As European markets navigate a landscape of renewed uncertainty due to shifting U.S. trade policies and escalating geopolitical tensions in the Middle East, the pan-European STOXX Europe 600 Index recently ended 1.57% lower, reflecting broader market volatility. In this context, identifying promising small-cap stocks becomes crucial for investors seeking opportunities amid economic fluctuations; these undiscovered gems often exhibit resilience through strong fundamentals and innovative business models that can thrive despite challenging conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| AB Traction | NA | 5.39% | 5.24% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| Martifer SGPS | 102.88% | -0.23% | 7.16% | ★★★★★★ |

| ABG Sundal Collier Holding | 8.55% | -4.14% | -12.38% | ★★★★★☆ |

| Flügger group | 20.98% | 3.24% | -29.82% | ★★★★★☆ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 19.46% | 0.47% | 7.14% | ★★★★★☆ |

| Dekpol | 63.20% | 11.06% | 13.37% | ★★★★★☆ |

| Alantra Partners | 3.79% | -3.99% | -23.83% | ★★★★★☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| Darwin | 3.03% | 84.88% | 5.63% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Cairo Communication (BIT:CAI)

Simply Wall St Value Rating: ★★★★★☆

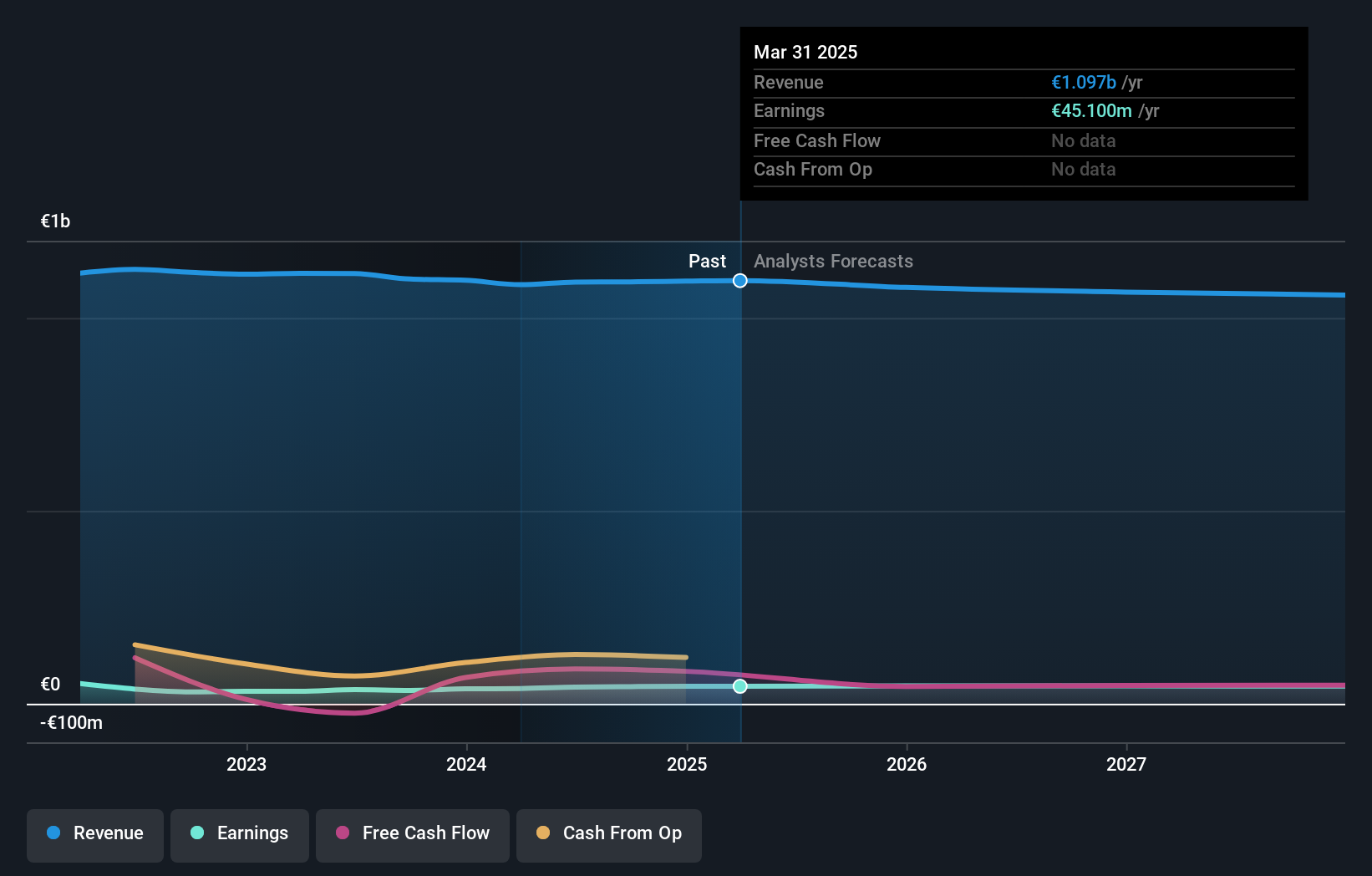

Overview: Cairo Communication S.p.A. is a communication company with operations in Italy and Spain, and it has a market capitalization of €413.33 million.

Operations: Cairo Communication's revenue is primarily derived from its RCS segment, contributing €866 million, and Licensees at €356.20 million. The company also generates income from Editoria periodici Cairo Editore (€78.90 million) and La7 Television Publishing and Network Operator (€123.40 million).

Cairo Communication, a notable player in the media sector, has shown resilience with earnings growth of 14.5% over the past year, outpacing the industry average of -21.2%. The company has effectively reduced its debt to equity ratio from 24.4% to 7.6% in five years and maintains more cash than total debt, indicating sound financial health. Recent share buybacks amounted to €41.35 million for 10.61% of shares, reflecting strategic capital management. Despite a net loss of €2.1 million in Q1 2025, it trades at an attractive value—31.9% below estimated fair value—suggesting potential for future gains.

- Navigate through the intricacies of Cairo Communication with our comprehensive health report here.

Evaluate Cairo Communication's historical performance by accessing our past performance report.

Cembre (BIT:CMB)

Simply Wall St Value Rating: ★★★★★★

Overview: Cembre S.p.A. is involved in the production and distribution of electrical connectors, cable accessories, and tools across Italy, Europe, and globally with a market cap of €934.91 million.

Operations: Electric connectors and related tools contribute significantly to Cembre's revenue, amounting to €231.29 million.

Cembre, a dynamic player in the European market, showcases impressive financial health with earnings climbing 12.8% over the past year, outpacing the Electrical industry's -1.8%. The company reported a net income of €11.9 million for Q1 2025, up from €9.72 million in the previous year, reflecting its robust growth trajectory. With a debt-to-equity ratio shrinking from 15.6% to just 0.04% over five years and EBIT covering interest payments by an astounding 186 times, Cembre's financial stability is evident. As earnings are forecast to grow at 6%, this firm seems poised for continued success amidst industry challenges.

- Delve into the full analysis health report here for a deeper understanding of Cembre.

Gain insights into Cembre's historical performance by reviewing our past performance report.

Malteries Franco-Belges Société Anonyme (ENXTPA:MALT)

Simply Wall St Value Rating: ★★★★★☆

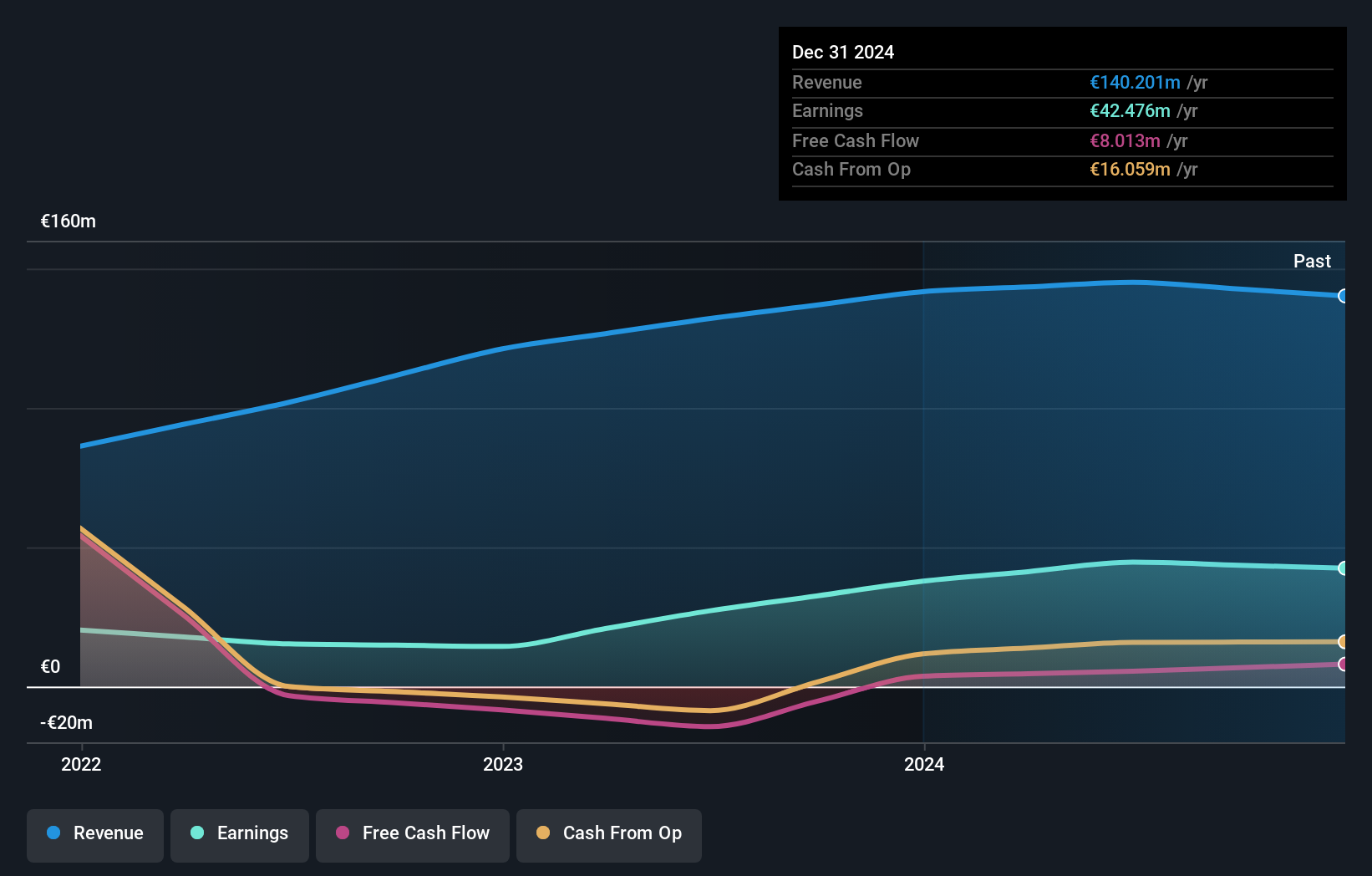

Overview: Malteries Franco-Belges Société Anonyme focuses on producing and selling malt mainly to brewers both in France and abroad, with a market capitalization of €451.35 million.

Operations: Malteries Franco-Belges Société Anonyme generates revenue primarily from its malt factory, which reported €140.20 million in sales. The company's market capitalization stands at €451.35 million.

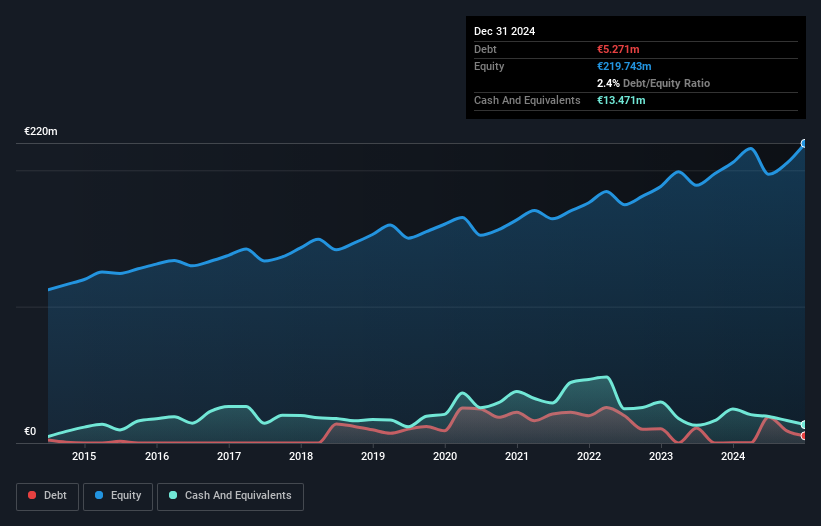

Malteries Franco-Belges, a smaller player in the European market, has been making waves with its solid financial standing. The company boasts more cash than its total debt, reflecting a robust balance sheet. Trading at 32.2% below estimated fair value suggests potential undervaluation. Over the past year, earnings grew by 12.4%, outpacing the Food industry’s -3%. However, recent results showed some challenges; sales for the half-year ending December 2024 were €64.65M compared to €69.55M previously, with net income at €18.16M versus €20.3M last year—indicating room for improvement despite strong fundamentals.

- Click here and access our complete health analysis report to understand the dynamics of Malteries Franco-Belges Société Anonyme.

Understand Malteries Franco-Belges Société Anonyme's track record by examining our Past report.

Taking Advantage

- Unlock our comprehensive list of 336 European Undiscovered Gems With Strong Fundamentals by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:CAI

Cairo Communication

Operates as a communication company in Italy and Spain.

Undervalued with solid track record.

Market Insights

Community Narratives