Is L.D.C. S.A. (EPA:LOUP) A Good Fit For Your Dividend Portfolio?

Today we'll take a closer look at L.D.C. S.A. (EPA:LOUP) from a dividend investor's perspective. Owning a strong business and reinvesting the dividends is widely seen as an attractive way of growing your wealth. Yet sometimes, investors buy a popular dividend stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

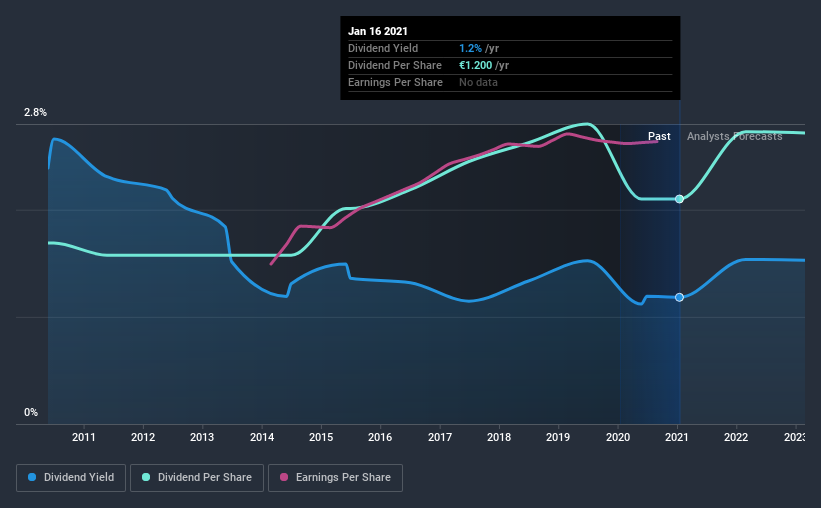

A slim 1.2% yield is hard to get excited about, but the long payment history is respectable. At the right price, or with strong growth opportunities, L.D.C could have potential. Before you buy any stock for its dividend however, you should always remember Warren Buffett's two rules: 1) Don't lose money, and 2) Remember rule #1. We'll run through some checks below to help with this.

Click the interactive chart for our full dividend analysis

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. As a result, we should always investigate whether a company can afford its dividend, measured as a percentage of a company's net income after tax. L.D.C paid out 14% of its profit as dividends, over the trailing twelve month period. We like this low payout ratio, because it implies the dividend is well covered and leaves ample opportunity for reinvestment.

We also measure dividends paid against a company's levered free cash flow, to see if enough cash was generated to cover the dividend. L.D.C's cash payout ratio last year was 19%, which is quite low and suggests that the dividend was thoroughly covered by cash flow. It's positive to see that L.D.C's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

With a strong net cash balance, L.D.C investors may not have much to worry about in the near term from a dividend perspective.

Consider getting our latest analysis on L.D.C's financial position here.

Dividend Volatility

From the perspective of an income investor who wants to earn dividends for many years, there is not much point buying a stock if its dividend is regularly cut or is not reliable. L.D.C has been paying dividends for a long time, but for the purpose of this analysis, we only examine the past 10 years of payments. This dividend has been unstable, which we define as having been cut one or more times over this time. During the past 10-year period, the first annual payment was €1.0 in 2011, compared to €1.2 last year. This works out to be a compound annual growth rate (CAGR) of approximately 2.2% a year over that time. L.D.C's dividend payments have fluctuated, so it hasn't grown 2.2% every year, but the CAGR is a useful rule of thumb for approximating the historical growth.

It's good to see some dividend growth, but the dividend has been cut at least once, and the size of the cut would eliminate most of the growth, anyway. We're not that enthused by this.

Dividend Growth Potential

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. L.D.C has grown its earnings per share at 5.5% per annum over the past five years. With a decent amount of growth and a low payout ratio, we think this bodes well for L.D.C's prospects of growing its dividend payments in the future.

Conclusion

To summarise, shareholders should always check that L.D.C's dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend. First, we like that the company's dividend payments appear well covered, although the retained capital also needs to be effectively reinvested. Unfortunately, earnings growth has also been mediocre, and the company has cut its dividend at least once in the past. L.D.C has a number of positive attributes, but it falls slightly short of our (admittedly high) standards. Were there evidence of a strong moat or an attractive valuation, it could still be well worth a look.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Earnings growth generally bodes well for the future value of company dividend payments. See if the 5 L.D.C analysts we track are forecasting continued growth with our free report on analyst estimates for the company.

We have also put together a list of global stocks with a market capitalisation above $1bn and yielding more 3%.

If you decide to trade L.D.C, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTPA:LOUP

L.D.C

Produces and sells poultry and processed products in France and internationally.

Very undervalued with flawless balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success