What Do New Danone Partnerships Mean for the Stock After a 19.5% Surge in 2025?

Reviewed by Bailey Pemberton

- Ever found yourself wondering whether Danone’s stock is a bargain, fairly valued, or maybe getting ahead of itself? You are not alone. Today we will dig into what really matters when sizing up this global food giant.

- Despite dipping slightly by 0.2% over the past week and 0.7% over the last month, Danone’s shares are up 19.5% year-to-date and 23.5% over the past year. These figures suggest renewed investor confidence and highlight growth potential.

- Momentum around Danone has been fueled by recent announcements of partnerships in plant-based product lines and strategic sustainability initiatives, as well as buzz about ongoing shifts in consumer preferences. These headlines have sparked new interest and help explain the stock’s recent trajectory.

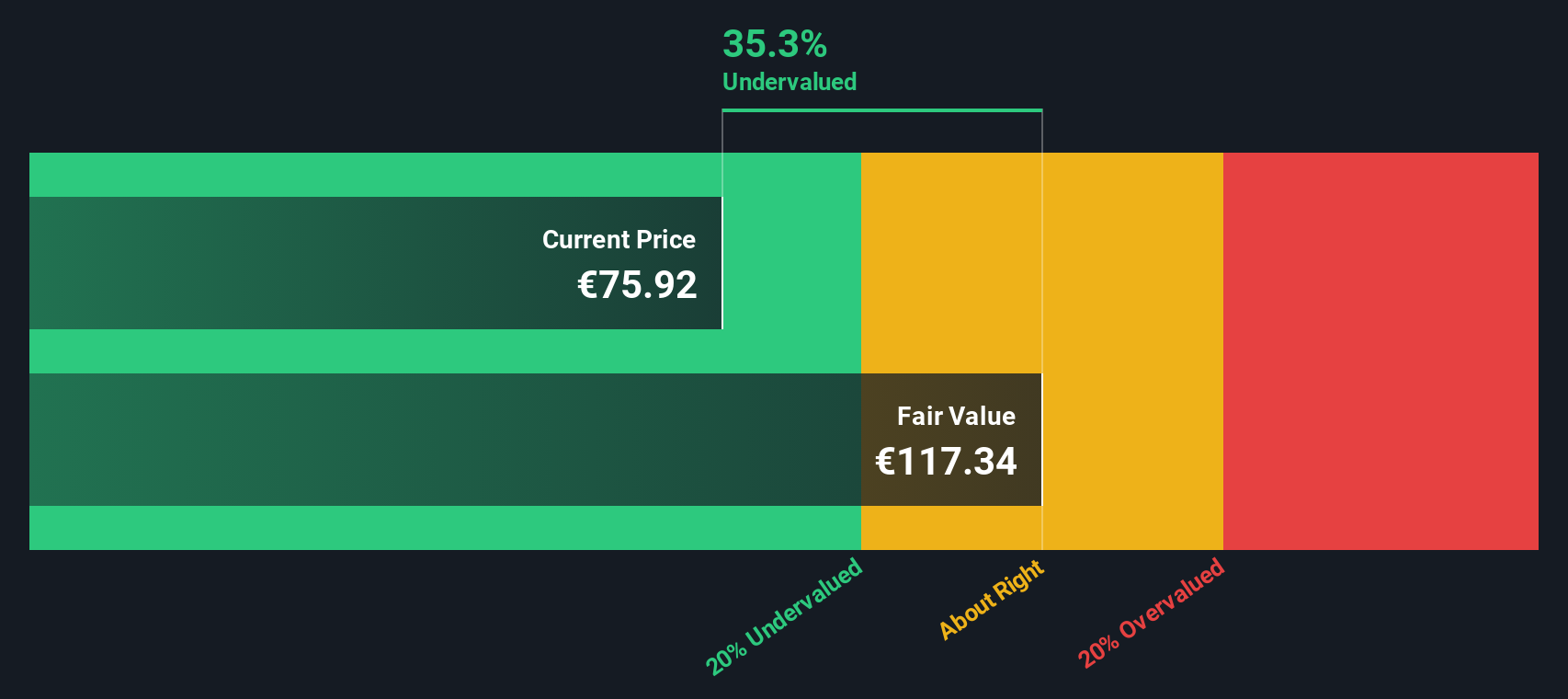

- When measured against our 6-point valuation checklist, Danone scores a modest 2 out of 6 for being undervalued. This indicates there is room for improvement. Next, I will break down what this means for the current share price using popular valuation methods, and at the end of the article, reveal an additional way to cut through the noise around stock value.

Danone scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Danone Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a well-known tool for estimating a company’s intrinsic value. It relies on future cash flow projections and discounts them back to their present value. This method provides a forward-looking perspective by forecasting Danone’s Free Cash Flow (FCF) over time and adjusting for risk and the time value of money.

For Danone, current trailing twelve month Free Cash Flow stands at approximately €2.96 billion. Analysts have projected FCF growth over the coming years, estimating it will reach €3.39 billion by 2029. Beyond 2029, projections from Simply Wall St extend these growth trends to 2035, with annual increases gradually slowing. This reflects a more cautious outlook generally associated with longer-term estimates.

After discounting all projected cash flows with the 2 Stage Free Cash Flow to Equity model, the estimated intrinsic value for Danone shares is €130.77. This value is about 40.7% higher than the current trading price, indicating a notable margin of safety and suggesting the stock is undervalued according to this approach.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Danone is undervalued by 40.7%. Track this in your watchlist or portfolio, or discover 925 more undervalued stocks based on cash flows.

Approach 2: Danone Price vs Earnings

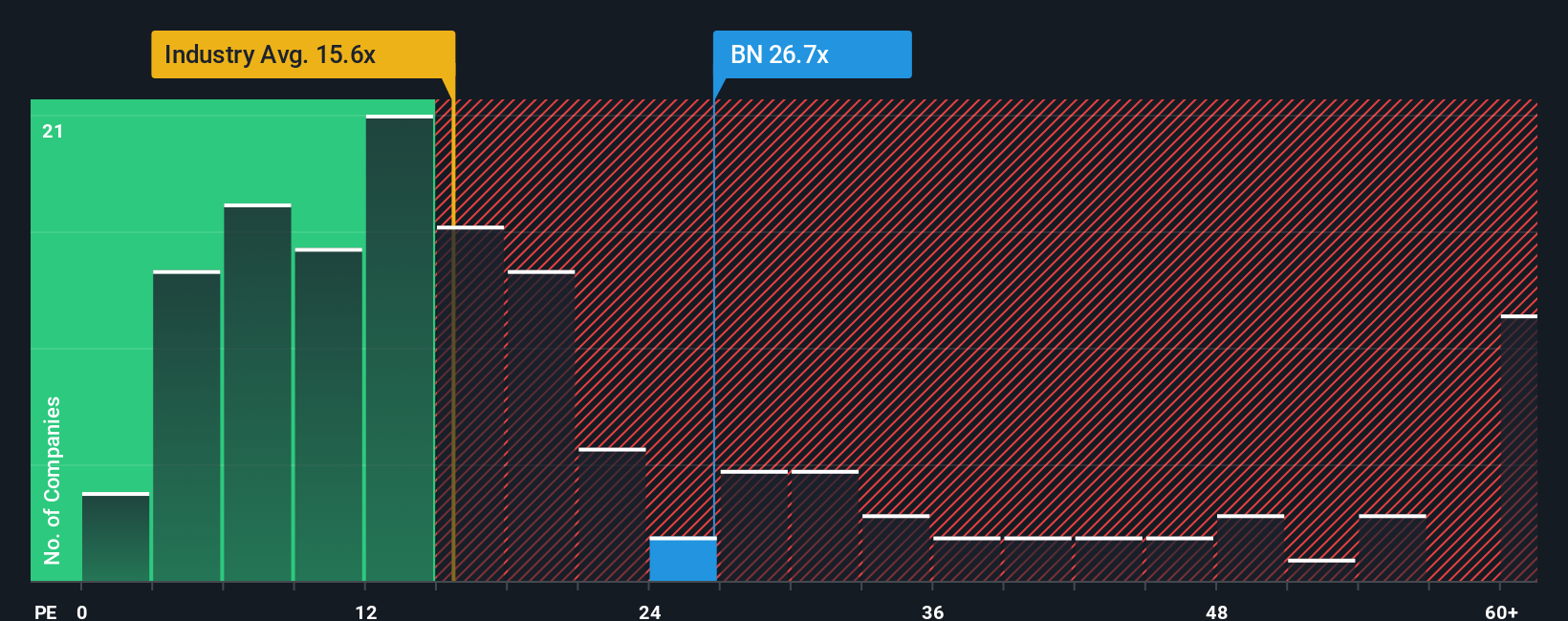

For profitable companies like Danone, the Price-to-Earnings (PE) ratio is a widely recognized valuation metric. The PE ratio tells us how much investors are willing to pay for each euro of current earnings, helping to gauge whether a stock’s price reflects its profit potential. Generally, higher growth expectations or lower perceived risk will justify a higher "normal" or "fair" PE ratio, while lower growth or higher risk pushes that fair ratio down.

Currently, Danone trades at a PE ratio of 27.2x, which is significantly higher than the average for its industry at 16.0x, as well as the peer group average of 12.3x. At first glance, this premium might suggest the stock is expensive compared to sector and peer benchmarks.

However, Simply Wall St’s proprietary “Fair Ratio” metric considers more than just surface-level comparisons. It calibrates a fair PE multiple specifically for Danone by factoring in not just industry trends and market capitalization, but also crucial details like earnings growth, risks, and profit margins. For Danone, the Fair Ratio is calculated at 24.5x. This offers a more tailored and nuanced sense of what the company’s PE should be, rather than assuming a single figure is right for all companies in a broadly defined peer set.

Comparing Danone’s actual PE of 27.2x to its Fair Ratio of 24.5x, the stock is currently trading above its customized fair value. This points to an overvalued position according to this approach.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1432 companies where insiders are betting big on explosive growth.

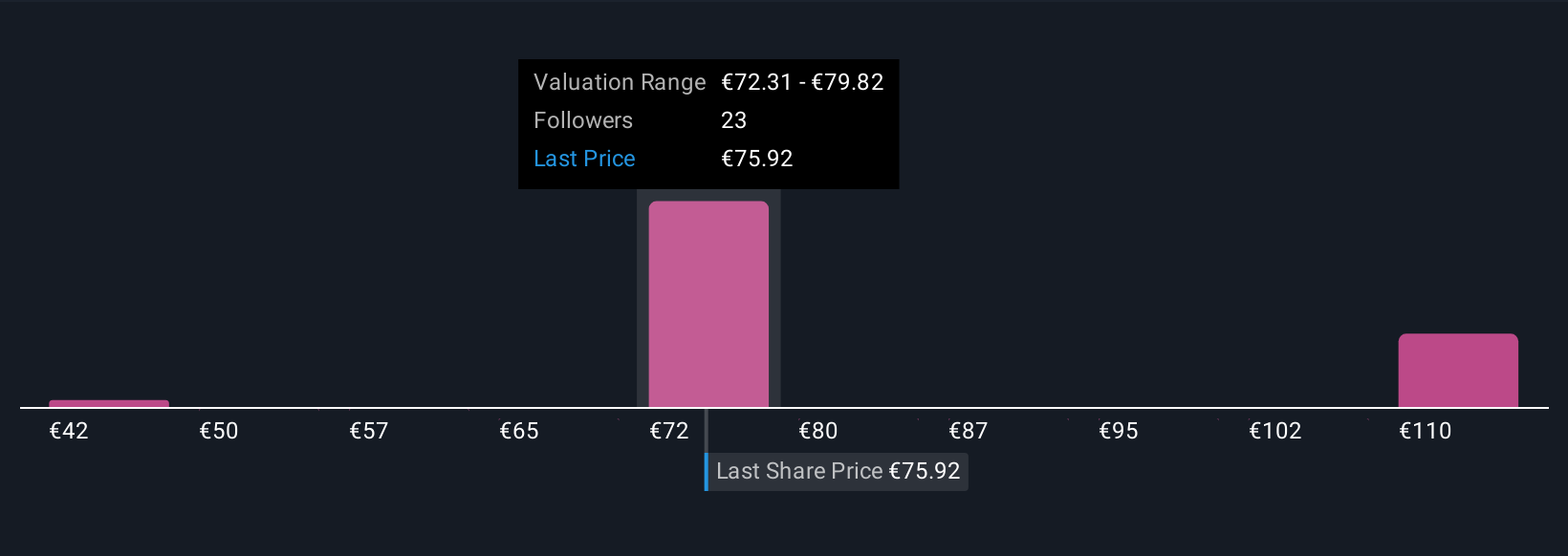

Upgrade Your Decision Making: Choose your Danone Narrative

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a practical tool that allows you to tell your story about a company by combining your expectations around Danone’s future revenue, profits, and margins into a forecast that links directly to a fair value. By translating your investment perspective into numbers, Narratives connect what you believe about a company’s strengths, risks, and future developments to a specific price. This makes it simple to compare with the current market and decide when to buy or sell. Narratives are easy to use and accessible on Simply Wall St’s Community page, where millions of investors share and update their views as news or earnings are announced, so your outlook stays relevant. For Danone, for example, some investors might forecast aggressive growth driven by health-focused product innovation and rising margins, resulting in a higher estimated fair value such as the analyst high price target of €85. Others might take a more cautious view, expecting only modest improvements and pricing in risks from integration challenges or global competition, which aligns with a lower target such as €62. Narratives help you cut through headline noise and make investment decisions with clarity and confidence, based on your own well-reasoned outlook.

Do you think there's more to the story for Danone? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:BN

Danone

Operates in the food and beverage industry in Europe, Ukraine, North America, China, North Asia, the Oceania, Latin America, rest of Asia, Africa, Turkey, the Middle East, and the Commonwealth of Independent States.

Established dividend payer with proven track record.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success