- France

- /

- Healthcare Services

- /

- ENXTPA:BLC

Investors Appear Satisfied With Bastide Le Confort Médical SA's (EPA:BLC) Prospects As Shares Rocket 28%

Bastide Le Confort Médical SA (EPA:BLC) shareholders would be excited to see that the share price has had a great month, posting a 28% gain and recovering from prior weakness. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 10% in the last twelve months.

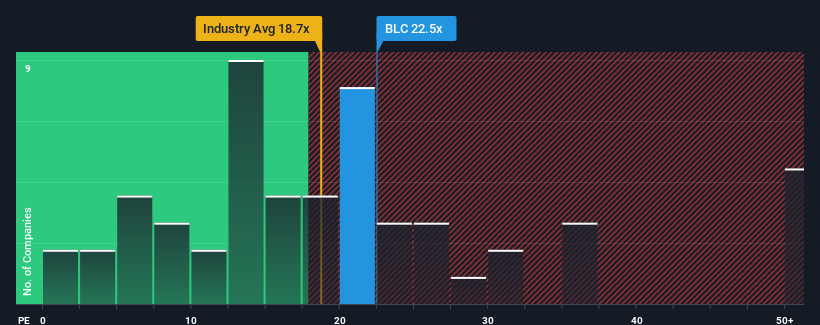

Since its price has surged higher, given close to half the companies in France have price-to-earnings ratios (or "P/E's") below 13x, you may consider Bastide Le Confort Médical as a stock to avoid entirely with its 22.5x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Recent times haven't been advantageous for Bastide Le Confort Médical as its earnings have been falling quicker than most other companies. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Bastide Le Confort Médical

Is There Enough Growth For Bastide Le Confort Médical?

Bastide Le Confort Médical's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 54%. This means it has also seen a slide in earnings over the longer-term as EPS is down 45% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 53% each year as estimated by the dual analysts watching the company. That's shaping up to be materially higher than the 15% per year growth forecast for the broader market.

In light of this, it's understandable that Bastide Le Confort Médical's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

The strong share price surge has got Bastide Le Confort Médical's P/E rushing to great heights as well. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Bastide Le Confort Médical maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

You need to take note of risks, for example - Bastide Le Confort Médical has 3 warning signs (and 1 which is a bit concerning) we think you should know about.

Of course, you might also be able to find a better stock than Bastide Le Confort Médical. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Bastide Le Confort Médical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:BLC

Bastide Le Confort Médical

Engages in the sale and rental of medical equipment for individuals and health professionals in France and internationally.

High growth potential and fair value.

Market Insights

Community Narratives