- France

- /

- Personal Products

- /

- ENXTPA:OR

L'Oréal (ENXTPA:OR): Assessing Valuation After Recent Pullback and Long-Term Gains

Reviewed by Simply Wall St

L'Oréal (ENXTPA:OR) shares have seen some movement recently, with the price closing at €361.5. Over the past month, the stock has declined 4%. This comes despite a solid 7% rise year to date and annual returns above 11%.

See our latest analysis for L'Oréal.

While L'Oréal's share price has slipped in the last month, the longer-term story looks more resilient, with a steady build-up in momentum reflected by an 11.85% total shareholder return over the past year. Recent moves suggest that investors continue to weigh growth prospects against a slightly more cautious market outlook.

If you're on the lookout for other bright spots, now is a great moment to see what’s next and discover fast growing stocks with high insider ownership

With L'Oréal’s recent pullback and a valuation still below analyst price targets, the big question remains: Is this a buying opportunity for long-term investors, or has the market already factored in its future growth?

Most Popular Narrative: 6.7% Undervalued

L'Oréal's fair value, according to the most widely followed narrative, stands well above the recent closing price. This suggests market expectations are lagging behind the company's growth potential. Forward-looking assumptions form the basis for the premium.

Major capital allocation to strategic acquisitions (e.g., Medik8, Color Wow) and digital/AI-driven innovation (AI personalization, beauty tech partnerships) is expected to increase category leadership, fuel product differentiation, and raise future revenue and net margins.

Curious what projected growth rates and margin upgrades could justify the lofty valuation? The most popular narrative hinges on strategic bets and future earnings power. What bold assumptions are hiding behind this fair value?

Result: Fair Value of €387.55 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition from digital-first brands and changing consumer preferences could challenge L'Oréal’s ability to maintain its growth and premium positioning.

Find out about the key risks to this L'Oréal narrative.

Another View: Room for Valuation Debate

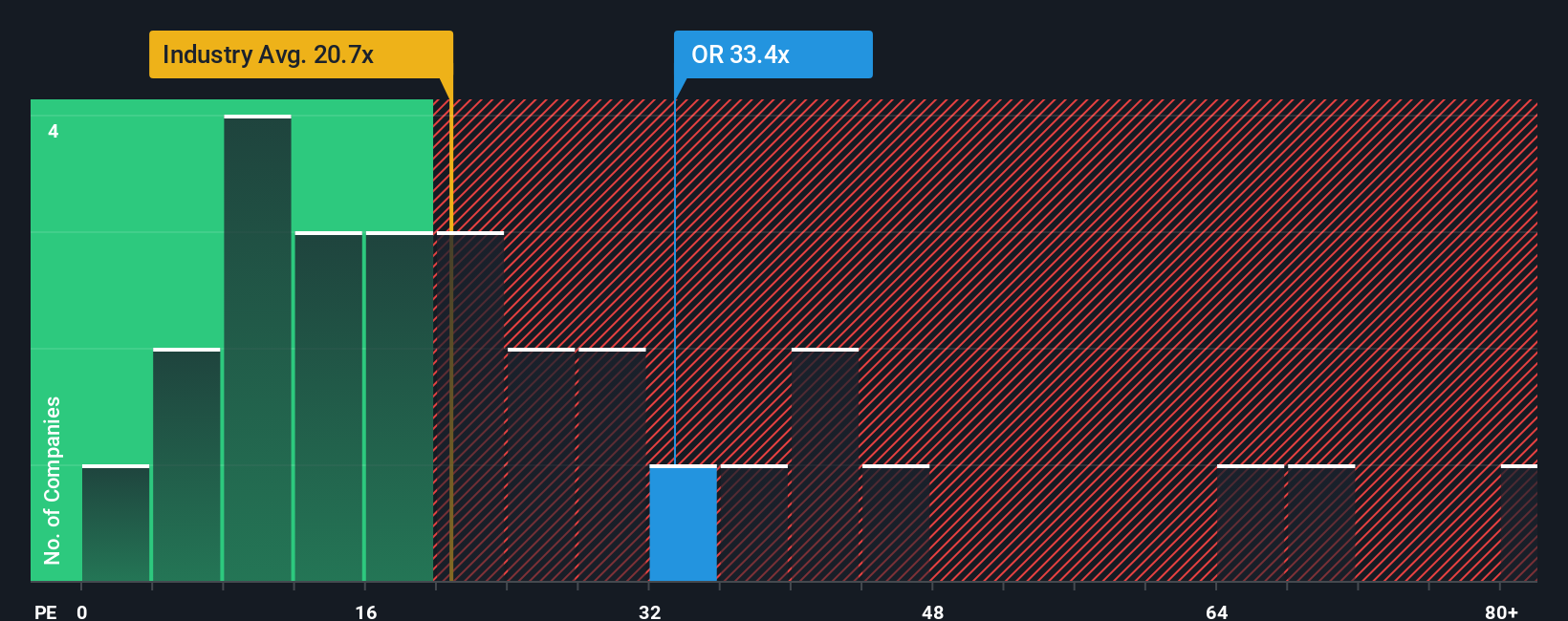

Looking from a market multiple perspective, L'Oréal trades at around 31.5 times earnings. This is notably higher than European peers averaging 19 times and above its fair ratio of 29.9. This premium signals confidence in future growth, but does it also expose investors to greater downside if expectations slip?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own L'Oréal Narrative

If you want to approach the numbers from your own angle or challenge the consensus, building your own analysis will take just a few minutes, so why not Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding L'Oréal.

Looking for More Investment Ideas?

Take the lead and broaden your watchlist with smart, high-potential stock picks available through the Simply Wall Street Screener. Get ahead of the trends, as these opportunities may not last forever.

- Uncover fresh value by tracking these 926 undervalued stocks based on cash flows that pass strict cash flow tests and could be overlooked gems in the current market.

- Secure steady income streams by tapping into these 16 dividend stocks with yields > 3% with yields above 3% and proven financial resilience.

- Explore generative innovation by investigating these 26 AI penny stocks at the forefront of artificial intelligence breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:OR

L'Oréal

Through its subsidiaries, manufactures and sells cosmetic products for women and men worldwide.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives