- France

- /

- Metals and Mining

- /

- ENXTPA:ERA

Will a New CFO Reshape Eramet's Strategic Direction or Reinforce Stability for ENXTPA:ERA?

Reviewed by Simply Wall St

- Eramet S.A. recently announced the appointment of Abel Martins-Alexandre as Chief Financial Officer and member of the Executive Committee, following the departure of Nicolas Carré for a new opportunity outside the Group.

- Martins-Alexandre brings over 25 years of global experience across finance and the natural resources sector, including a leadership role at Rio Tinto and most recently at Lloyds Corporate & Institutional Bank.

- We’ll explore how Martins-Alexandre’s extensive background in corporate finance and global industry roles may influence Eramet’s investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is ERAMET's Investment Narrative?

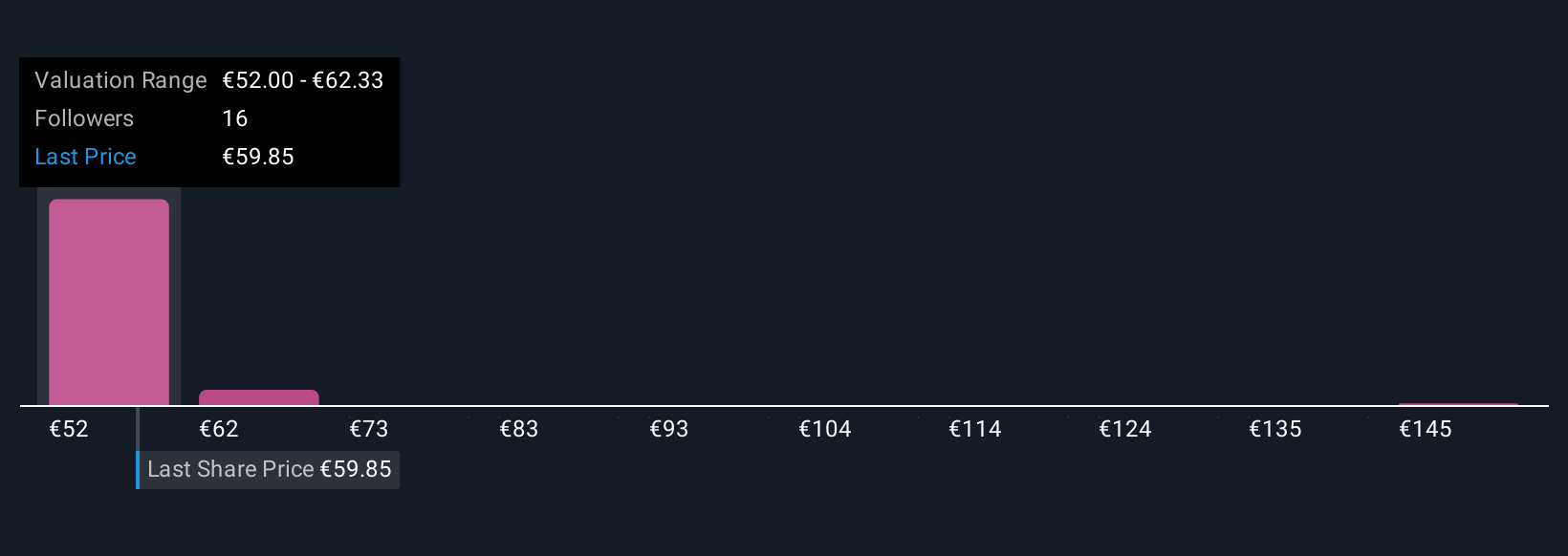

For anyone considering Eramet as an investment, the story centers on the company’s ability to regain profitability and deliver on strategic pivots in energy transition materials, while managing ongoing operational and financial risks. The recent appointment of Abel Martins-Alexandre as CFO adds new experience in global mining finance and capital markets, arriving at a time when Eramet faces a string of executive changes and an urgent need to address widening net losses. With shares trading below consensus fair value and earnings expected to improve over the next three years, short-term catalysts like increased lithium output, decarbonization products, and the Molle Verde joint venture remain in focus. However, the rapid management turnover could impact execution on these ambitions. If Martins-Alexandre brings successful cost controls and capital discipline, he could influence Eramet’s risk profile, but the impact will only become clear as financial performance unfolds.

On the flipside, the dividend payout remains poorly covered by earnings, a risk worth keeping on your radar.

Exploring Other Perspectives

Explore 4 other fair value estimates on ERAMET - why the stock might be worth as much as 47% more than the current price!

Build Your Own ERAMET Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ERAMET research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free ERAMET research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ERAMET's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ERAMET might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ERA

ERAMET

Produces and sells manganese and nickel in France, Europe, North America, China, Other Asia, Oceania, Africa, South America, and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives