Market Sentiment Around Loss-Making Marie Brizard Wine & Spirits SA (EPA:MBWS)

With the business potentially at an important milestone, we thought we'd take a closer look at Marie Brizard Wine & Spirits SA's (EPA:MBWS) future prospects. Marie Brizard Wine & Spirits SA produces and sells wine and spirits in Western Europe, the Middle East, Africa, Central and Eastern Europe, the Americas, and Asia-Pacific. The €157m market-cap company announced a latest loss of €5.6m on 31 December 2020 for its most recent financial year result. As path to profitability is the topic on Marie Brizard Wine & Spirits' investors mind, we've decided to gauge market sentiment. Below we will provide a high-level summary of the industry analysts’ expectations for the company.

See our latest analysis for Marie Brizard Wine & Spirits

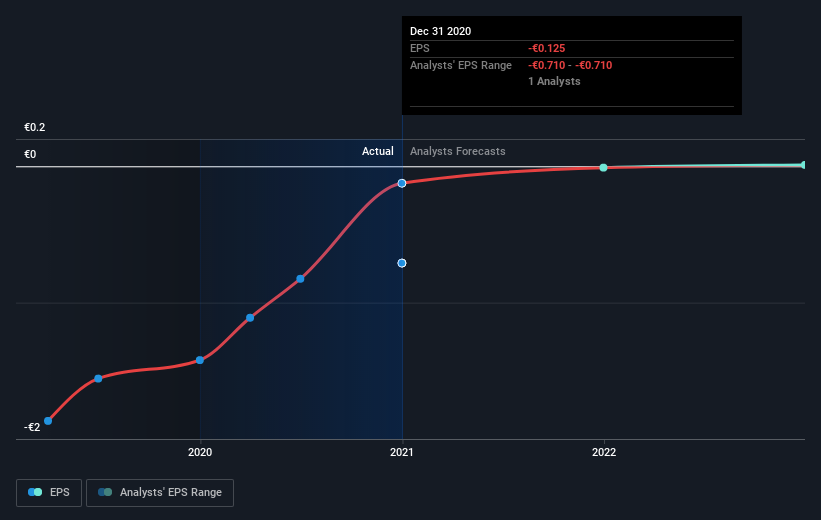

According to the 2 industry analysts covering Marie Brizard Wine & Spirits, the consensus is that breakeven is near. They expect the company to post a final loss in 2021, before turning a profit of €1.6m in 2022. Therefore, the company is expected to breakeven just over a year from today. What rate will the company have to grow year-on-year in order to breakeven on this date? Using a line of best fit, we calculated an average annual growth rate of 133%, which is extremely buoyant. If this rate turns out to be too aggressive, the company may become profitable much later than analysts predict.

Given this is a high-level overview, we won’t go into details of Marie Brizard Wine & Spirits' upcoming projects, however, take into account that by and large a high growth rate is not out of the ordinary, particularly when a company is in a period of investment.

One thing we’d like to point out is that The company has managed its capital prudently, with debt making up 22% of equity. This means that it has predominantly funded its operations from equity capital, and its low debt obligation reduces the risk around investing in the loss-making company.

Next Steps:

This article is not intended to be a comprehensive analysis on Marie Brizard Wine & Spirits, so if you are interested in understanding the company at a deeper level, take a look at Marie Brizard Wine & Spirits' company page on Simply Wall St. We've also compiled a list of pertinent aspects you should further examine:

- Valuation: What is Marie Brizard Wine & Spirits worth today? Has the future growth potential already been factored into the price? The intrinsic value infographic in our free research report helps visualize whether Marie Brizard Wine & Spirits is currently mispriced by the market.

- Management Team: An experienced management team on the helm increases our confidence in the business – take a look at who sits on Marie Brizard Wine & Spirits’s board and the CEO’s background.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

If you’re looking to trade Marie Brizard Wine & Spirits, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTPA:MBWS

Marie Brizard Wine & Spirits

Engages in the producing, marketing, and selling wines and spirits in France, Europe, Africa, the Americas, and the Asia Pacific.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives