- France

- /

- Energy Services

- /

- ENXTPA:VK

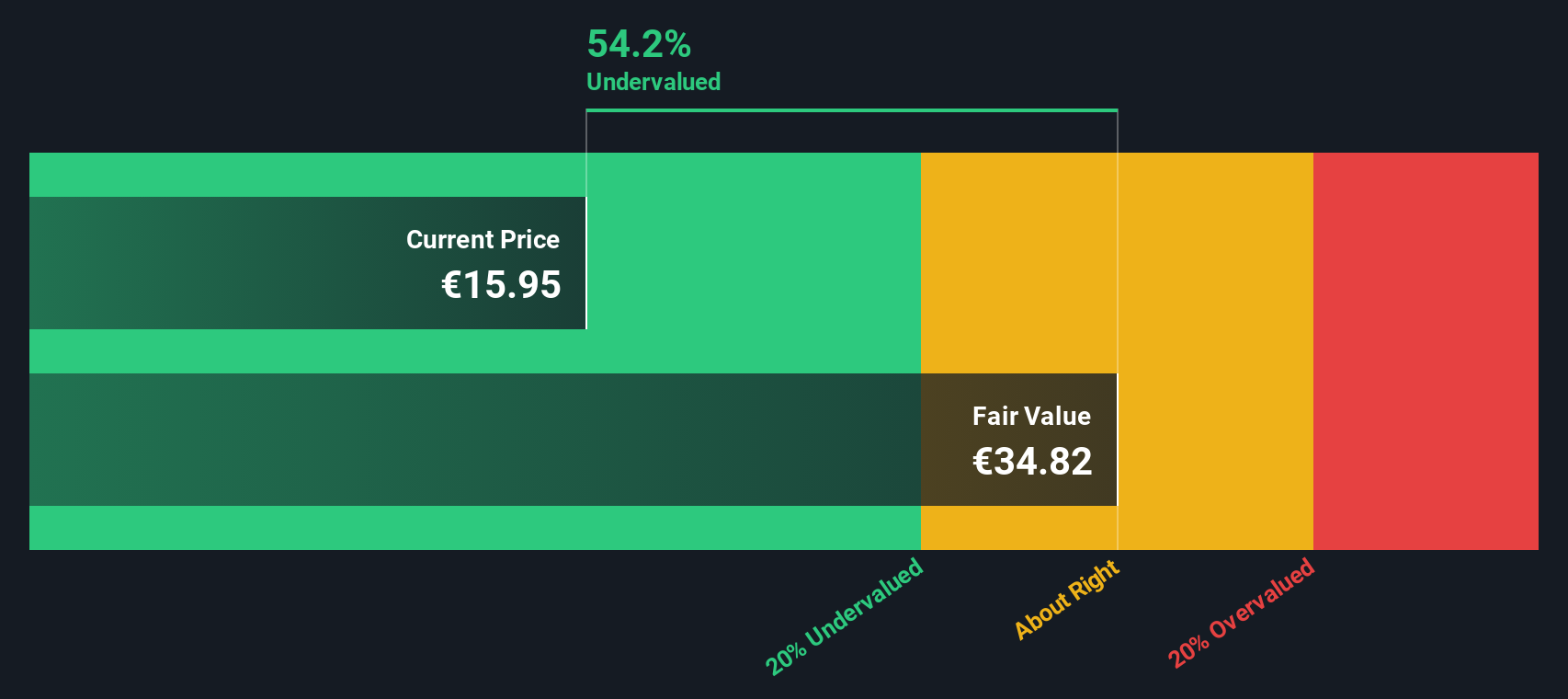

Vallourec (ENXTPA:VK) Reports Q3 Earnings Decline, Explores AI for Growth Amid Undervaluation

Reviewed by Simply Wall St

Click here to discover the nuances of Vallourec with our detailed analytical report.

Unique Capabilities Enhancing Vallourec's Market Position

Vallourec's expected annual profit growth of 21.4% outpaces the French market average, underscoring its financial health. The company has reported high-quality earnings, with a net profit margin improving to 9.3% from 8.7% last year. This is complemented by a strong net debt to equity ratio of 8.5% and interest coverage of 136.3x, indicating financial stability. Philippe Guillemot, CEO, highlighted a significant increase in order intake, reflecting strong demand in key markets. This positions Vallourec well to leverage market opportunities. The company is currently undervalued at €16.23, significantly below its estimated fair value of €52.79, suggesting potential for future growth.

Vulnerabilities Impacting Vallourec

Vallourec faces challenges with a revenue growth forecast of 3.1%, which lags behind the market average. The return on equity stands at 17.8%, below the desired threshold of 20%. Recent earnings results showed a 7.3% decline in net income for the third quarter compared to the previous year. CFO Sascha Bibert acknowledged operational inefficiencies impacting margins, exacerbated by rising raw material costs. These factors highlight the need for improved cost management and operational efficiency to sustain profitability.

Potential Strategies for Leveraging Growth and Competitive Advantage

Opportunities abound as Vallourec explores emerging markets, which could diversify its revenue streams. Investments in AI and automation are expected to enhance operational efficiency and reduce costs. Upcoming product launches are strategically aligned with customer needs, aiming to capture additional market share. These initiatives reflect a forward-thinking approach that could bolster Vallourec's competitive edge and market position.

Market Volatility Affecting Vallourec's Position

However, the company must navigate economic headwinds and regulatory hurdles that pose risks to its operations. Supply chain disruptions remain a concern, with strategies being developed to mitigate these risks. The absence of dividend payouts raises questions about dividend sustainability, while the share price's proximity to the target price indicates limited short-term upside potential. These external factors necessitate vigilant strategic planning to ensure continued growth and market resilience.

Conclusion

Vallourec's projected annual profit growth of 21.4% significantly surpasses the French market average, indicating its strong financial performance and potential for future growth. The company's improved net profit margin and solid financial ratios, such as a net debt to equity ratio of 8.5% and interest coverage of 136.3x, reflect its financial stability and ability to capitalize on increasing order intake. However, challenges such as a lower-than-desired revenue growth forecast and operational inefficiencies necessitate strategic improvements in cost management to maintain profitability. Despite these challenges, Vallourec's current trading price of €16.23, well below its estimated fair value of €52.79, suggests substantial room for appreciation as the company implements strategies to enhance operational efficiency and explore emerging markets. This undervaluation presents an opportunity for investors as Vallourec positions itself to strengthen its market presence and achieve sustainable growth.

Turning Ideas Into Actions

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About ENXTPA:VK

Vallourec

Through its subsidiaries, provides tubular solutions for the oil and gas, industry, and new energies markets in Europe, North America, South America, Asia, the Middle East, and internationally.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives