- Sweden

- /

- Specialty Stores

- /

- OM:SYNSAM

VIEL & Cie société anonyme And 2 Other Undiscovered Gems with Strong Potential

Reviewed by Simply Wall St

In recent weeks, European markets have experienced a downturn, with the pan-European STOXX Europe 600 Index and major national indexes like Germany's DAX and France's CAC 40 all posting losses amid concerns over inflated AI stock valuations and shifting expectations for U.S. interest rate cuts. Despite these challenges, eurozone business activity continues to expand steadily, offering a backdrop of resilience that can create opportunities for discerning investors seeking undiscovered gems in the market. In such an environment, stocks that demonstrate strong fundamentals, adaptability to changing economic conditions, and potential for growth can stand out as promising candidates for investment consideration.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Evergent Investments | 3.63% | 11.27% | 22.67% | ★★★★★☆ |

| KABE Group AB (publ.) | 3.82% | 3.46% | 5.42% | ★★★★★☆ |

| Inmocemento | 28.68% | 4.15% | 33.84% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 13.23% | 20.22% | 17.99% | ★★★★★☆ |

| Deutsche Balaton | 4.58% | -18.46% | -16.14% | ★★★★★☆ |

| Mangold Fondkommission | NA | -6.00% | -42.55% | ★★★★★☆ |

| VNV Global | 15.38% | -18.33% | -18.19% | ★★★★★☆ |

| ABG Sundal Collier Holding | 35.58% | -7.59% | -18.30% | ★★★★☆☆ |

| Procimmo Group | 141.47% | 6.84% | 6.01% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

We'll examine a selection from our screener results.

VIEL & Cie société anonyme (ENXTPA:VIL)

Simply Wall St Value Rating: ★★★★★☆

Overview: VIEL & Cie, société anonyme is an investment company that offers interdealer broking, online trading, and private banking services across various regions including France, Europe, the Middle East, Africa, the Americas, and the Asia-Pacific region with a market cap of approximately €1.08 billion.

Operations: The company generates revenue primarily through its Professional Intermediation segment, which contributes €1.16 billion, followed by the Stock Exchange Online segment at €72.80 million.

VIEL & Cie, a notable player in the European market, has been gaining traction with its recent inclusion in the CAC Small and All-Tradable Indexes. The company's earnings growth of 10.6% over the past year outpaced the Capital Markets industry average of 8.7%, highlighting its robust performance. With revenue reaching €655 million for H1 2025, up from €598 million last year, and net income at €69 million compared to €65 million previously, VIEL demonstrates solid financial health. Its debt-to-equity ratio improved from 89.9% to 79.4% over five years, suggesting prudent financial management amidst competitive market conditions.

- Click to explore a detailed breakdown of our findings in VIEL & Cie société anonyme's health report.

Learn about VIEL & Cie société anonyme's historical performance.

Synsam (OM:SYNSAM)

Simply Wall St Value Rating: ★★★★☆☆

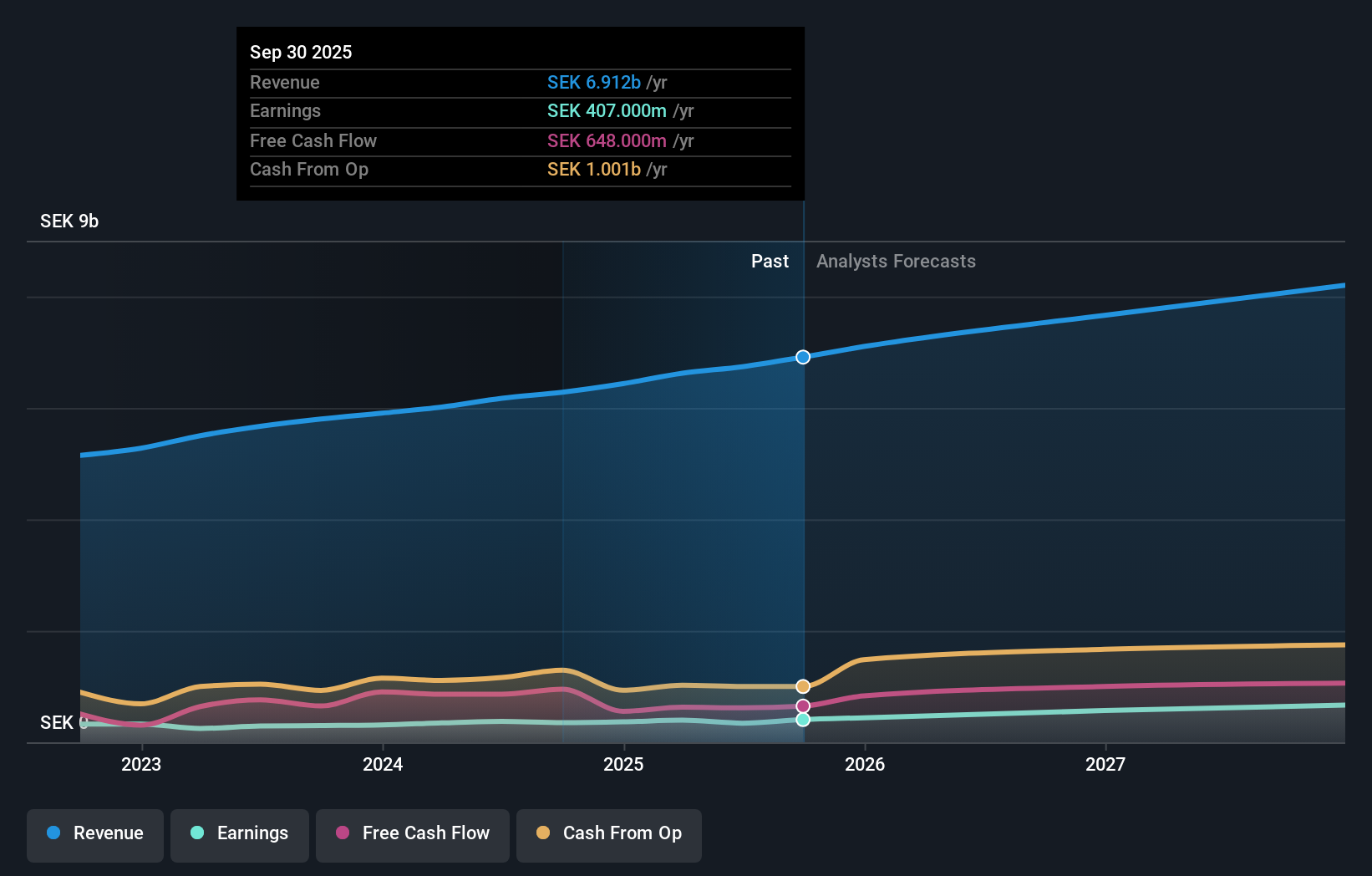

Overview: Synsam AB (publ) is a company that operates in the optical retail and eye health sector across the Nordic Region, with a market capitalization of approximately SEK9.21 billion.

Operations: The company generates revenue primarily from its operations in Sweden (SEK3.37 billion), Norway (SEK1.36 billion), Denmark (SEK1.16 billion), and Finland (SEK812 million).

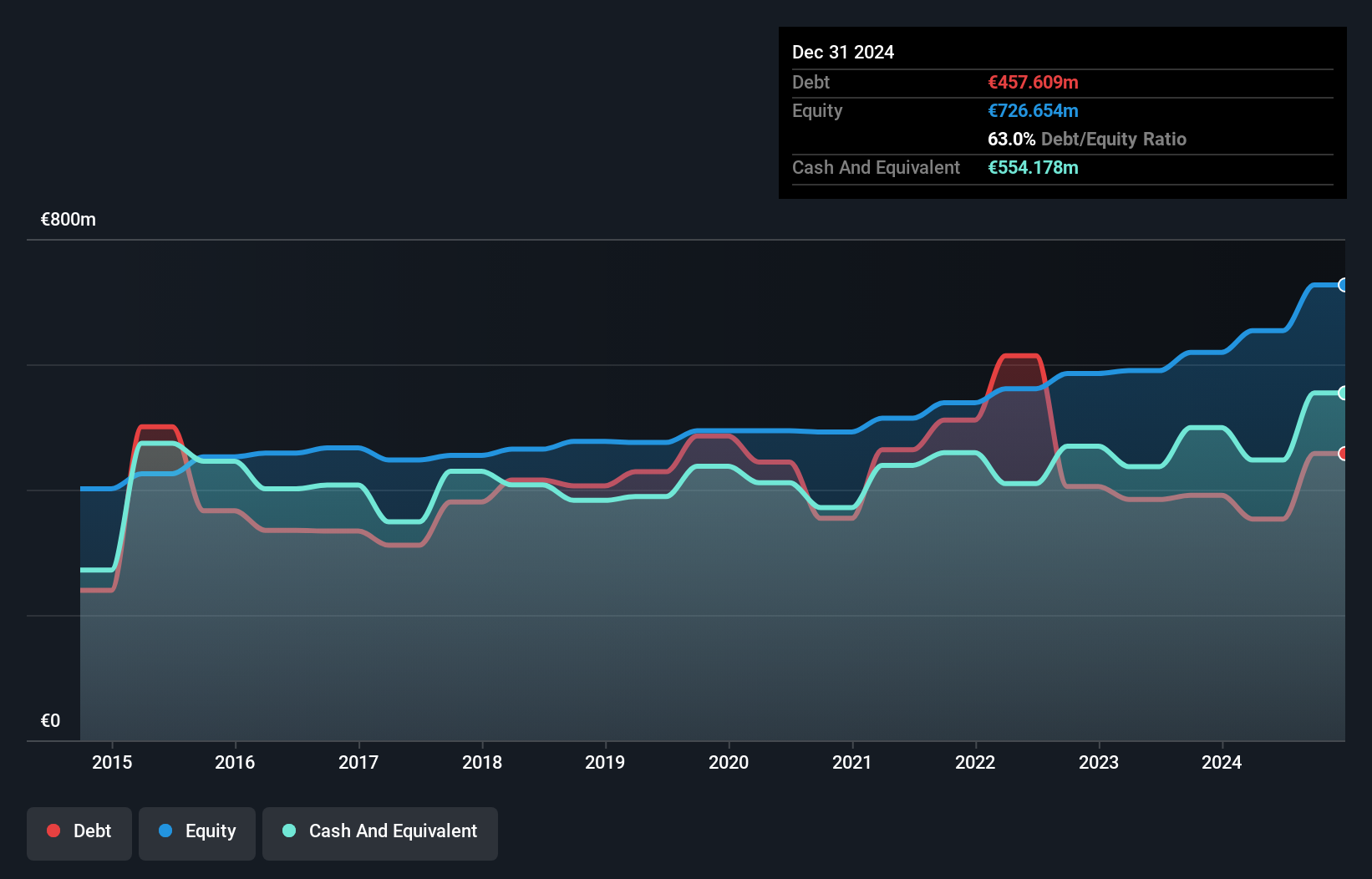

Synsam, a notable player in the Nordic optical retail space, showcases strong financials with earnings growing 42.7% annually over five years. Its net debt to equity ratio stands at 89.6%, indicating high leverage, but interest payments are well covered by EBIT at 3.2 times coverage. The company trades at a significant discount of 55.3% below estimated fair value and remains cash flow positive with SEK 952 million in levered free cash flow as of September 2024. Recent expansions include plans for new stores and innovative product lines like smart glasses, enhancing its market position despite geographic concentration risks in core Nordic markets.

Burkhalter Holding (SWX:BRKN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Burkhalter Holding AG, with a market cap of CHF1.52 billion, operates through its subsidiaries to deliver electrical engineering services to the construction industry mainly in Switzerland.

Operations: Burkhalter Holding generates revenue of CHF1.19 billion from its electrical engineering services in Switzerland.

Burkhalter Holding, a niche player in the construction sector, has shown promising financial health. With earnings growth of 7.2% over the past year, it outpaced the industry average of 7%. The company's net debt to equity ratio stands at a satisfactory 39.2%, indicating sound financial management despite an increase from 19.7% to 69.7% over five years. Recent half-year results reveal revenue climbed to CHF 591 million from CHF 570 million last year, while net income reached CHF 23.97 million compared to CHF 23.3 million previously, reflecting its robust performance and potential for future growth within its industry context.

- Click here to discover the nuances of Burkhalter Holding with our detailed analytical health report.

Seize The Opportunity

- Dive into all 315 of the European Undiscovered Gems With Strong Fundamentals we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SYNSAM

Synsam

Operates in the optical retail and eye health sector in the Nordic Region.

High growth potential and good value.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success