- France

- /

- Oil and Gas

- /

- ENXTPA:LHYFE

3 European Penny Stocks With Market Caps Over €40M To Watch

Reviewed by Simply Wall St

Amid renewed concerns about inflated AI stock valuations, the pan-European STOXX Europe 600 Index recently ended 2.21% lower, reflecting a cautious sentiment across major European markets. Despite these broader market challenges, penny stocks continue to attract attention for their potential to offer surprising value and growth opportunities. Though the term 'penny stock' may seem outdated, these smaller or newer companies often present unique investment prospects when supported by strong financials.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €4.182 | €1.45B | ✅ 4 ⚠️ 2 View Analysis > |

| Orthex Oyj (HLSE:ORTHEX) | €4.67 | €82.93M | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €233.95M | ✅ 3 ⚠️ 3 View Analysis > |

| Libertas 7 (BME:LIB) | €3.12 | €66.18M | ✅ 3 ⚠️ 3 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.285 | €378.73M | ✅ 4 ⚠️ 1 View Analysis > |

| High (ENXTPA:HCO) | €3.88 | €75.67M | ✅ 1 ⚠️ 5 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.175 | €300.63M | ✅ 3 ⚠️ 1 View Analysis > |

| Dovre Group (HLSE:DOV1V) | €0.08 | €8.46M | ✅ 2 ⚠️ 3 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.858 | €28.73M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 277 stocks from our European Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Antares Vision (BIT:AV)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Antares Vision S.p.A. specializes in producing, installing, and maintaining inspection systems for quality control, with a market cap of €354.98 million.

Operations: The company's revenue segment includes Industrial Automation & Controls, generating €211.12 million.

Market Cap: €354.98M

Antares Vision S.p.A., with a market cap of €354.98 million, has been added to the S&P Global BMI Index, reflecting its growing recognition. The company reported half-year sales of €90.43 million, up from €86.97 million the previous year, though it remains unprofitable with a net loss of €13 million. Crane NXT's recent agreement to acquire a 30% stake for approximately €110 million indicates strategic interest in Antares Vision's potential despite its high net debt to equity ratio (56.1%). Short-term assets exceed liabilities, offering financial stability and a cash runway exceeding three years due to positive free cash flow growth.

- Click here and access our complete financial health analysis report to understand the dynamics of Antares Vision.

- Examine Antares Vision's earnings growth report to understand how analysts expect it to perform.

Fermentalg (ENXTPA:ALGAE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Fermentalg SA develops biosolutions using aquatic micro-organisms across Europe, North America, Asia, and internationally, with a market cap of €40.23 million.

Operations: The company generates €12.78 million in revenue from its biotechnology segment.

Market Cap: €40.23M

Fermentalg SA, with a market cap of €40.23 million, reported half-year sales of €7.61 million, up from €6.32 million the previous year, yet remains unprofitable with a net loss of €4.33 million. The company benefits from strong financial positioning as its short-term assets (€22.9M) surpass both short-term (€12.2M) and long-term liabilities (€4.5M), ensuring stability despite ongoing losses which have increased at 8.8% annually over five years. While not expected to achieve profitability in the near term, Fermentalg's cash reserves exceed its debt and provide a cash runway exceeding three years if free cash flow growth continues historically at 8%.

- Jump into the full analysis health report here for a deeper understanding of Fermentalg.

- Explore Fermentalg's analyst forecasts in our growth report.

Lhyfe (ENXTPA:LHYFE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Lhyfe SA produces and supplies renewable green hydrogen for mobility and industry markets, with a market cap of €143.95 million.

Operations: The company generates revenue from its Oil & Gas - Exploration & Production segment, amounting to €8.07 million.

Market Cap: €143.95M

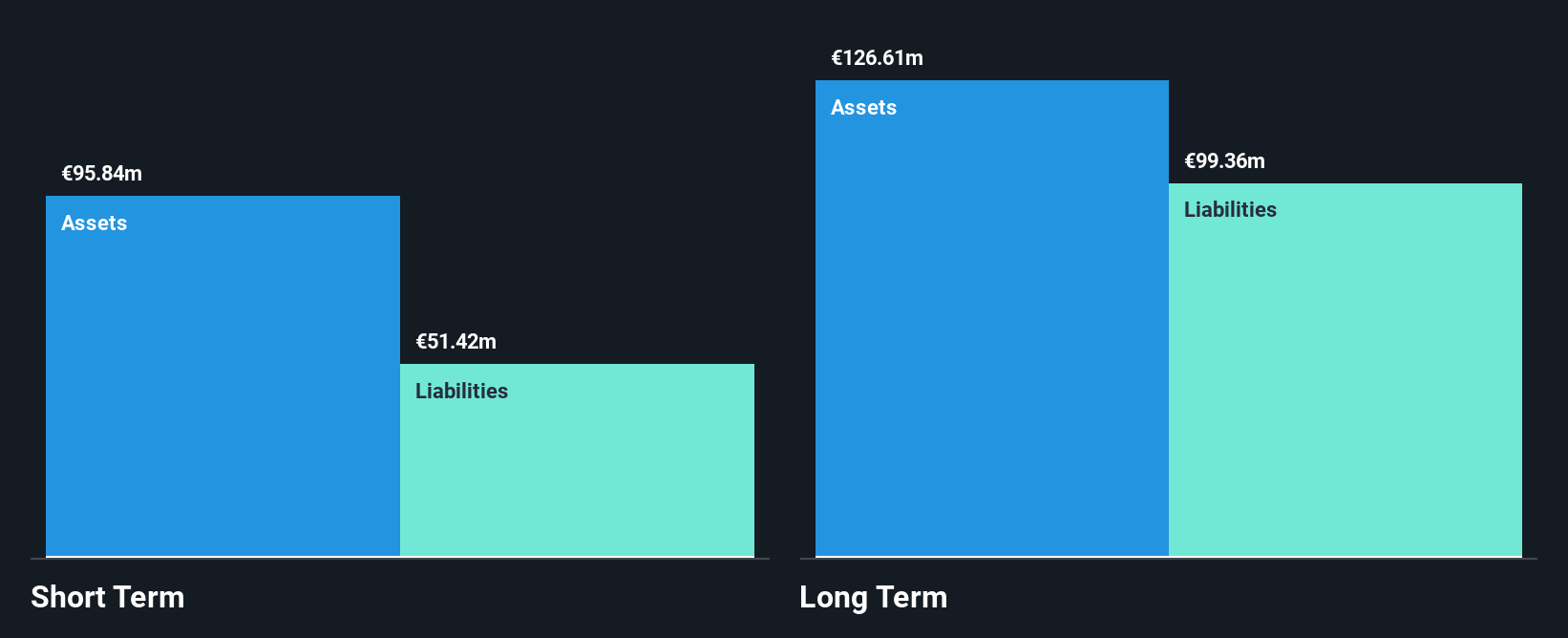

Lhyfe SA, with a market cap of €143.95 million, is a key player in Europe's renewable hydrogen sector, recently securing multi-year contracts to supply RFNBO-certified hydrogen for heavy mobility and service stations. Despite reporting half-year sales of €4.64 million, the company remains unprofitable with increasing losses and negative return on equity (-72.65%). While Lhyfe's cash exceeds its debt and it maintains a cash runway over a year if free cash flow trends persist, short-term assets (€87.7M) fall short of long-term liabilities (€134.8M). Revenue growth is projected at 92.95% annually as the company expands its production capacity across Europe.

- Navigate through the intricacies of Lhyfe with our comprehensive balance sheet health report here.

- Review our growth performance report to gain insights into Lhyfe's future.

Turning Ideas Into Actions

- Click this link to deep-dive into the 277 companies within our European Penny Stocks screener.

- Ready To Venture Into Other Investment Styles? Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:LHYFE

Lhyfe

Produces and supplies renewable green hydrogen for mobility and industry markets.

Excellent balance sheet with limited growth.

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

The AI Infrastructure Giant Grows Into Its Valuation

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success