- France

- /

- Metals and Mining

- /

- ENXTPA:ERA

How Lower Manganese Guidance at ERAMET (ENXTPA:ERA) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- On October 30, 2025, ERAMET S.A. announced an updated production outlook, lowering its 2025 manganese ore transported volume guidance to between 6.1 and 6.3 million tonnes, down from the previous estimate of 6.5 to 7.0 million tonnes, while leaving guidance for nickel ore, lithium carbonate, and mineral sands unchanged.

- This revision highlights that ERAMET anticipates challenges specific to manganese operations, even as its forecasts for other commodities remain stable.

- We'll examine what this lowered manganese production expectation could mean for ERAMET's investment narrative moving forward.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is ERAMET's Investment Narrative?

To be a shareholder in ERAMET right now, you need to believe in its turnaround story and exposure to future-focused minerals like lithium and nickel. Recent news of reduced 2025 manganese ore production is a meaningful update, especially as this segment has been central to ERAMET’s operations and revenue base. Short term, the adjustment could dampen one of the main recovery catalysts, especially with volumes now expected to be several hundred thousand tonnes below prior forecasts. Still, guidance for lithium and nickel remains intact, which matters for anyone focusing on ERAMET’s “energy transition” narrative. Given limited recent share price reaction and with other divisional forecasts unchanged, the immediate financial impact may not be dramatic, but it does shift attention to productivity risks and the company’s ability to execute on its remaining growth priorities. Dividend cover and profitability also remain watchpoints for anyone considering the shares.

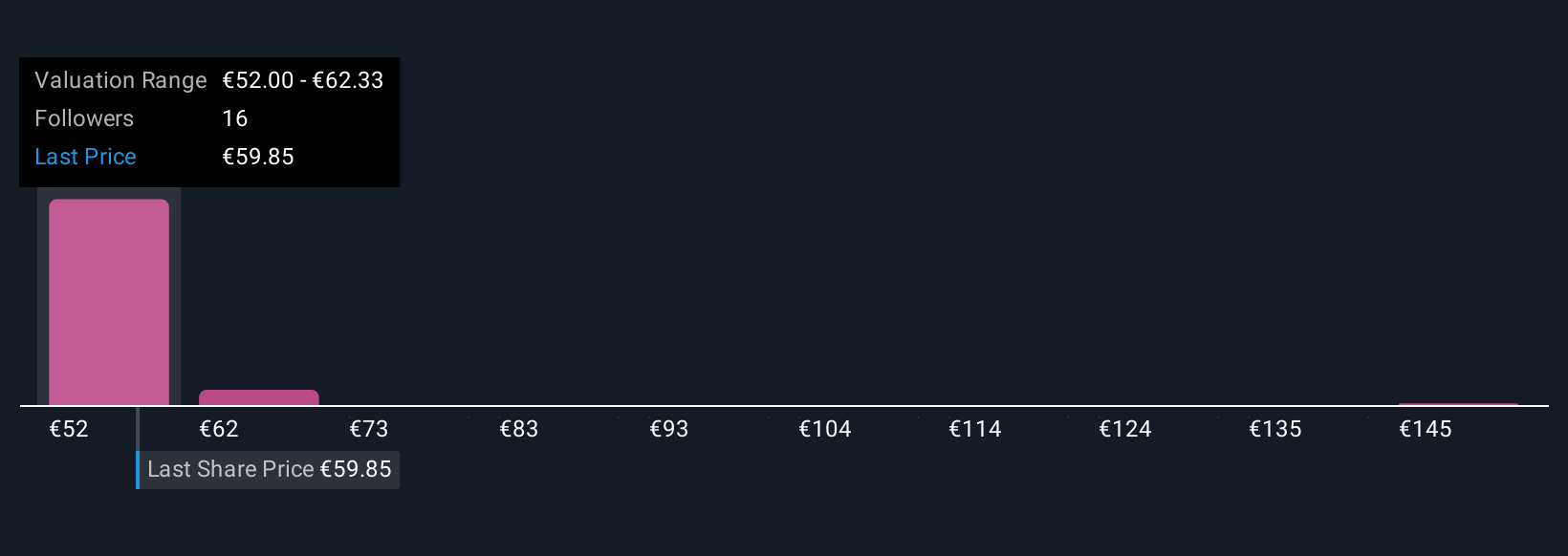

However, the stability of lithium and nickel guidance doesn’t mean other risks have faded from view. Despite retreating, ERAMET's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 4 other fair value estimates on ERAMET - why the stock might be worth just €50.25!

Build Your Own ERAMET Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ERAMET research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free ERAMET research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ERAMET's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ERAMET might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ERA

ERAMET

Produces and sells manganese and nickel metals in Asia, Europe, North America, and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives