- France

- /

- Medical Equipment

- /

- ENXTPA:BIM

How the AmPORE-TB Launch at bioMérieux (ENXTPA:BIM) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Oxford Nanopore Technologies and bioMérieux recently launched AmPORE-TB, a Research Use Only solution for rapid detection of antimicrobial resistance mutations in tuberculosis, with recognition from the World Health Organization and a focus on high-need, low- and middle-income regions.

- This development highlights bioMérieux’s expanding role in addressing global health threats and reflects continued innovation in molecular diagnostics through international partnerships.

- Let’s explore how the WHO-recognized AmPORE-TB launch and updated earnings guidance may reshape bioMérieux’s investment outlook.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

bioMérieux Investment Narrative Recap

To own shares of bioMérieux, you need to believe in its ability to drive consistent growth through innovation in diagnostics and leverage global health trends. While the recent launch of AmPORE-TB places a spotlight on bioMérieux’s leadership in molecular diagnostics, it does not materially change the near-term catalyst, which remains strong cross-selling in BIOFIRE’s nonrespiratory panels, nor does it reduce the most pressing risk, which is volatility from BIOFIRE contract expirations and competitive pressures. The most relevant recent announcement is bioMérieux’s updated earnings guidance for 2025, reaffirming sales growth expectations and a robust CEBIT outlook. This guidance gives some confidence in the short-term financial trajectory, though it does not address the headwinds from contract expirations or mounting competition in key markets. But in contrast, investors should be aware that pricing pressure and contract volatility...

Read the full narrative on bioMérieux (it's free!)

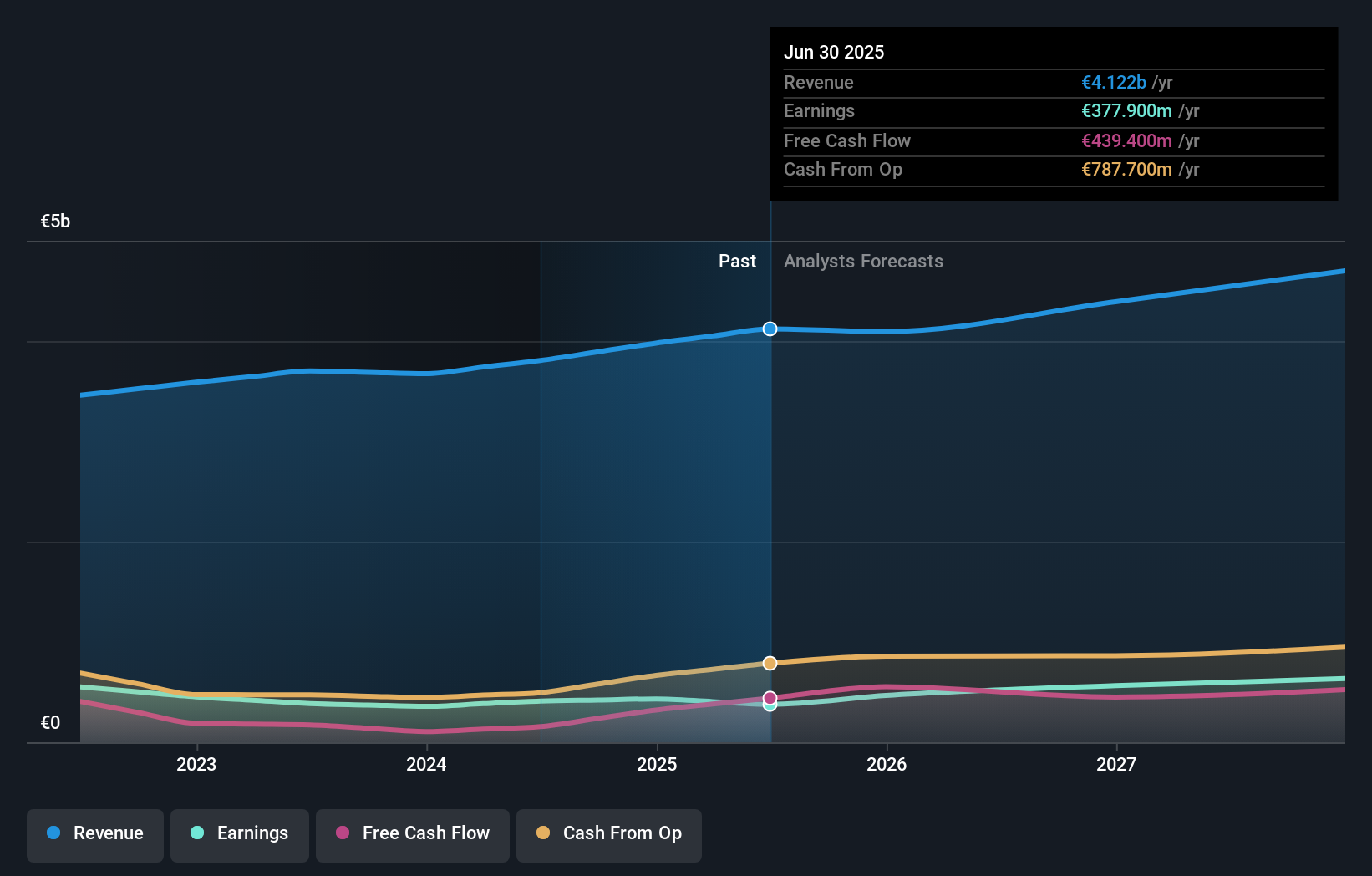

bioMérieux's narrative projects €4.9 billion revenue and €648.5 million earnings by 2028. This requires 7.1% yearly revenue growth and a €216.3 million earnings increase from €432.2 million today.

Uncover how bioMérieux's forecasts yield a €123.46 fair value, a 14% upside to its current price.

Exploring Other Perspectives

Fair value targets from three Simply Wall St Community contributors range from €95.15 to €123.46 per share. With BIOFIRE’s cross-selling capacity highlighted as a key catalyst, several viewpoints on future performance invite you to weigh different scenarios for bioMérieux’s earnings power.

Explore 3 other fair value estimates on bioMérieux - why the stock might be worth 12% less than the current price!

Build Your Own bioMérieux Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your bioMérieux research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free bioMérieux research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate bioMérieux's overall financial health at a glance.

No Opportunity In bioMérieux?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:BIM

bioMérieux

Develops, manufactures, and markets in vitro diagnostic solutions for infectious diseases in France, Europe, Africa, the Middle East, North and South America, the Asia Pacific, and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives