- France

- /

- Healthcare Services

- /

- ENXTPA:GDS

Ramsay Générale de Santé (EPA:GDS shareholders incur further losses as stock declines 5.1% this week, taking three-year losses to 52%

If you are building a properly diversified stock portfolio, the chances are some of your picks will perform badly. Long term Ramsay Générale de Santé SA (EPA:GDS) shareholders know that all too well, since the share price is down considerably over three years. Unfortunately, they have held through a 52% decline in the share price in that time. The more recent news is of little comfort, with the share price down 32% in a year. More recently, the share price has dropped a further 13% in a month.

Since Ramsay Générale de Santé has shed €53m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

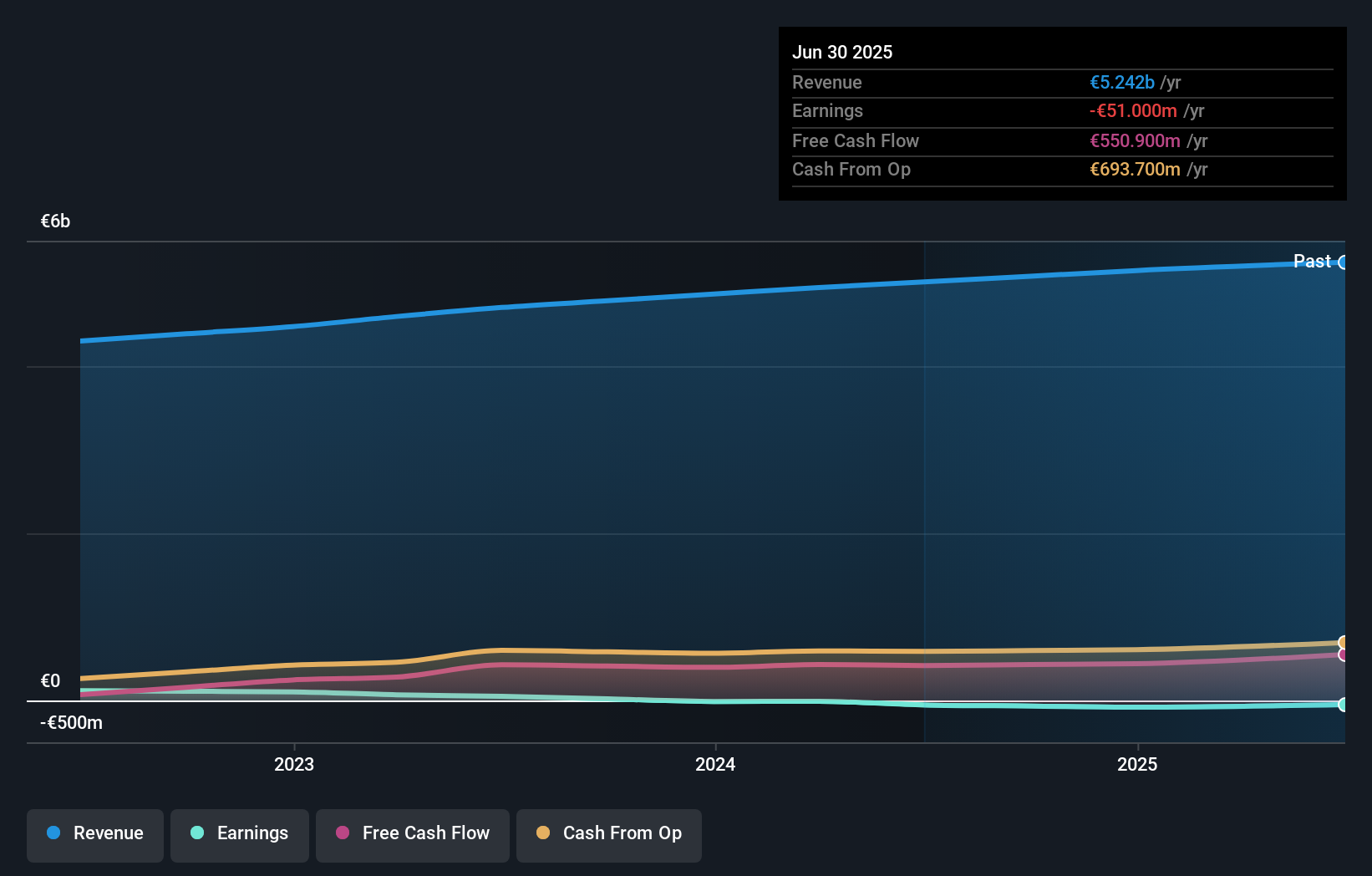

Because Ramsay Générale de Santé made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last three years, Ramsay Générale de Santé saw its revenue grow by 6.8% per year, compound. Given it's losing money in pursuit of growth, we are not really impressed with that. This uninspiring revenue growth has no doubt helped send the share price lower; it dropped 15% during the period. It can be well worth keeping an eye on growth stocks that disappoint the market, because sometimes they re-accelerate. Keep in mind it isn't unusual for good businesses to have a tough time or a couple of uninspiring years.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Investors in Ramsay Générale de Santé had a tough year, with a total loss of 32%, against a market gain of about 13%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 8% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Ramsay Générale de Santé better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for Ramsay Générale de Santé you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on French exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:GDS

Ramsay Générale de Santé

Operates healthcare facilities in France, Sweden, Norway, Denmark, and Italy.

Good value with imperfect balance sheet.

Market Insights

Community Narratives