- France

- /

- Oil and Gas

- /

- ENXTPA:ES

Esso S.A.F. (ENXTPA:ES): Valuation Perspective Following Special Dividend Announcement and Shareholder Approval

Reviewed by Simply Wall St

EssoF (ENXTPA:ES) just announced a hefty €60.21 per share special dividend, set for November 14, 2025, after shareholders gave the green light during the recent Combined General Meeting. Investors are paying close attention.

See our latest analysis for EssoF.

That extraordinary dividend comes after an eventful year for EssoF, with the share price recently closing at €47.44. Despite a sharp drop in price over the past month and year-to-date, investors who held on for the past twelve months have enjoyed an impressive 1-year total shareholder return of over 80%. The five-year total return has increased by more than 1,700%. Momentum has cooled lately, but those long-term figures highlight just how dramatic the ride has been.

If this hefty payout has you thinking bigger, now is a great moment to broaden your investing horizons and discover fast growing stocks with high insider ownership

This new windfall is grabbing headlines, but has EssoF’s long-term value already been recognized? Alternatively, is the market still underestimating its potential? Could this special dividend signal a fresh buying opportunity, or is future growth fully priced in?

Price-to-Sales of 0x: Is it justified?

With EssoF currently trading at a price-to-sales ratio of 0x, the shares look dramatically inexpensive compared to both the industry and peers, especially with the last close at €47.44.

The price-to-sales ratio measures how much investors are willing to pay for each euro of revenue the company generates. It is a useful gauge for companies that may not have consistent earnings, as is common in energy and resource sectors during volatile periods. For EssoF, this multiple offers a snapshot of valuation disconnected from near-term profits or losses.

EssoF's price-to-sales ratio stands well below the European Oil and Gas industry average of 1.3x and is even further below the peer average of 3.7x. This substantial gap suggests the market is deeply discounting EssoF's top-line value relative to its sector, potentially presenting a significant mispricing if the company's prospects improve or sector dynamics stabilize.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Sales of 0x (UNDERVALUED)

However, investors should keep in mind volatile sector conditions and EssoF’s recent net loss, as either factor could quickly shift the outlook for the stock.

Find out about the key risks to this EssoF narrative.

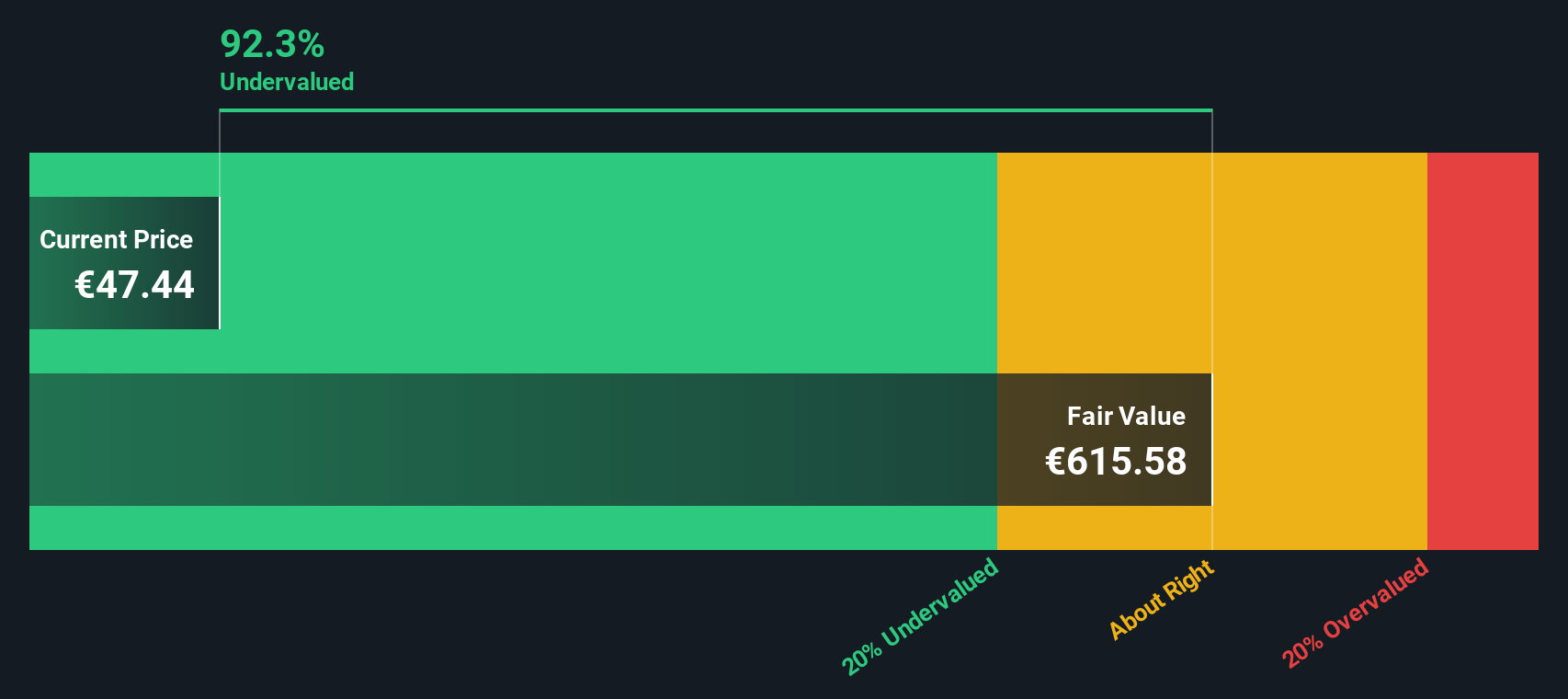

Another View: SWS DCF Model Says Shares Are Still Drastically Undervalued

Beyond sales multiples, our SWS DCF model values EssoF at €615.58 per share, which is far above the recent €47.44 trading price. This large gap implies the market could be missing even more upside. But is this just a theoretical number, or is the market overlooking something significant?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out EssoF for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 879 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own EssoF Narrative

If you see things differently or want to dig into the numbers firsthand, you can easily craft your own take on EssoF’s story in just a few minutes, so why not Do it your way

A great starting point for your EssoF research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Ready to Act on Even More Opportunities?

Smart investors never settle for just one idea. Expand your portfolio and stay ahead of the market by tapping into the most promising trends today.

- Capture the potential of soaring yields as you browse these 16 dividend stocks with yields > 3% designed for investors seeking reliable income above 3%.

- Accelerate your tech exposure by targeting innovation leaders through these 25 AI penny stocks, which are shaping the future with next-generation breakthroughs.

- Get ahead of the curve on value by reviewing these 879 undervalued stocks based on cash flows, which stand out based on strong underlying cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EssoF might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ES

EssoF

Esso S.A.F. refines, distributes, and markets oil products in France and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives