How Do Hydrogen Partnerships Affect Air Liquide’s Share Price in 2025?

Reviewed by Bailey Pemberton

- If you have ever wondered whether L'Air Liquide is good value at these levels, you are not alone. Today we are digging into exactly that question.

- While the stock has been relatively steady over the past month, dipping only 0.7%, it is still up 8.4% year-to-date and 5.5% over the last year, reflecting long-term momentum.

- Recently, L'Air Liquide captured headlines by announcing expanded hydrogen projects and partnerships to support Europe's transition to clean energy. These moves have kept investors interested and fueled debate over whether its growth story justifies the current share price.

- Currently, L'Air Liquide scores 0 out of 6 on our undervaluation checks, raising questions about how the market is pricing the company. We will explore what those numbers mean using a few different valuation lenses, and by the end, you may see that there is an even smarter way to approach valuation than you think.

L'Air Liquide scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: L'Air Liquide Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future free cash flows and discounting them back to today using an appropriate rate. In other words, it is a way of asking what all of L'Air Liquide's expected future cash generation is worth in today's money.

At present, L'Air Liquide generates €3.05 billion in free cash flow. Analyst consensus provides projections up to five years, estimating consistent annual growth in free cash flow, with Simply Wall St extrapolating future years. By 2029, free cash flow is forecast to reach €4.08 billion, and the model projects just under €4.7 billion annually a decade from now. These are solid, steadily increasing figures and reflect confidence in the company's ability to continue generating significant cash.

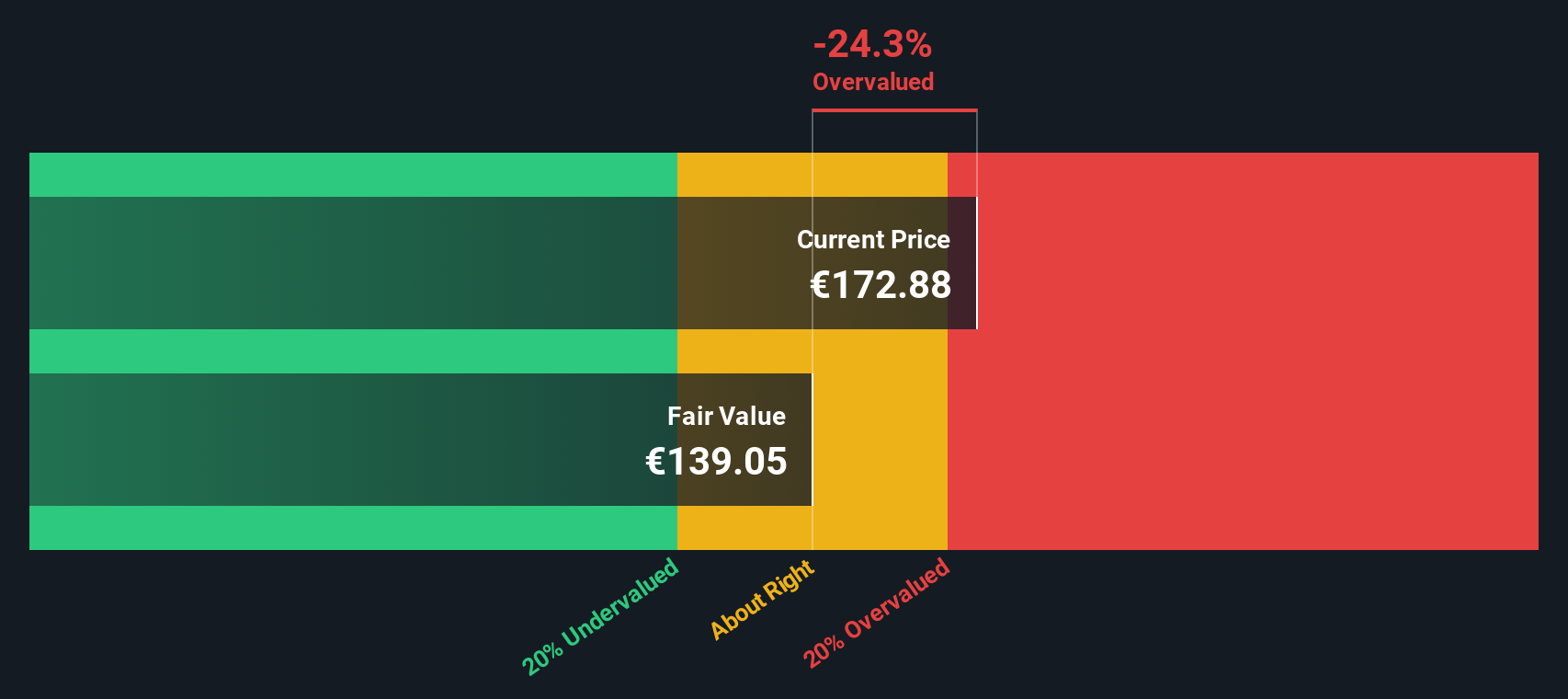

Based on this model, the estimated intrinsic value of L'Air Liquide stands at €141.77 per share. Currently, the share price is about 19.1% higher than this estimate, which suggests the stock trades at a significant premium to what the DCF model considers fair value.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests L'Air Liquide may be overvalued by 19.1%. Discover 840 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: L'Air Liquide Price vs Earnings

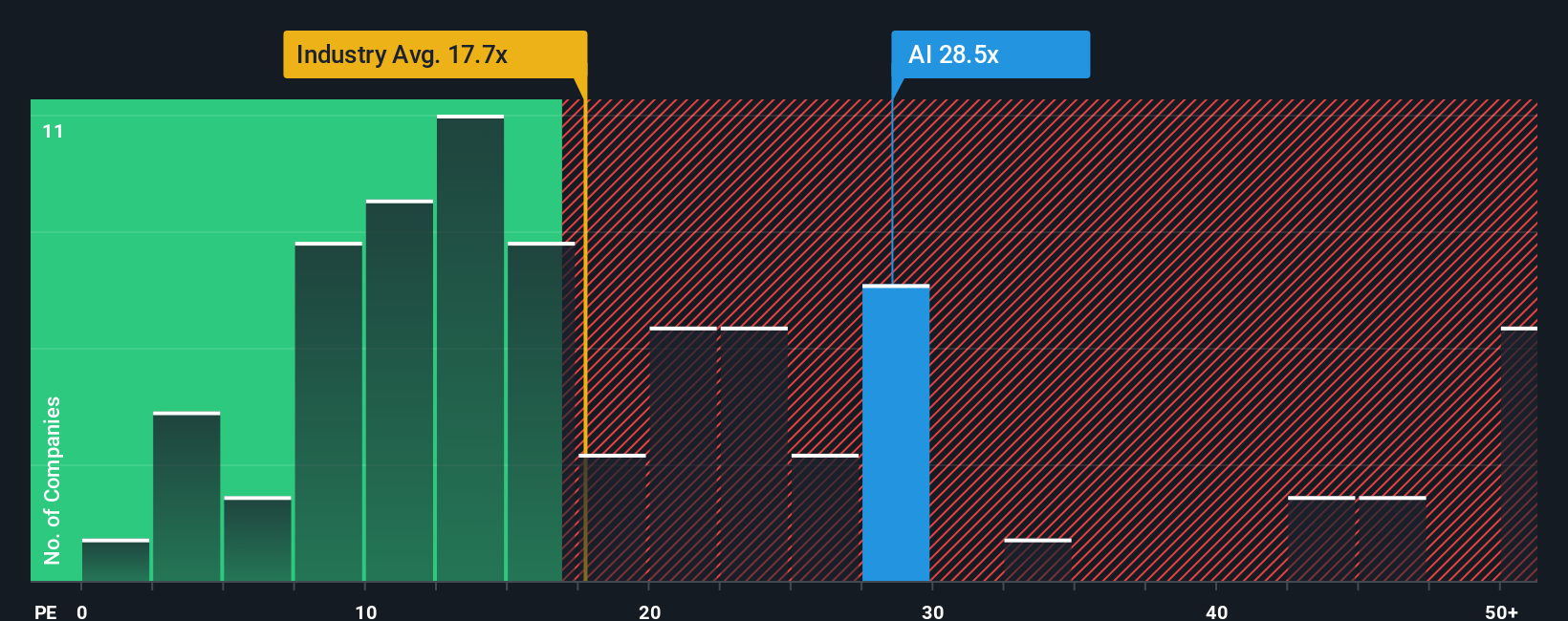

The price-to-earnings (PE) ratio is a time-tested valuation metric, especially useful when analyzing profitable companies like L'Air Liquide. It provides a snapshot of how much investors are willing to pay for every euro of current earnings, making it an accessible way to gauge market expectations.

Growth prospects and risk both play critical roles in shaping what constitutes a “normal” or “fair” PE ratio. Fast-growing businesses and those facing less risk typically command higher PE multiples because investors are willing to pay a premium for future profits and stability.

L'Air Liquide’s current PE ratio sits at 28.4x, noticeably higher than both the industry average of about 21.9x and the peer average of 24.4x. This suggests that the market is placing a premium on the company relative to its direct competitors and the broader chemicals sector. However, Simply Wall St’s proprietary “Fair Ratio” is 24.9x, reflecting a blend of factors including L'Air Liquide’s earnings growth outlook, margins, industry positioning, market capitalization, and risk profile.

Unlike basic peer or industry comparisons, the Fair Ratio is a more nuanced benchmark tailored to a company’s unique fundamentals. It helps investors avoid the pitfalls of one-size-fits-all analysis by considering elements that drive true value, rather than just broad averages.

Comparing the Fair Ratio of 24.9x to the current PE of 28.4x, L'Air Liquide appears to be overvalued on this metric, with its stock price factoring in more optimism than its underlying fundamentals might support.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your L'Air Liquide Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a clear story investors create about a company like L'Air Liquide, weaving together their view of where the business is heading and what it is worth based on future revenue, earnings, and profit margin assumptions.

With Narratives, your view on L'Air Liquide is not just a gut feeling; it becomes a structured perspective that connects your expectations for the company to a financial forecast and an up-to-date Fair Value, helping you decide if the current price offers an opportunity or a warning signal.

This approach is easy to use and accessible for everyone. On Simply Wall St’s Community page, millions of investors are already sharing their Narratives, updating them as new information, like quarterly reports or major news, comes in. As a result, when facts change, so does your Narrative’s fair value, making your decisions far more dynamic than traditional ratios or models.

Narratives make it simple to compare your forecasted Fair Value to today’s share price so you can decide whether to buy, hold, or sell. For example, right now, the most optimistic Narrative for L'Air Liquide values the company at €216.0 per share, while the most cautious sees fair value at just €154.0. This shows how much your own research and story can shape your investment decisions.

Do you think there's more to the story for L'Air Liquide? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:AI

L'Air Liquide

Provides gases, technologies, and services for the industrial and health sectors in Europe, the Americas, the Asia Pacific, the Middle East, and Africa.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives