As global markets navigate a landscape marked by fluctuating indices and economic uncertainties, the focus on small-cap stocks has intensified, particularly in light of recent AI competition fears and central bank policy shifts. The volatility seen in major indexes like the Nasdaq Composite and S&P 500 underscores the importance of identifying resilient investment opportunities that can thrive amid changing market dynamics. In this context, discovering promising stocks often involves looking for companies with strong fundamentals, innovative potential, or unique market positions that may not yet be fully recognized by broader market sentiment.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Resource Alam Indonesia | 2.66% | 30.36% | 43.87% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Cardig Aero Services | NA | 6.60% | 69.79% | ★★★★★★ |

| Kenturn Nano. Tec | 45.38% | 9.73% | 28.94% | ★★★★★☆ |

| Co-Tech Development | 26.81% | 3.29% | 6.53% | ★★★★★☆ |

| Feedback Technology | 23.09% | 11.19% | 19.33% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Al-Deera Holding Company K.P.S.C | 6.11% | 51.44% | 59.77% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Savencia (ENXTPA:SAVE)

Simply Wall St Value Rating: ★★★★★★

Overview: Savencia SA is a company that produces, distributes, and markets dairy and cheese products across France, the rest of Europe, and internationally with a market cap of €682.06 million.

Operations: Savencia generates revenue primarily through the production, distribution, and marketing of dairy and cheese products. The company has a market capitalization of €682.06 million.

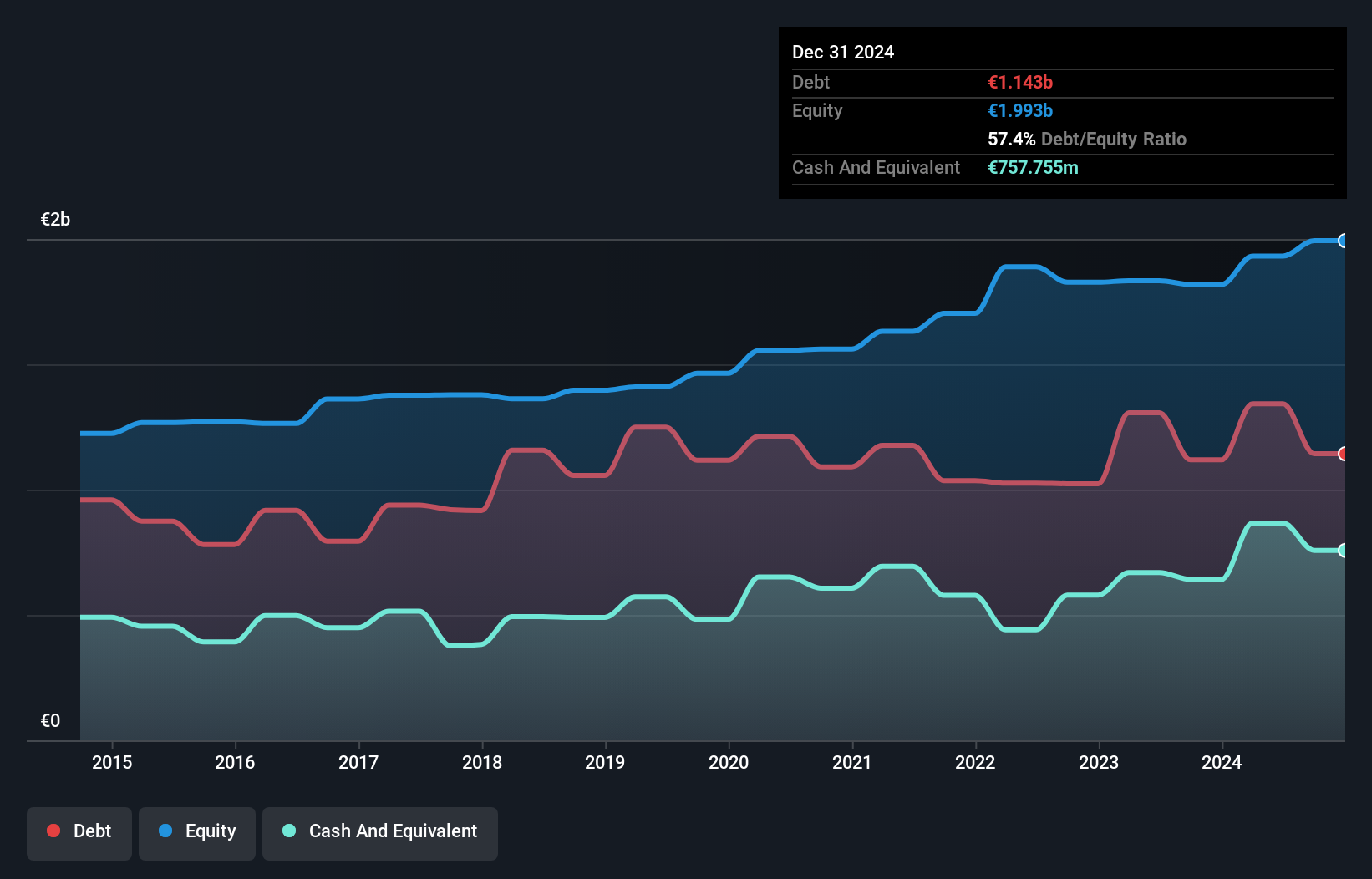

Savencia, a notable player in the food sector, reported sales of €7.14 billion for 2024, up from €6.79 billion the previous year. Despite a robust earnings growth of 114.7% last year, boosted by outperforming the industry average of 5.3%, future earnings are forecasted to decline by an average of 3.4% annually over the next three years. The company's net debt to equity ratio stands at a satisfactory 24.9%, and interest payments are well covered with EBIT at 32x coverage, although recent results were impacted by a one-off loss of €43.6 million as of June 2024.

- Get an in-depth perspective on Savencia's performance by reading our health report here.

Assess Savencia's past performance with our detailed historical performance reports.

Harbin Pharmaceutical Group (SHSE:600664)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Harbin Pharmaceutical Group Co., Ltd. operates in the research, development, manufacture, wholesale, and retail of pharmaceuticals both in China and internationally with a market capitalization of CN¥9.65 billion.

Operations: Harbin Pharmaceutical Group generates revenue through the research, development, manufacture, wholesale, and retail of pharmaceuticals both domestically and internationally.

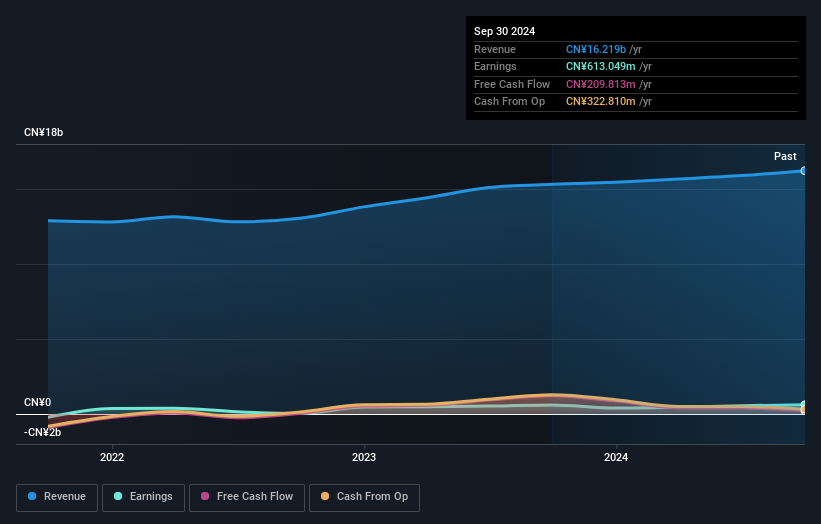

Harbin Pharma, a smaller player in the pharmaceutical sector, shows promise with its price-to-earnings ratio at 15.7x, notably below the CN market average of 35.8x. This suggests potential undervaluation compared to peers. The company has demonstrated robust financial health with interest payments well-covered by EBIT at 146 times, indicating strong earnings relative to debt obligations. Over the past year, Harbin's earnings grew by 2.3%, outpacing the industry average of -2.5%. Despite a rising debt-to-equity ratio from 8% to 30% over five years, it holds more cash than total debt, highlighting financial resilience and growth potential in a challenging market environment.

- Delve into the full analysis health report here for a deeper understanding of Harbin Pharmaceutical Group.

Gain insights into Harbin Pharmaceutical Group's past trends and performance with our Past report.

Qingdao Kingking Applied Chemistry (SZSE:002094)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Qingdao Kingking Applied Chemistry Co., Ltd. is a company involved in the production and sale of various chemical products, with a market cap of CN¥3.86 billion.

Operations: Qingdao Kingking Applied Chemistry generates revenue through the production and sale of various chemical products. The company's financial performance is highlighted by its net profit margin, which reflects its ability to manage costs effectively relative to its revenue streams.

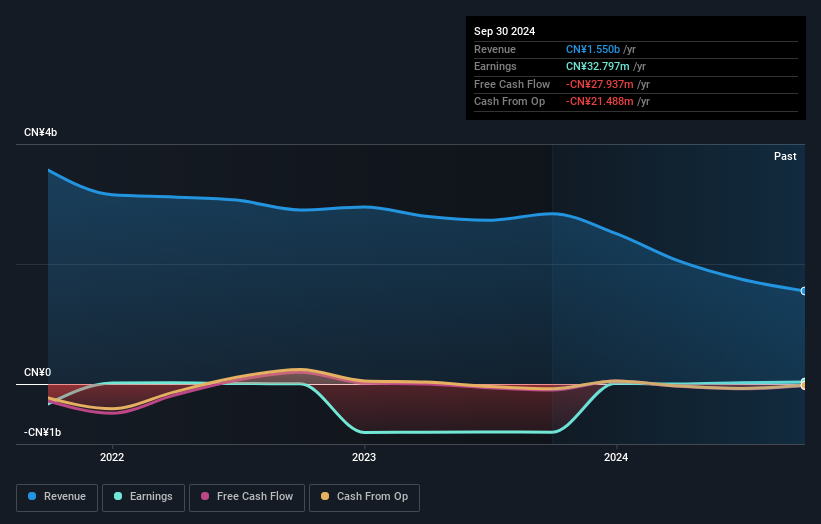

Qingdao Kingking Applied Chemistry, a small player in the personal products sector, has recently turned profitable, outperforming an industry that saw a 10.1% earnings drop. The company's high-quality earnings and satisfactory net debt to equity ratio of 32.8% highlight its financial health. However, over the past five years, its debt to equity ratio has climbed from 31.8% to 76.4%, suggesting increased leverage that investors should monitor closely. Despite interest coverage not being an issue due to earning more than it pays in interest, free cash flow remains negative which could pose challenges for future expansion plans or investments.

- Take a closer look at Qingdao Kingking Applied Chemistry's potential here in our health report.

Learn about Qingdao Kingking Applied Chemistry's historical performance.

Turning Ideas Into Actions

- Get an in-depth perspective on all 4724 Undiscovered Gems With Strong Fundamentals by using our screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Harbin Pharmaceutical Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600664

Harbin Pharmaceutical Group

Engages in the research, development, manufacture, wholesale, and retail of pharmaceuticals in China and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives