines Desjoyaux (ENXTPA:ALPDX) | 8.06% | ★★★★★☆ |

| Eiffage (ENXTPA:FGR) | 4.36% | ★★★★☆☆ |

Click here to see the full list of 35 stocks from our Top Euronext Paris Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

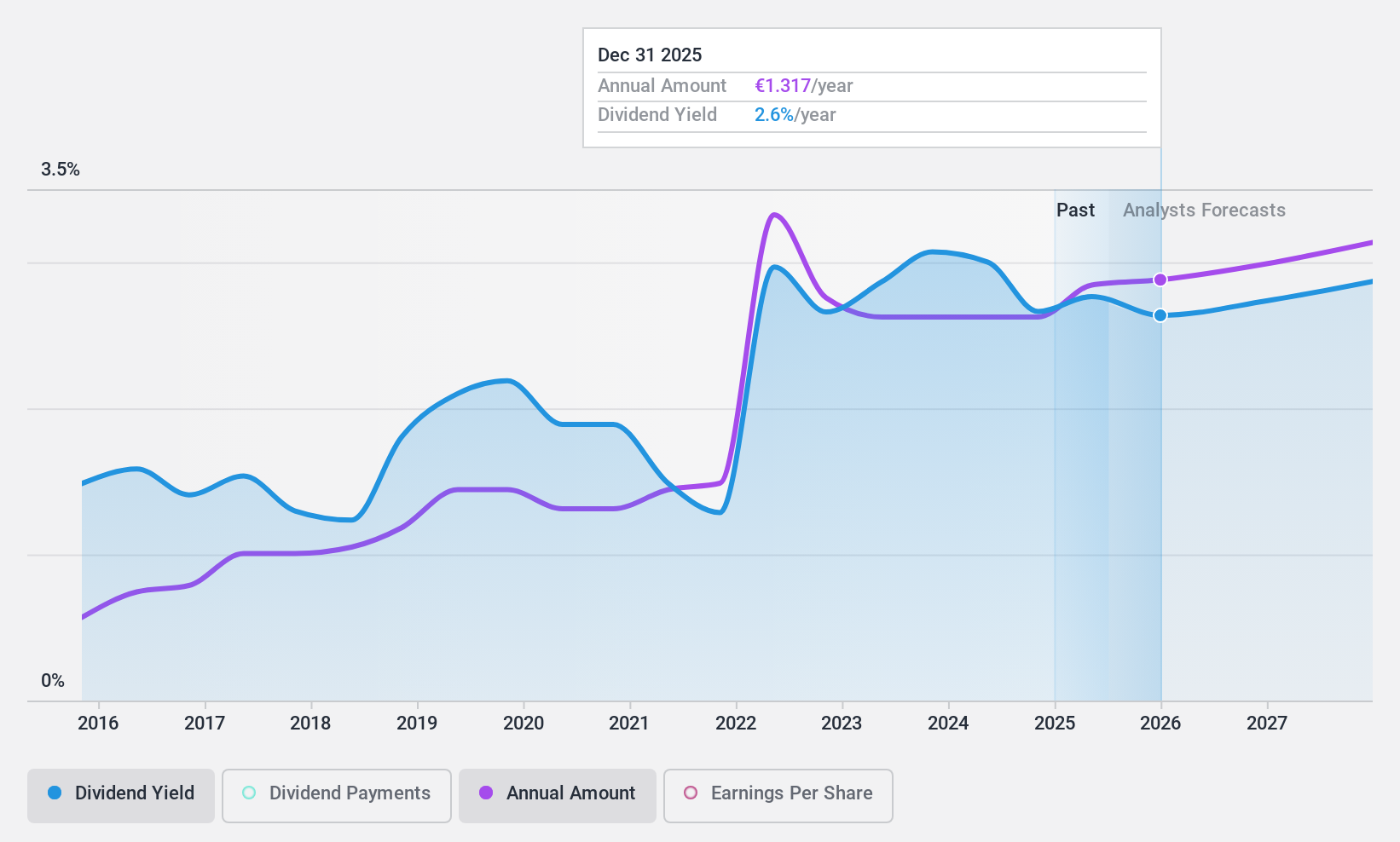

Aubay Société Anonyme (ENXTPA:AUB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Aubay Société Anonyme delivers application services across Belgium, Luxembourg, Spain, Portugal, Italy, France, and the United Kingdom with a market cap of €468.15 million.

Operations: Aubay Société Anonyme generates revenue from various segments, including €31.40 million from Administration, €205.60 million from Banking/Finance, €12.20 million from Commerce & Distribution, €29.60 million from Industry/Transportation, €77.70 million from Telecoms, Media & Gaming, €70.10 million from Services/Utilities/Health, and €107.50 million from Insurance and Social Protection.

Dividend Yield: 3.3%

Aubay Société Anonyme's dividend payments have been volatile and unreliable over the past decade, though they have increased overall. The company's dividends are well covered by both earnings (46.9% payout ratio) and cash flows (39.5% cash payout ratio), indicating sustainability despite an unstable track record. Trading at 47.5% below estimated fair value, Aubay offers good relative value but its current yield of 3.35% is lower than the top quartile in France's market (5.43%).

