What Does The Future Hold For Lanson-BCC (EPA:ALLAN)? These Analysts Have Been Cutting Their Estimates

The latest analyst coverage could presage a bad day for Lanson-BCC (EPA:ALLAN), with the analysts making across-the-board cuts to their statutory estimates that might leave shareholders a little shell-shocked. This report focused on revenue estimates, and it looks as though the consensus view of the business has become substantially more conservative.

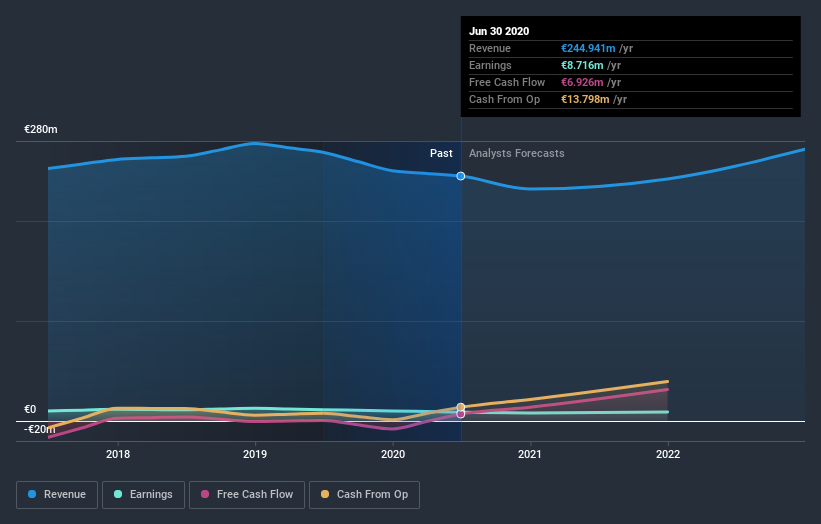

Following the downgrade, the consensus from two analysts covering Lanson-BCC is for revenues of €211m in 2020, implying a chunky 14% decline in sales compared to the last 12 months. Before the latest update, the analysts were foreseeing €242m of revenue in 2020. It looks like forecasts have become a fair bit less optimistic on Lanson-BCC, given the substantial drop in revenue estimates.

View our latest analysis for Lanson-BCC

We'd point out that there was no major changes to their price target of €22.00, suggesting the latest estimates were not enough to shift their view on the value of the business. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. There are some variant perceptions on Lanson-BCC, with the most bullish analyst valuing it at €25.70 and the most bearish at €21.00 per share. This is a very narrow spread of estimates, implying either that Lanson-BCC is an easy company to value, or - more likely - the analysts are relying heavily on some key assumptions.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Lanson-BCC's past performance and to peers in the same industry. One more thing stood out to us about these estimates, and it's the idea that Lanson-BCC'sdecline is expected to accelerate, with revenues forecast to fall 14% next year, topping off a historical decline of 0.9% a year over the past five years. Compare this against analyst estimates for companies in the wider industry, which suggest that revenues (in aggregate) are expected to grow 5.4% next year. So it's pretty clear that, while it does have declining revenues, the analysts also expect Lanson-BCC to suffer worse than the wider industry.

The Bottom Line

The clear low-light was that analysts slashing their revenue forecasts for Lanson-BCC this year. They're also anticipating slower revenue growth than the wider market. Overall, given the drastic downgrade to this year's forecasts, we'd be feeling a little more wary of Lanson-BCC going forwards.

Of course, there's always more to the story. At least one of Lanson-BCC's two analysts has provided estimates out to 2022, which can be seen for free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

If you’re looking to trade Lanson-BCC, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ENXTPA:ALLAN

Undervalued average dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success