Danone (ENXTPA:BN): Examining the Valuation After Recent Share Price Gains

Reviewed by Simply Wall St

Danone (ENXTPA:BN) shares have delivered a 7% gain over the past month, contributing to a total return above 21% over the past year. This consistent performance has sparked fresh conversations among investors who are evaluating the stock’s valuation and growth prospects.

See our latest analysis for Danone.

Danone’s 7% share price return over the last month adds to a steady climb that has now seen total shareholder returns top 21% in the past year. Recent gains suggest growing market confidence in Danone's ability to navigate shifts in consumer trends and inflationary pressures, with the stock's momentum clearly building on both a short- and long-term basis.

If strong momentum gets you thinking about what else is out there, now is a perfect time to broaden your investing search and discover fast growing stocks with high insider ownership

But with such solid gains already achieved, the key question for investors is whether Danone still trades at an attractive value or if expectations for future growth are already fully reflected in the share price.

Most Popular Narrative: 2.3% Overvalued

Danone’s closing price of €77.78 sits just above the widely followed narrative’s fair value estimate of €76.01, signaling little room for upside in the current valuation climate. This slim premium puts the spotlight on the specific factors analysts believe will shape Danone's future growth trajectory.

Continued innovation and expansion in health-driven, functional foods and specialized nutrition, such as high-protein, probiotic, and medical nutrition products, positions Danone to capture above-market revenue growth as global consumers become increasingly focused on wellness and science-based nutrition.

How are analysts justifying such a tight valuation call? There is one critical set of financial forecasts behind this number, tied to expanding margins and product shifts rarely seen in this sector. Ready to uncover what financial assumptions separate this consensus target from the pack?

Result: Fair Value of €76.01 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent challenges in Danone's core dairy business and ongoing currency volatility could quickly undermine even the most optimistic outlook.

Find out about the key risks to this Danone narrative.

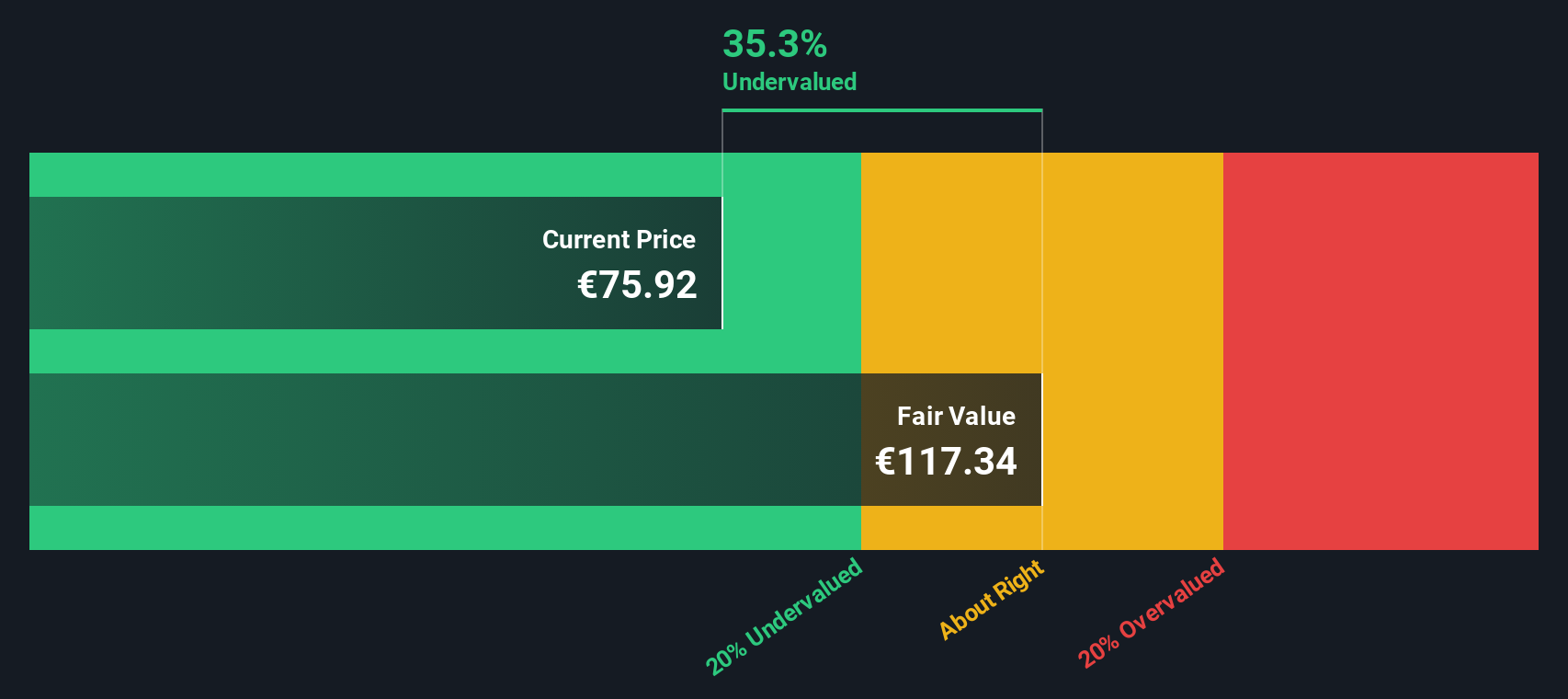

Another Perspective: SWS DCF Model Sees Opportunity

While analyst price targets suggest Danone is overvalued based on future earnings projections, our SWS DCF model offers a different perspective. It estimates Danone’s fair value at €105.56 per share, which is 26.3% above the current trading price. This suggests potential undervaluation. Which approach aligns with your investment thinking?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Danone for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Danone Narrative

If these valuation models and forecasts do not match your perspective or if you want a closer look at the numbers, you can build your own take on Danone in just a few minutes, and Do it your way.

A great starting point for your Danone research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Do not miss your chance to strengthen your portfolio with unique opportunities. Use the Simply Wall Street Screener to confidently act on smart investment trends today.

- Capitalize on high-yield opportunities by tapping into these 17 dividend stocks with yields > 3% with strong cash flows and solid payout potential.

- Catch the wave of innovation by finding these 27 AI penny stocks that are moving quickly in artificial intelligence and technology disruption.

- Boost your strategy with these 872 undervalued stocks based on cash flows trading below intrinsic value, primed for potential upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:BN

Danone

Operates in the food and beverage industry in Europe, Ukraine, North America, China, North Asia, the Oceania, Latin America, rest of Asia, Africa, Turkey, the Middle East, and the Commonwealth of Independent States.

Established dividend payer with proven track record.

Market Insights

Community Narratives