- Click here and access our complete dividend analysis report to understand the dynamics of Aubay Société Anonyme.

- The valuation report we've compiled suggests that Aubay Société Anonyme's current price could be quite moderate.

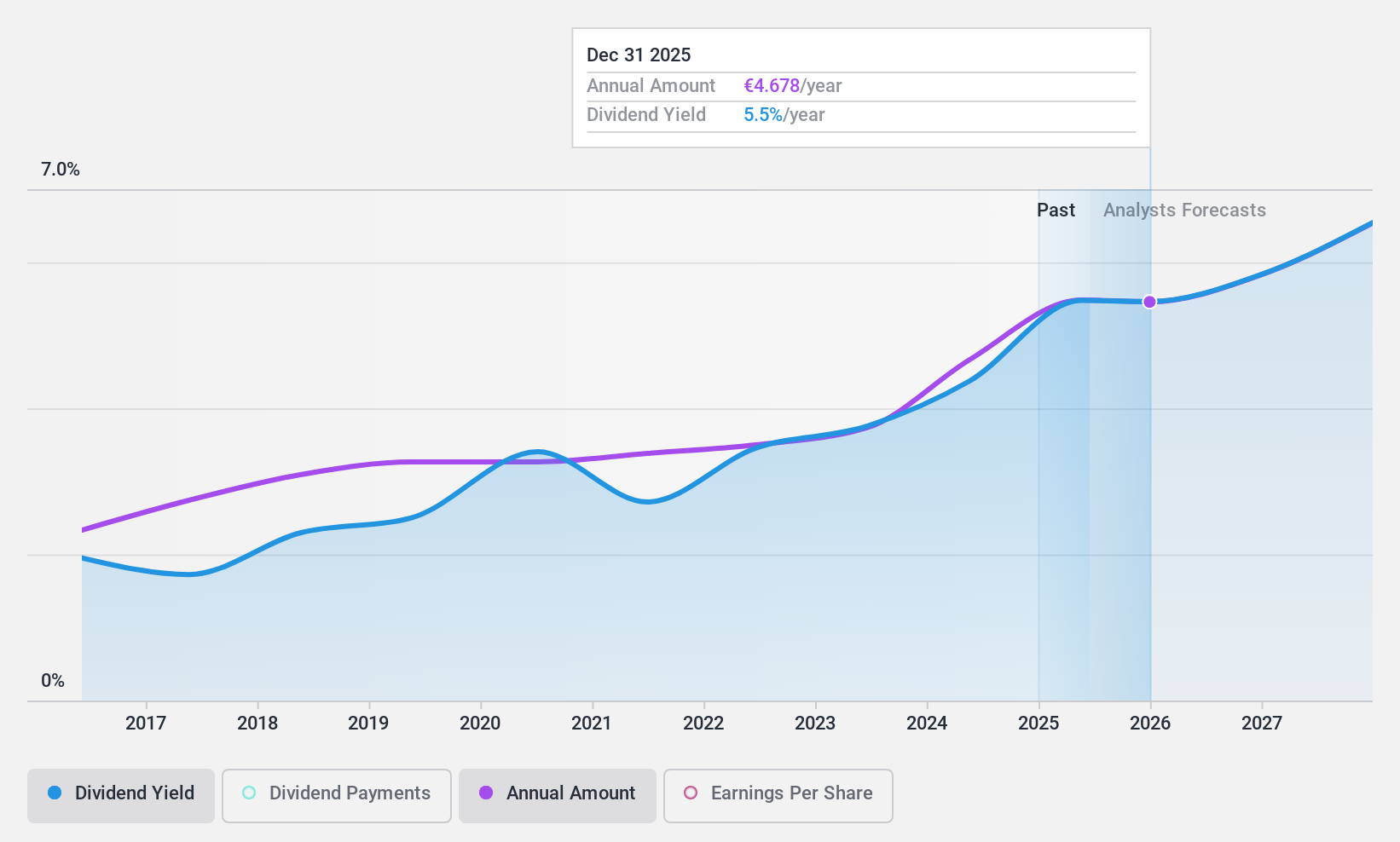

Wendel (ENXTPA:MF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Wendel is a private equity firm focusing on middle market and later stage equity financing through leveraged buy-outs and acquisitions, with a market cap of €3.81 billion.

Operations: Wendel generates revenue from several segments, including Bureau Veritas (€5.99 billion), Stahl (€935.20 million), CPI (€136 million), and ACAMS (€93.60 million).

Dividend Yield: 4.5%

Wendel's recent earnings report showed significant revenue growth to €3.99 billion from €3.53 billion year-over-year, with net income rising sharply to €388.2 million from €39.6 million. Despite this, the company posted a basic loss per share of €0.7 for continuing operations, contrasting last year's earnings per share of €0.61. Wendel's dividend yield of 4.46% is below the top quartile in France but remains stable and well-covered by cash flows (14.2% cash payout ratio).

- Click here to discover the nuances of Wendel with our detailed analytical dividend report.

- Our valuation report here indicates Wendel may be undervalued.

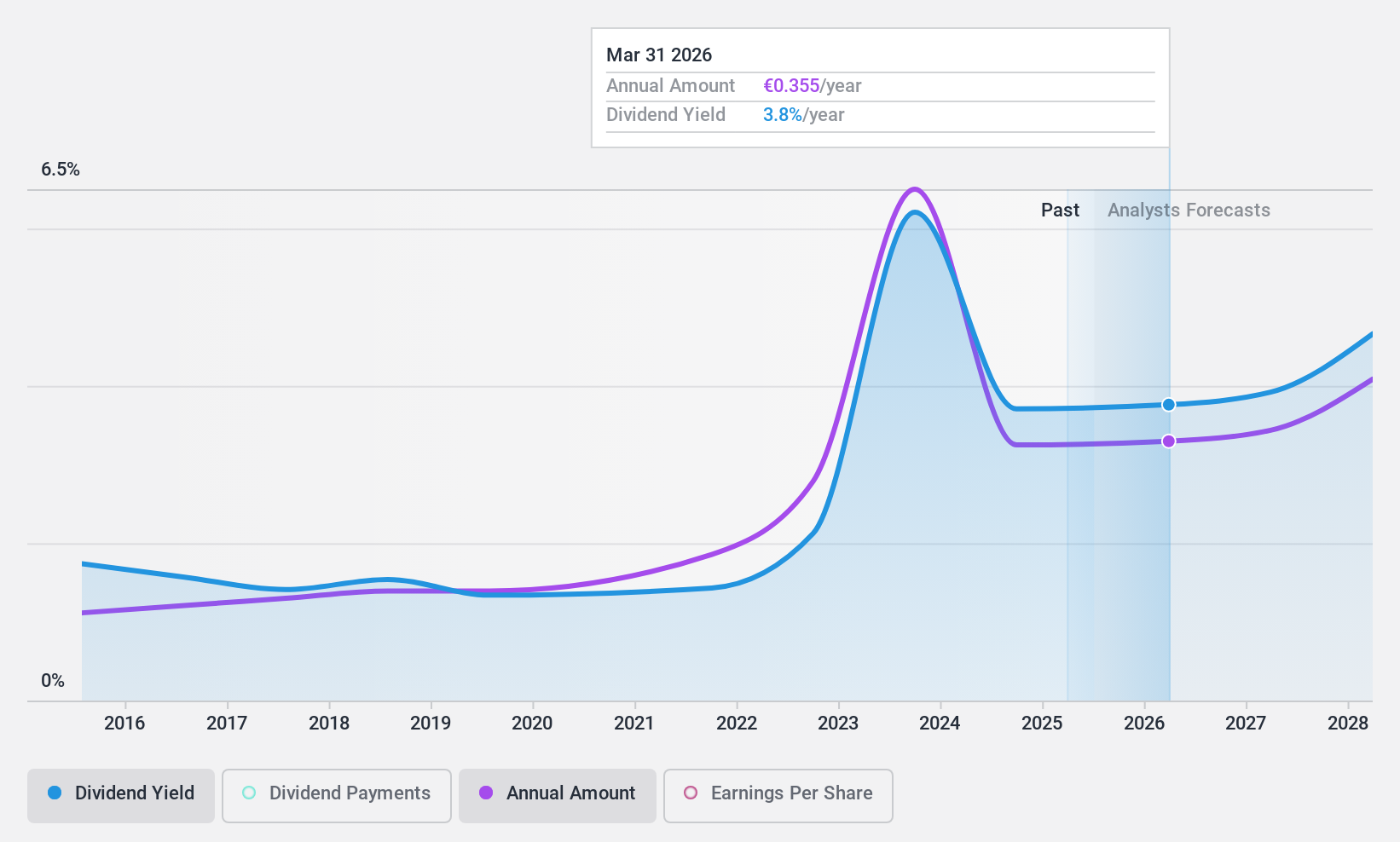

Oeneo (ENXTPA:SBT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Oeneo SA, with a market cap of €656.61 million, operates in the wine industry worldwide.

Operations: Oeneo SA generates revenue from Corking (€211.57 million) and Breeding (€94.17 million) segments within the global wine industry.

Dividend Yield: 3.4%

Oeneo's recent earnings report revealed a decline in sales to €305.73 million from €348.24 million year-over-year, with net income dropping to €28.85 million from €41.16 million. The company’s dividend yield of 3.45% is below the top quartile in France, and its dividend payments have been volatile over the past decade despite recent increases. However, dividends are covered by both earnings (78.2% payout ratio) and cash flows (83.3% cash payout ratio).

- Delve into the full analysis dividend report here for a deeper understanding of Oeneo.

- Insights from our recent valuation report point to the potential overvaluation of Oeneo shares in the market.

Summing It All Up

- Access the full spectrum of 35 Top Euronext Paris Dividend Stocks by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:SBT

Flawless balance sheet average dividend payer.