- France

- /

- Medical Equipment

- /

- ENXTPA:EL

EssilorLuxottica (ENXTPA:EL): A Fresh Look at Valuation as Shares Build on Steady Gains

Reviewed by Simply Wall St

Most Popular Narrative: Fairly Valued

The most widely followed narrative suggests that EssilorLuxottica is fairly valued at its current share price, with analysts viewing the stock as neither significantly undervalued nor overpriced relative to expected future growth and risks.

Investments in smart eyewear, AI-enabled vision solutions, and MedTech (Ray-Ban Meta, Oakley Meta, Nuance Audio, acquisition of Optegra Eye Clinics) capitalize on long-term demand for technologically advanced and personalized eye health platforms, catalyzing product mix upgrades and higher ASPs, which will benefit gross margin and future earnings.

Want to know what drives this balanced valuation? The narrative is built around ambitious forecasts for both top-line and bottom-line expansion, as well as expectations for healthier margins. These projections are usually reserved for industry leaders. Which specific trends in the business model convinced analysts the growth story is on track? Discover the game-changing assumptions that underpin this fair value and see what could tip the balance next.

Result: Fair Value of €265.94 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.However, aggressive investment in emerging tech and rising global cost pressures could challenge profitability if margins continue to face structural headwinds.

Find out about the key risks to this EssilorLuxottica Société anonyme narrative.Another View: Assessing Value from a Different Angle

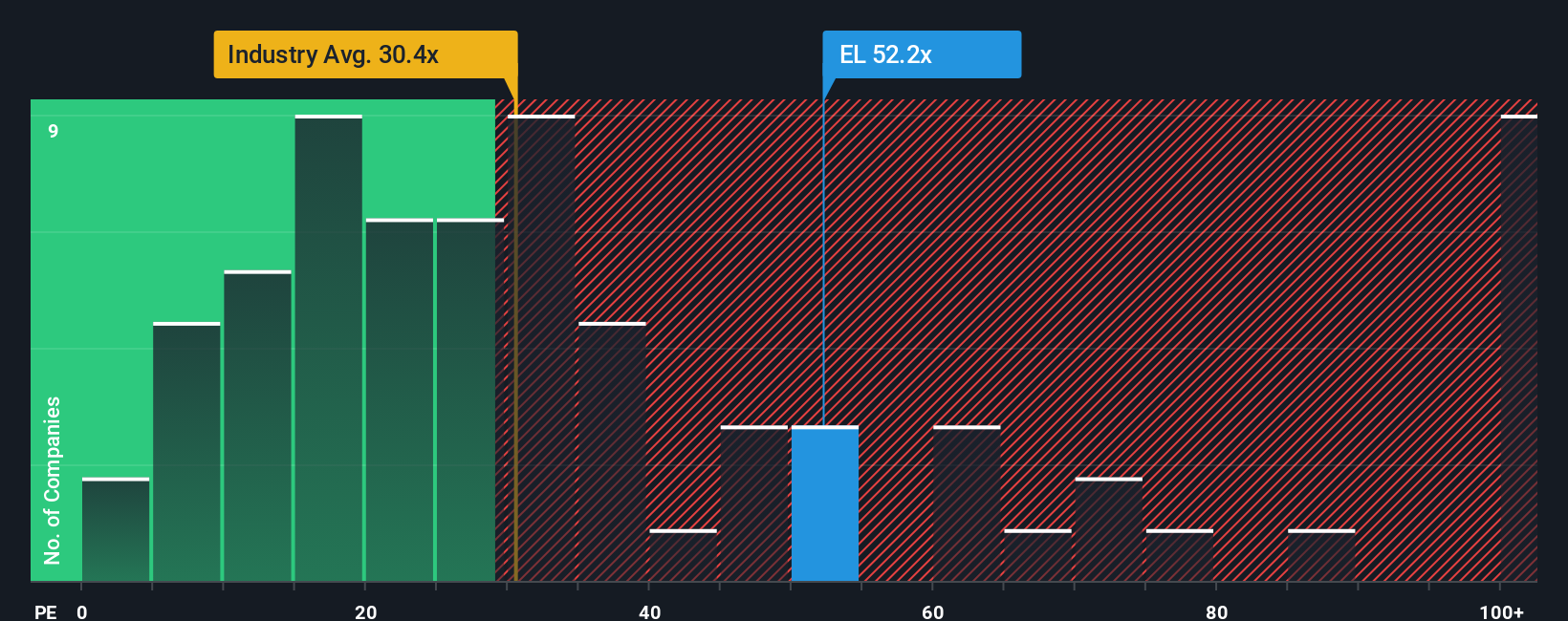

Looking at it from a market comparison, EssilorLuxottica trades at a much higher earnings ratio than the European medical devices sector. This raises the question of whether it reflects strong confidence in future growth or suggests that investors are overpaying.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own EssilorLuxottica Société anonyme Narrative

If you see things differently or want to dig deeper on your own terms, you can craft your own story within just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding EssilorLuxottica Société anonyme.

Looking for more investment ideas?

Why settle for the usual stocks when smarter possibilities are just a click away? Uncover hidden potential with these dynamic strategies designed to move you ahead of the market.

- Spot rising stars among tomorrow’s market leaders by tapping into undervalued stocks based on cash flows, your shortcut to companies trading below their true worth.

- Get ahead of innovation trends and ride the momentum fueling AI penny stocks for a front-row seat to the future of artificial intelligence.

- Watch your portfolio grow with reliable income streams by targeting dividend stocks with yields > 3% that deliver strong yields and financial consistency.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EssilorLuxottica Société anonyme might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About ENXTPA:EL

EssilorLuxottica Société anonyme

Designs, manufactures, and distributes ophthalmic lenses, frames, and sunglasses in North America, the Middle East, Africa, Europe, Latin America, and the Asia-Pacific.

Adequate balance sheet with moderate growth potential.

Market Insights

Community Narratives