Lanson-BCC (EPA:ALLAN) Share Prices Have Dropped 37% In The Last Three Years

While not a mind-blowing move, it is good to see that the Lanson-BCC (EPA:ALLAN) share price has gained 19% in the last three months. But that doesn't change the fact that the returns over the last three years have been less than pleasing. After all, the share price is down 37% in the last three years, significantly under-performing the market.

Check out our latest analysis for Lanson-BCC

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

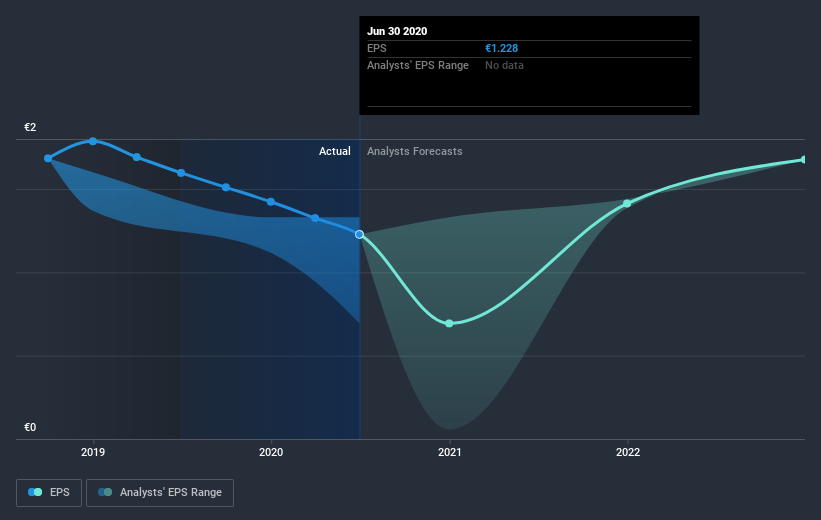

Lanson-BCC saw its EPS decline at a compound rate of 4.5% per year, over the last three years. The share price decline of 14% is actually steeper than the EPS slippage. So it's likely that the EPS decline has disappointed the market, leaving investors hesitant to buy.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

This free interactive report on Lanson-BCC's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, Lanson-BCC's TSR for the last 3 years was -35%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

Investors in Lanson-BCC had a tough year, with a total loss of 17% (including dividends), against a market gain of about 0.4%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 5% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Lanson-BCC has 1 warning sign we think you should be aware of.

But note: Lanson-BCC may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.

If you decide to trade Lanson-BCC, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTPA:ALLAN

Undervalued average dividend payer.

Market Insights

Community Narratives