- France

- /

- Energy Services

- /

- ENXTPA:TE

Technip Energies (ENXTPA:TE) Valuation Update Following Major Indonesia LNG Contract Wins

Reviewed by Simply Wall St

Most Popular Narrative: 4.3% Undervalued

According to the most widely followed narrative, Technip Energies is currently trading at a discount to its consensus fair value estimate, suggesting modest upside potential under current assumptions for future growth and risk.

Significant recent growth in decarbonization-related orders (now nearly 40% of total intake and over €5 billion in the last 18 months), combined with global net-zero commitments and increasing government incentives for clean energy infrastructure (like CCUS and blue hydrogen), indicates substantial forward demand that should support backlog expansion and sustained top-line revenue growth.

Curious how Technip Energies’ valuation stacks up? There is a hidden engine under the surface: aggressive expansion, ambitious profit forecasts, and a bold outlook for margin growth all shape this narrative’s target price. Want to know the real numbers behind the market’s expectation? The story is packed with analyst projections you will not want to miss.

Result: Fair Value of €41.08 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent dependency on LNG projects and delays in investment decisions could threaten Technip Energies' otherwise positive growth outlook.

Find out about the key risks to this Technip Energies narrative.Another View: Valuing Technip Energies Through Market Comparisons

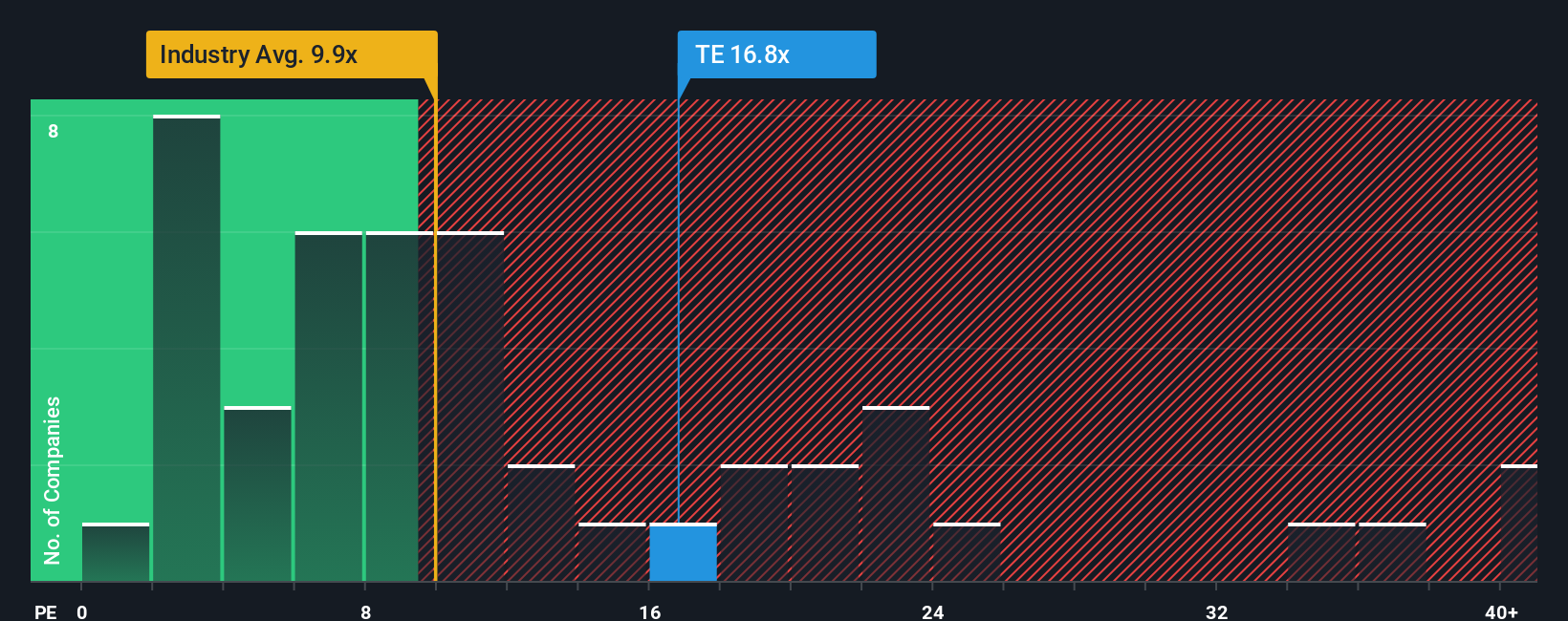

While the consensus view finds Technip Energies undervalued, market-based valuation suggests the shares look expensive compared to the industry average. Could the broader market be pricing in more risk or less growth?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Technip Energies to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Technip Energies Narrative

If you have a different perspective or want to investigate the numbers yourself, it only takes a few minutes to craft your personal analysis and share your unique outlook. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Technip Energies.

Ready to Find Your Next Smart Opportunity?

Don’t limit your investing journey to just one company. Open the door to even more compelling ideas with Simply Wall Street’s powerful screening tools. Seize the chance to get ahead of the market and uncover trends others might miss.

- Uncover hidden gems with growth potential by jumping into penny stocks with strong financials that show strong financial health and resilience.

- Ride the technology wave and tap into future innovation when you check out AI penny stocks companies leveraging artificial intelligence for tomorrow’s breakthroughs.

- Set your sights on real value and maximize your investment returns using undervalued stocks based on cash flows opportunities based on rigorous cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Technip Energies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:TE

Technip Energies

Operates as an engineering and technology company for the energy transition in Europe, Central Asia, the Asia Pacific, Africa, the Middle East, and the Americas.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives