- France

- /

- Oil and Gas

- /

- ENXTPA:TTE

How TotalEnergies’ Renewables Push Could Impact Its Share Price in 2025

Reviewed by Bailey Pemberton

- Ever wondered whether TotalEnergies could be trading at a bargain right now? You are not alone. There are some interesting metrics to dive into before making any calls.

- The share price has held steady over the past week. In the last month, the stock climbed 5.3%, and is up 129.2% over five years. This points to long-term growth despite some recent volatility.

- Much of the recent buzz has centered around TotalEnergies' renewable energy projects and expansion plans. Headlines highlight new investments in wind and solar initiatives. These strategic moves may be influencing investor perception and helping to drive shares higher in a market increasingly focused on energy transition.

- On our valuation scorecard, TotalEnergies clocks in at 5 out of 6, suggesting it is undervalued on nearly every metric we track. Next, we will break down how these numbers are calculated using standard valuation approaches. At the end, we introduce an even smarter way to look at value.

Find out why TotalEnergies's -1.6% return over the last year is lagging behind its peers.

Approach 1: TotalEnergies Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s worth by projecting its expected future cash flows and discounting them back to today's value. This method aims to capture the true, underlying value of a business, regardless of short-term market swings.

For TotalEnergies, analysts estimate that the company generated a Free Cash Flow of $14.17 Billion in the last twelve months. Looking ahead, cash flows are forecast to rise steadily, reaching $14.99 Billion by 2029. Projections beyond that year are based on modest extrapolation. While only five years of detailed analyst estimates are available, extended forecasts help form a complete DCF valuation picture.

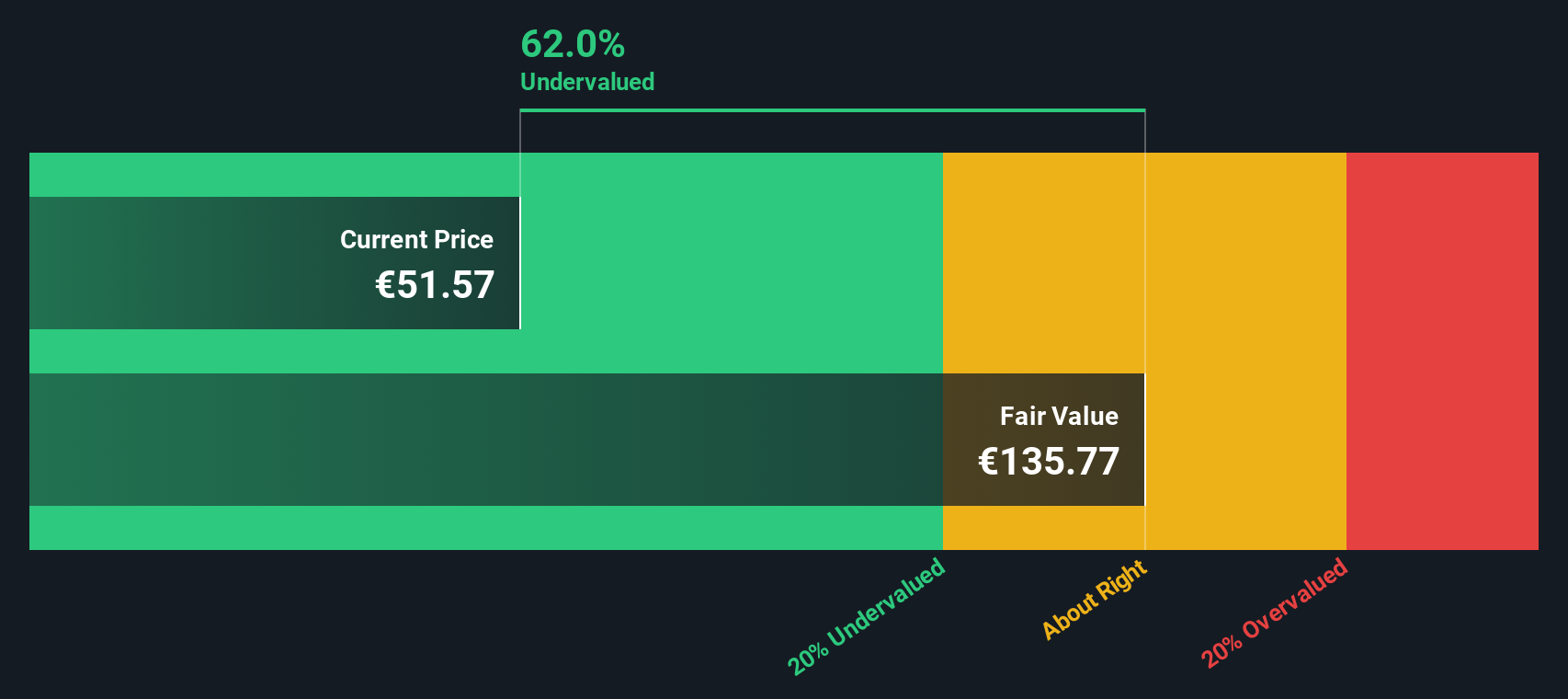

Based on these projections, the DCF analysis suggests TotalEnergies’ shares have an intrinsic value of €120.60 per share. The current share price sits well below this estimate. The DCF model implies the stock is trading at a 55.4% discount to fair value, indicating significant undervaluation in the market right now.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests TotalEnergies is undervalued by 55.4%. Track this in your watchlist or portfolio, or discover 841 more undervalued stocks based on cash flows.

Approach 2: TotalEnergies Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is often considered the most relevant valuation metric for profitable companies like TotalEnergies. This ratio helps investors understand how much they are paying for each euro of earnings, making it a practical tool for evaluating established businesses with steady profits.

What counts as a "normal" or "fair" PE ratio depends on expectations for a company’s growth, overall risk, and how it stacks up against industry peers. Higher expected growth and lower risk tend to justify higher PE ratios, while slower growth or more uncertainty call for a lower multiple.

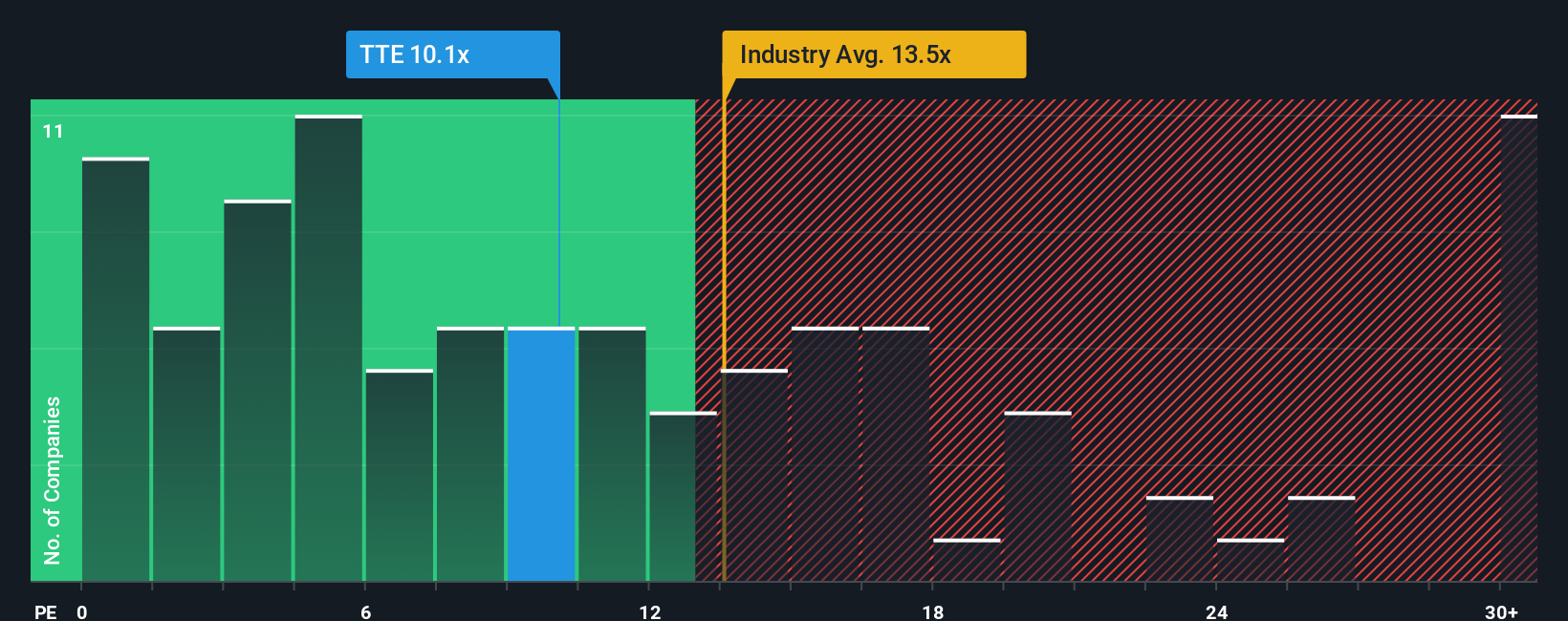

TotalEnergies currently trades at a PE ratio of 9.45x. That is noticeably below the Oil and Gas industry average of 13.25x and sharply lower than the peer group average of 48.51x. At first glance, this suggests the stock might be undervalued compared to its competitors.

However, Simply Wall St’s Fair Ratio offers a more tailored benchmark by taking into account TotalEnergies’ unique earnings growth, industry context, profit margins, size, and specific risks. Unlike simple peer or industry comparisons, the Fair Ratio is designed to reflect the appropriate multiple for the company in its current situation, making it a more meaningful indicator for investors.

With a Fair Ratio of 16.17x, compared to the actual PE of 9.45x, TotalEnergies’ shares appear to be significantly undervalued on this metric as well.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your TotalEnergies Narrative

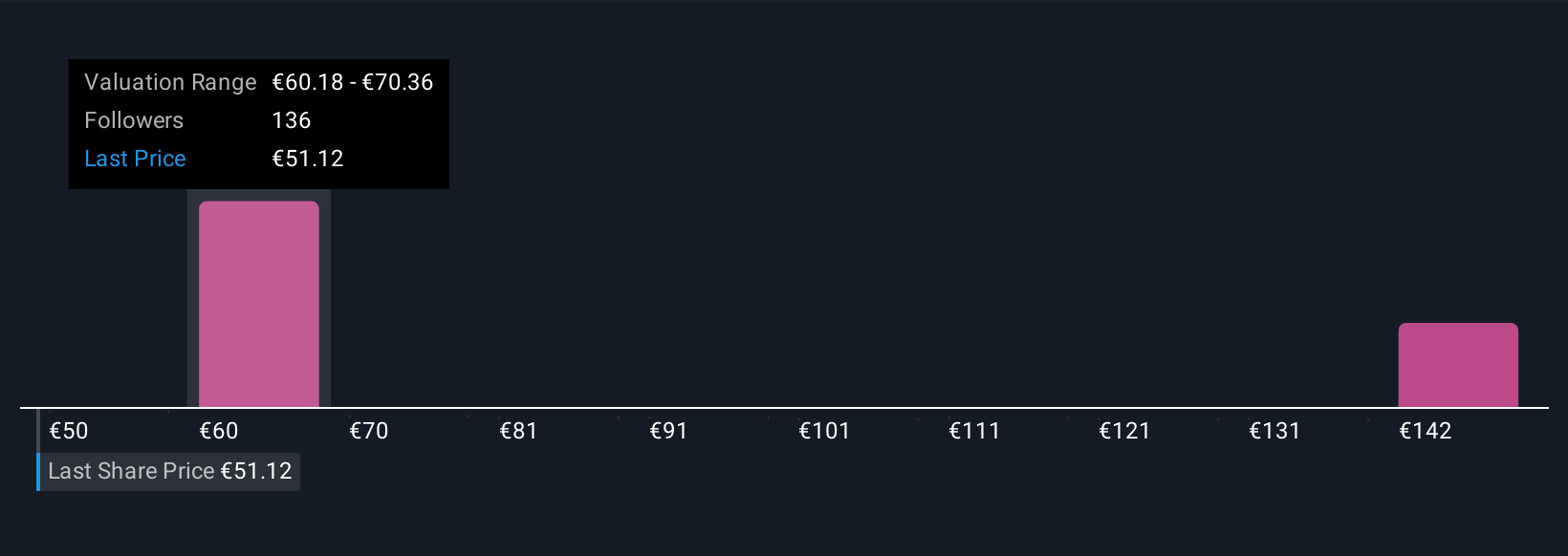

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story or perspective about a company’s future, expressed through your own forecast for revenue, earnings, margins and the fair value you place on its shares. It connects the dots between what you believe about a business, such as its leadership in LNG and renewables or its exposure to oil price swings, and what those beliefs mean for its financial future and stock price today.

Narratives make investing more personal, allowing you to link your outlook directly to financial forecasts and valuations. On Simply Wall St, Narratives are easy to create and share within the Community page, where millions of investors compare and refine their views. With Narratives, you can see in real time how your fair value compares to the current market price, helping you decide when a stock is truly worth buying or selling. Plus, your Narrative updates automatically when fresh news or earnings are released, so your analysis keeps pace with the market.

For example, some investors see TotalEnergies’ strong renewables expansion and digital transformation pushing its fair value as high as €77.57, while others, concerned about oil price headwinds and capital risks, estimate it closer to €52.82. Narratives let you decide which story and which price you believe in most.

Do you think there's more to the story for TotalEnergies? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TotalEnergies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:TTE

TotalEnergies

A multi-energy company, produces and markets oil and biofuels, natural gas, biogas and low-carbon hydrogen, renewables, and electricity in France, rest of Europe, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives