- Sweden

- /

- Retail Distributors

- /

- OM:MEKO

These 3 European Small Caps Are Undiscovered Gems For Your Portfolio

Reviewed by Simply Wall St

As European markets navigate a landscape of mixed economic signals, with the pan-European STOXX Europe 600 Index remaining relatively stable amid ongoing trade discussions, small-cap stocks present intriguing opportunities for investors. In this environment, identifying stocks that demonstrate resilience and potential for growth can be key to enhancing a portfolio's performance.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| Martifer SGPS | 102.88% | -0.23% | 7.16% | ★★★★★★ |

| La Forestière Equatoriale | NA | -65.30% | 37.55% | ★★★★★★ |

| Flügger group | 30.11% | 1.55% | -30.01% | ★★★★★☆ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 19.46% | 0.47% | 7.14% | ★★★★★☆ |

| Dekpol | 63.20% | 11.99% | 14.08% | ★★★★★☆ |

| Evergent Investments | 5.39% | 9.41% | 21.17% | ★★★★☆☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 15.57% | 6.53% | 7.16% | ★★★★☆☆ |

| Alantra Partners | 10.97% | -5.86% | -29.95% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

TotalEnergies EP Gabon Société Anonyme (ENXTPA:EC)

Simply Wall St Value Rating: ★★★★★★

Overview: TotalEnergies EP Gabon Société Anonyme is involved in the mining, exploration, and production of crude oil in Gabon with a market capitalization of €855 million.

Operations: TotalEnergies EP Gabon generates revenue primarily from its oil and gas exploration and production activities, amounting to $464.72 million. The company's financial performance is reflected in its net profit margin, which provides insight into profitability relative to total revenue.

In the world of energy, TotalEnergies EP Gabon stands out with its impressive earnings growth of 245.9% over the past year, far surpassing the industry's 10.9%. Its net income surged to US$91.19 million from US$26.36 million in just one year, while basic earnings per share jumped to US$20.26 from US$5.86, showcasing robust financial health and high-quality earnings. Despite a slight dip in crude oil production by 3% to 16.7 kb/d, this small player trades at a significant discount of 64.6% below estimated fair value, offering intriguing potential for investors seeking hidden opportunities in Europe’s energy sector.

Meko (OM:MEKO)

Simply Wall St Value Rating: ★★★★★☆

Overview: Meko AB (publ) operates in the automotive aftermarket across several Nordic and Baltic countries, with a market cap of approximately SEK 6.30 billion.

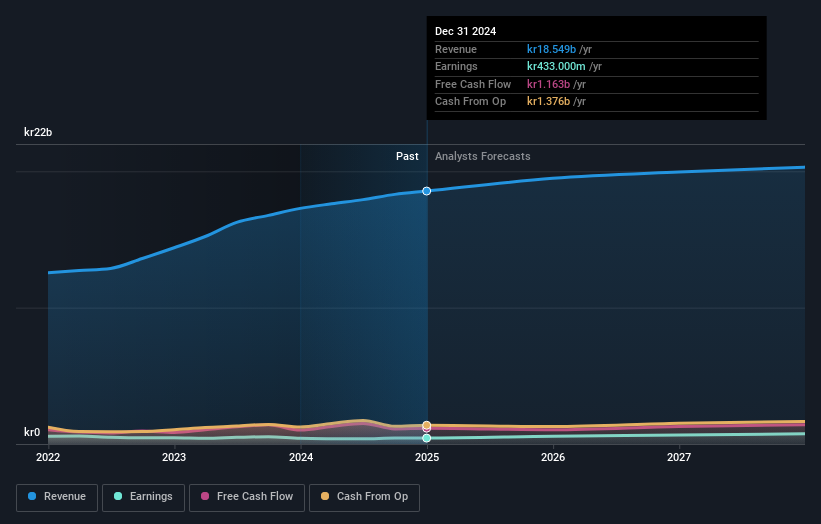

Operations: Meko generates revenue primarily from its operations in Sweden/Norway (SEK 6.99 billion), Poland/The Baltics (SEK 4.87 billion), and Denmark (SEK 4.37 billion).

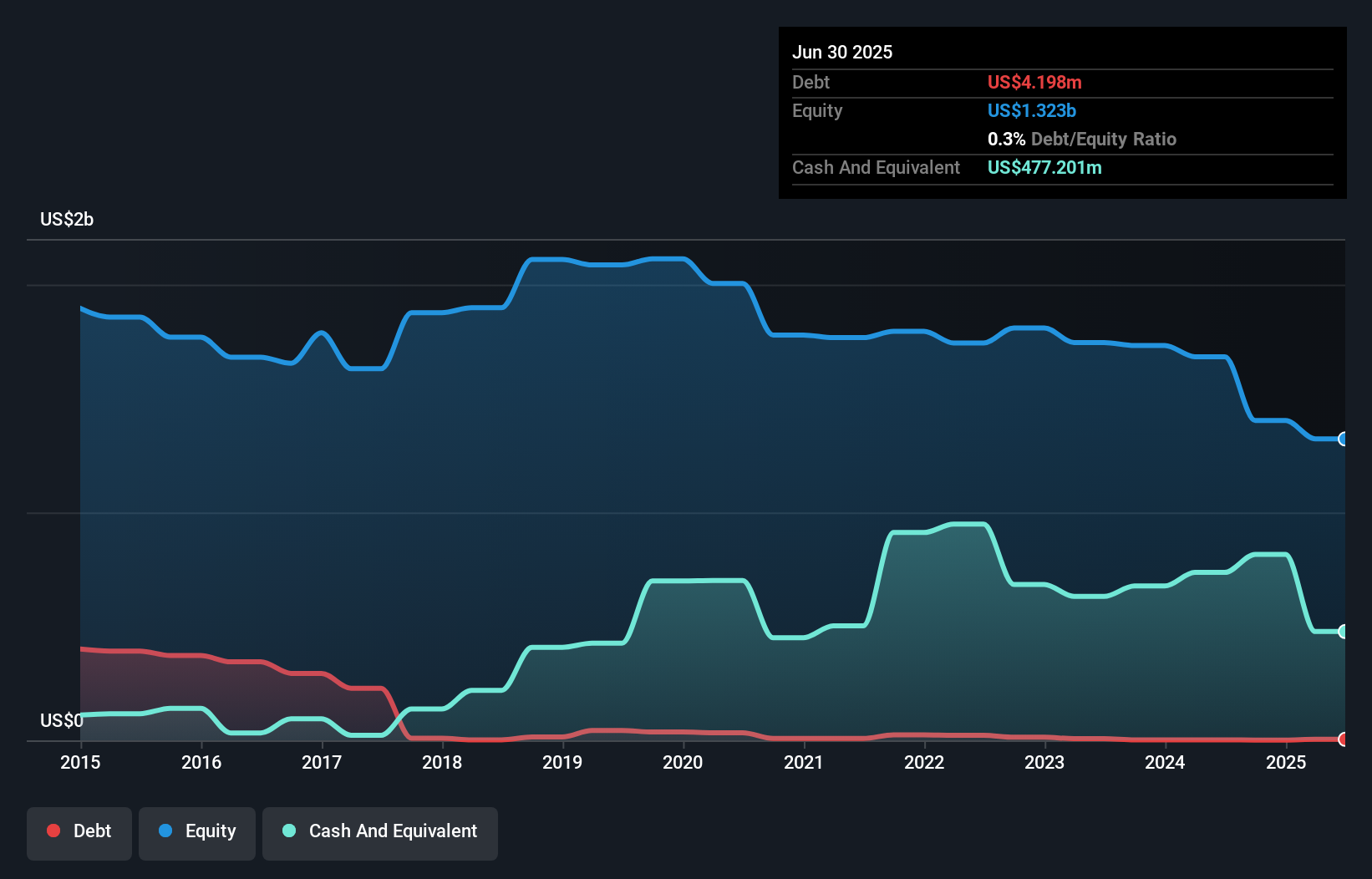

Meko, a promising player in the automotive aftermarket sector, is enhancing operations through warehouse automation and efficiency initiatives in Scandinavia and Poland. Over the past year, Meko's earnings grew by 9.7%, outpacing the industry average of 0.5%. The company has reduced its debt to equity ratio from 95% to 52.9% over five years, yet its net debt to equity remains high at 48.3%. Trading at a significant discount of 78.3% below estimated fair value, Meko presents potential upside despite facing challenges like integration costs and competitive pressures in Poland's market landscape.

Nexus (XTRA:NXU)

Simply Wall St Value Rating: ★★★★★★

Overview: Nexus AG is a company that develops and sells software solutions for the healthcare market across Germany, Switzerland, Liechtenstein, the Netherlands, Poland, France, Austria, and internationally with a market capitalization of approximately €1.20 billion.

Operations: Nexus generates revenue primarily from three segments: NEXUS / DE (€89.91 million), NEXUS / DIS (€72.94 million), and NEXUS / ROE (€115.55 million). The company experiences a consolidation adjustment of -€16.93 million across these segments.

Nexus, a European healthcare services player, showcases robust financial health with no debt and an impressive earnings growth of 17.9% annually over the past five years. Recent results highlight a solid performance with sales hitting €71.13 million for Q1 2025, up from €64.08 million in the previous year, while net income rose to €8.24 million from €6.57 million last year. The company seems to be leveraging its high-quality earnings effectively, as evidenced by their free cash flow positivity at €23.61 million in March 2024 and consistent capital expenditure management around -€9.90 million during the same period.

- Click to explore a detailed breakdown of our findings in Nexus' health report.

Explore historical data to track Nexus' performance over time in our Past section.

Make It Happen

- Click this link to deep-dive into the 324 companies within our European Undiscovered Gems With Strong Fundamentals screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:MEKO

Meko

Operates in the automotive aftermarket business in Sweden, Norway, Denmark, Finland, Poland, Estonia, Latvia, and Lithuania.

Good value with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives