- France

- /

- Oil and Gas

- /

- ENXTPA:FDE

La Française de l'Energie S.A. (EPA:FDE) Stocks Pounded By 25% But Not Lagging Market On Growth Or Pricing

La Française de l'Energie S.A. (EPA:FDE) shareholders won't be pleased to see that the share price has had a very rough month, dropping 25% and undoing the prior period's positive performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 39% share price drop.

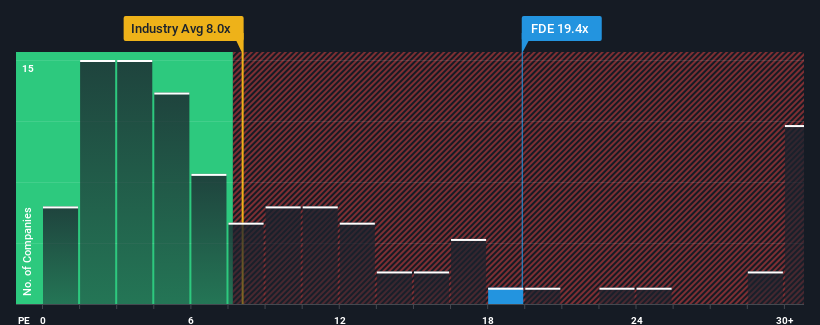

In spite of the heavy fall in price, La Française de l'Energie may still be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 19.4x, since almost half of all companies in France have P/E ratios under 15x and even P/E's lower than 8x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

Recent times haven't been advantageous for La Française de l'Energie as its earnings have been falling quicker than most other companies. It might be that many expect the dismal earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for La Française de l'Energie

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as high as La Française de l'Energie's is when the company's growth is on track to outshine the market.

Retrospectively, the last year delivered a frustrating 48% decrease to the company's bottom line. However, a few very strong years before that means that it was still able to grow EPS by an impressive 48,420% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Shifting to the future, estimates from the four analysts covering the company suggest earnings should grow by 52% per year over the next three years. That's shaping up to be materially higher than the 13% each year growth forecast for the broader market.

In light of this, it's understandable that La Française de l'Energie's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

There's still some solid strength behind La Française de l'Energie's P/E, if not its share price lately. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that La Française de l'Energie maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

You should always think about risks. Case in point, we've spotted 3 warning signs for La Française de l'Energie you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:FDE

La Française de l'Energie

Operates as a carbon-negative energy production company in France and internationally.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives