- France

- /

- Personal Products

- /

- ENXTPA:OR

L'Oréal (ENXTPA:OR): Exploring Fair Value After Recent Share Price Dip

Reviewed by Simply Wall St

L'Oréal (ENXTPA:OR) has recently drawn attention as investors react to shifts in the broader European consumer sector. The company’s performance remains a key focus, given its reputation for steady growth and resilience across various market cycles.

See our latest analysis for L'Oréal.

L'Oréal’s share price has slipped slightly in recent weeks, even as its year-to-date performance shows a solid gain. The 1-year total shareholder return is up 9.3 percent, extending a longer trend of steady compounding that underscores the brand’s staying power and suggests that investor optimism is holding firm despite recent volatility.

If you’re curious what else could offer resilient growth or fresh momentum, now is the perfect time to expand your search and discover fast growing stocks with high insider ownership

The question now is whether L'Oréal’s recent dip opens the door for value seekers, or if the market has already factored in all the company’s strengths and future growth potential. Could this be a real buying opportunity?

Most Popular Narrative: 6.5% Undervalued

Compared to the last close price of €362.50, the most popular narrative sees L'Oréal as trading below its fair value, with room for further upside if expected business drivers play out. This optimism stems from several forward-looking factors in the company's growth plan.

Major capital allocation to strategic acquisitions (e.g., Medik8, Color Wow) and digital/AI-driven innovation (AI personalization, beauty tech partnerships) is expected to increase category leadership, fuel product differentiation, and raise future revenue and net margins.

Ready to see what’s under the hood of this valuation? Only by uncovering the bold financial projections and the narrative’s surprising revenue and margin bets can you decide if this fair value truly makes sense. Crack open the full narrative for the crucial details that move the market.

Result: Fair Value of €387.55 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, fierce competition from local brands and shifting consumer tastes could quickly undermine L'Oréal’s growth and pricing power outlook.

Find out about the key risks to this L'Oréal narrative.

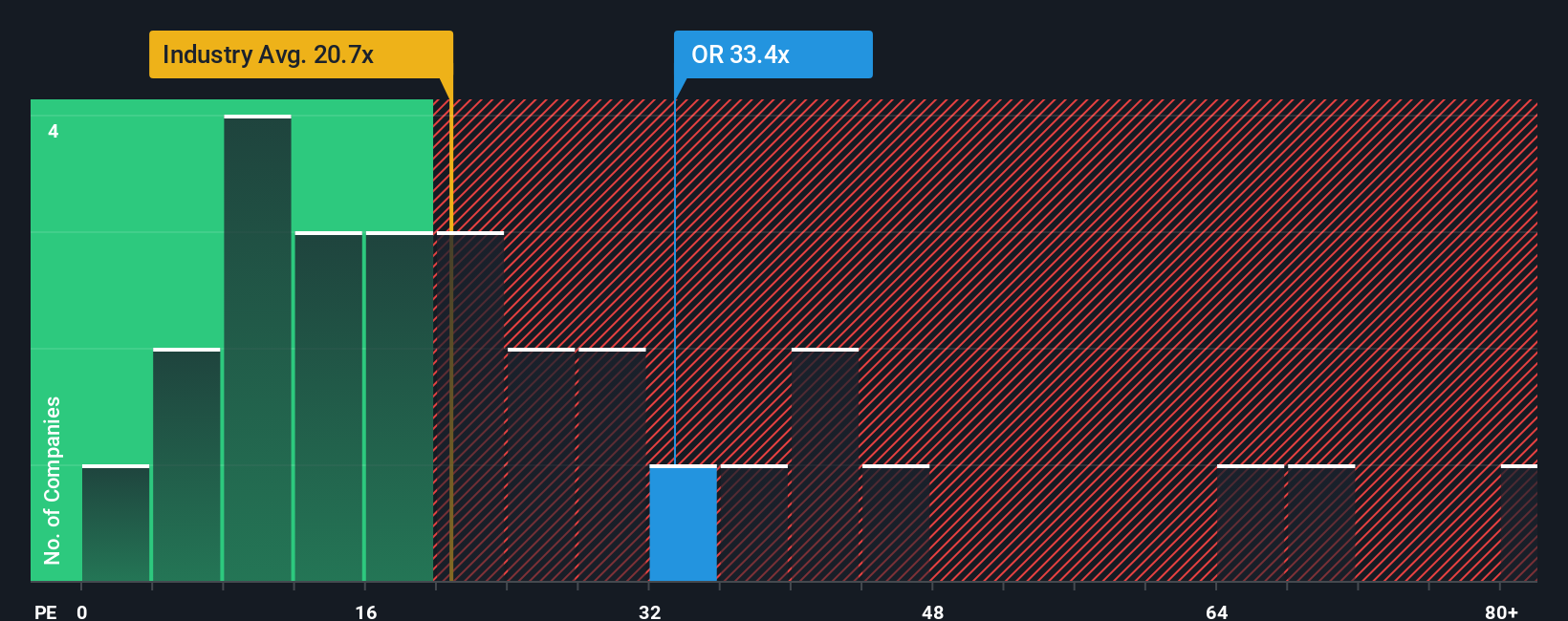

Another View: Price Tag Versus Peers

Looking at traditional valuation yardsticks, L'Oréal’s current price-to-earnings ratio of 31.6 times earnings is significantly higher than both its European industry average (21.2x) and its closest peer group (28.8x). It also exceeds the fair ratio, which stands at 29.9. This signals the market is demanding a premium, raising the stakes if the company’s growth stalls or misses expectations. So, which story will win out: the optimism in the growth narrative, or the warnings hidden in the price tag?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own L'Oréal Narrative

If you want to challenge the narrative or dive into L'Oréal’s numbers yourself, you can build your own perspective in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding L'Oréal.

Looking for More Winning Investment Ideas?

Smart investors always keep fresh opportunities on their radar. Don’t let your next great pick slip by. These targeted screens could be your ticket to the portfolio outperformance you’ve been seeking.

- Tap into tomorrow’s earnings with these 20 dividend stocks with yields > 3% that reward shareholders with robust yields and a track record of sustained payouts.

- Unlock exceptional value by targeting these 840 undervalued stocks based on cash flows. Find stocks that the market hasn’t fully recognized yet, and get ahead before prices catch up.

- Catalyze your watchlist by checking out these 26 AI penny stocks, packed with companies driving real-world change through artificial intelligence innovation and rapid technological advances.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:OR

L'Oréal

Through its subsidiaries, manufactures and sells cosmetic products for women and men worldwide.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives