Laurent-Perrier (ENXTPA:LPE) Net Margins Slip to 15.3%, Testing Defensive Reputation

Reviewed by Simply Wall St

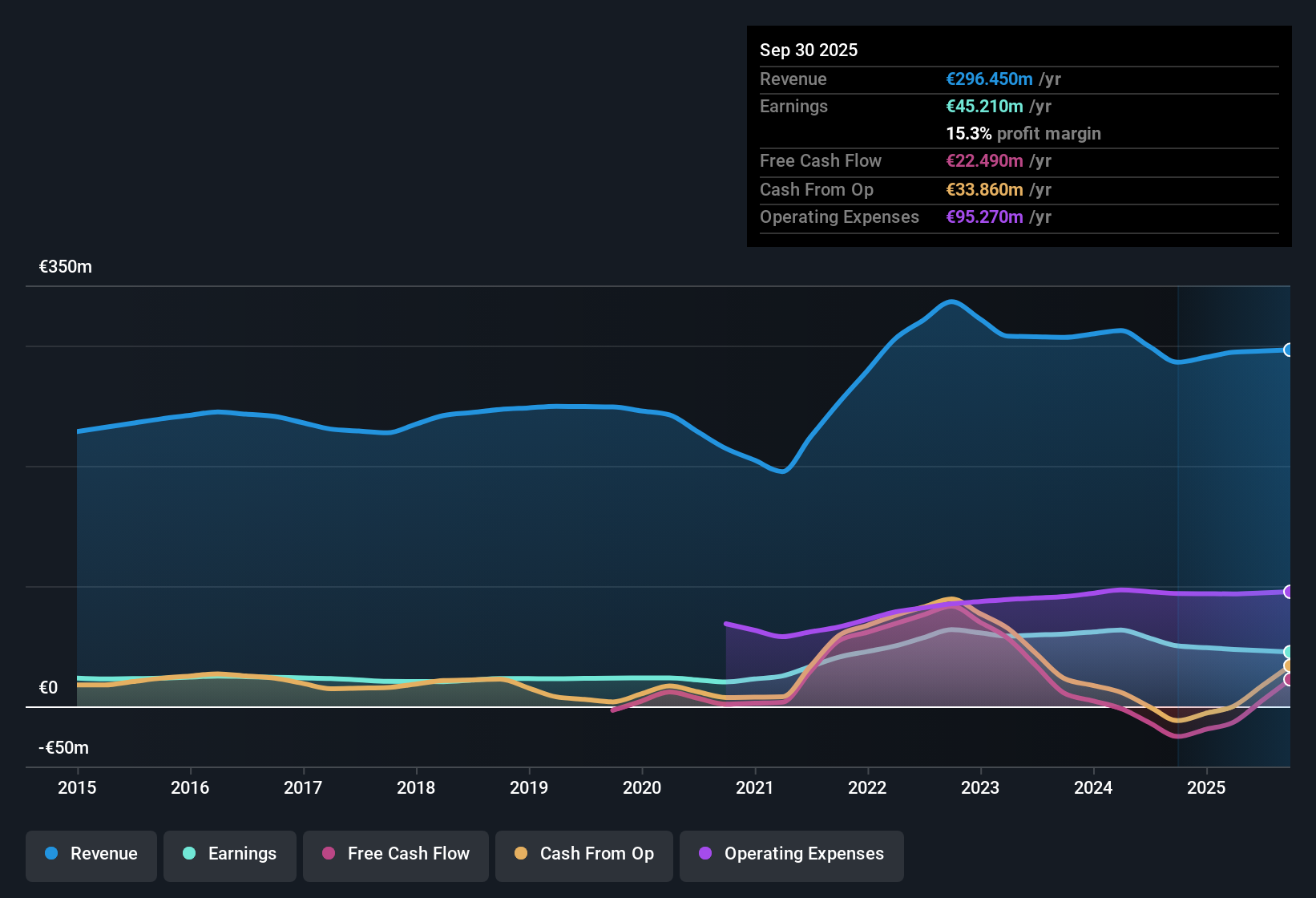

Laurent-Perrier (ENXTPA:LPE) just posted its financial results for H1 2026, reporting revenue of €296.45 million and EPS of €7.69 on a trailing twelve-month basis. Historically, the company has seen revenue move from €286.15 million in H1 2025 to €294.43 million in H2 2025, reflecting steady topline contributions. EPS moved from €8.50 to €8.02 over the same period. Margins are feeling the squeeze, with net profitability moderating compared to the previous year's results.

See our full analysis for Laurent-Perrier.Next up, let’s see how these numbers stack up against the stories investors are telling, and where the prevailing narratives hold up or get challenged.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Step Down to 15.3%

- Net profit margin for Laurent-Perrier in the last twelve months was 15.3%, sliding from 17.6% in the prior year, even as net income moved from €47.41 million in H2 2025 to €45.21 million in H1 2026.

- Despite a multi-year trend of 9.8% annual earnings growth, the prevailing market view points out that profits have actually decreased year-over-year, creating tension with the company’s reputation for steady expansion.

- This decline in margin and net income underscores that even established luxury brands are not insulated from rising costs or evolving consumer spending.

- While the company’s historic growth rate impresses, recent pressure on profitability tests how defensive Laurent-Perrier truly is when market conditions shift.

Valuation Nearly 43% Below DCF Fair Value

- Shares currently trade at €96.00, about 42.9% below the DCF fair value of €168.27 and well under both peer (40.9x) and beverage industry (17.3x) average Price-to-Earnings multiples, giving Laurent-Perrier a distinct value tilt in today’s market.

- The market’s view suggests this low valuation heavily supports arguments for the stock's upside, anchored by high quality earnings and a 2.19% dividend yield.

- Bulls highlight the reliable yield and defensive sector characteristics as key reasons for holding the stock, especially versus higher-priced beverage peers.

- On the other hand, the muted revenue growth (2% vs. 5.3% French market average) means value hunters must balance cheapness with slower fundamental momentum.

Revenue Growth Lags French Market

- Laurent-Perrier reported only 2% annual revenue growth over the past year, coming in noticeably below the French industry average of 5.3%.

- Consensus narrative notes, although Laurent-Perrier benefits from sector stability and global reach, its recent growth fails to keep pace with local peers, which may sustain the company’s defensive appeal but could leave it reliant on valuation support if top-line momentum does not pick up.

- This lagging revenue trend is especially relevant for investors seeking growth, as it underscores the tradeoff that comes with the company’s lower relative valuation and premium brand positioning.

- It also reminds investors that even with brand strength and export scale, competitive headwinds in the French beverage sector remain persistent.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Laurent-Perrier's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Laurent-Perrier faces challenges with declining profit margins and revenue growth lagging well behind industry peers. This raises questions about its future momentum.

If you want a shortlist of companies with consistent revenue and earnings growth, turn to stable growth stocks screener (2074 results) to focus your search on reliable performers.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:LPE

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026