- France

- /

- Healthcare Services

- /

- ENXTPA:CLARI

The Price Is Right For Clariane SE (EPA:CLARI) Even After Diving 26%

The Clariane SE (EPA:CLARI) share price has fared very poorly over the last month, falling by a substantial 26%. Still, a bad month hasn't completely ruined the past year with the stock gaining 66%, which is great even in a bull market.

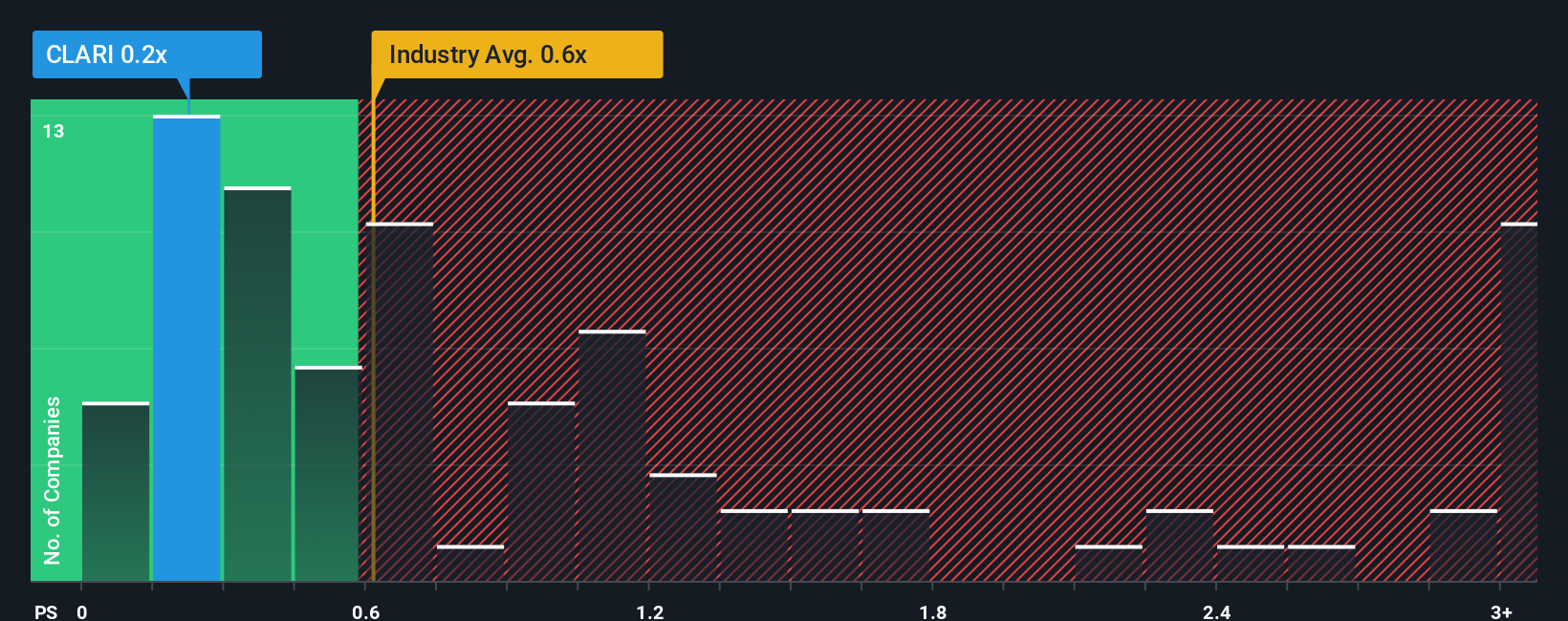

In spite of the heavy fall in price, it's still not a stretch to say that Clariane's price-to-sales (or "P/S") ratio of 0.2x right now seems quite "middle-of-the-road" compared to the Healthcare industry in France, where the median P/S ratio is around 0.3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Clariane

What Does Clariane's P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, Clariane has been relatively sluggish. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Clariane.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Clariane would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 2.7% last year. The latest three year period has also seen a 24% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 4.5% per annum over the next three years. With the industry predicted to deliver 5.3% growth per annum, the company is positioned for a comparable revenue result.

In light of this, it's understandable that Clariane's P/S sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Final Word

With its share price dropping off a cliff, the P/S for Clariane looks to be in line with the rest of the Healthcare industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look at Clariane's revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

Before you settle on your opinion, we've discovered 2 warning signs for Clariane (1 is a bit unpleasant!) that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:CLARI

Clariane

Provides care home, healthcare facilities and services, and shared living solutions in France, Germany, Benelux, Italy, Spain, and the United Kingdom.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives