- Switzerland

- /

- Insurance

- /

- SWX:SREN

European Dividend Stocks Yielding Up To 4.1%

Reviewed by Simply Wall St

As the European market navigates a period of mixed returns, with the STOXX Europe 600 Index remaining relatively flat and inflation reaching the ECB's target, investors are increasingly focused on finding stable income sources. In this environment, dividend stocks can offer a reliable stream of income, making them an attractive option for those looking to capitalize on steady cash flows amidst economic fluctuations.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.42% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.08% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.55% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.79% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.96% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.43% | ★★★★★★ |

| ERG (BIT:ERG) | 5.43% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 4.07% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.59% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.32% | ★★★★★★ |

Click here to see the full list of 228 stocks from our Top European Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

VIEL & Cie société anonyme (ENXTPA:VIL)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: VIEL & Cie, société anonyme, is an investment company offering interdealer broking, online trading, and private banking services across various regions including Europe and the Asia-Pacific, with a market cap of €957.57 million.

Operations: VIEL & Cie, société anonyme, generates revenue through professional intermediation (€1.11 billion), stock exchange online activities (€74.37 million), and contributions from holdings (€5.40 million).

Dividend Yield: 3%

VIEL & Cie société anonyme offers a reliable dividend with a 3.03% yield, though it is lower than the top 25% of French dividend payers. The company's dividends are well covered by both earnings and cash flows, with payout ratios of 24.5% and 24.2%, respectively. Over the past decade, VIL's dividends have been stable and growing, supported by a recent increase to €0.47 per share payable in June 2025.

- Click here and access our complete dividend analysis report to understand the dynamics of VIEL & Cie société anonyme.

- According our valuation report, there's an indication that VIEL & Cie société anonyme's share price might be on the cheaper side.

Mikron Holding (SWX:MIKN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mikron Holding AG is a company that specializes in developing, producing, and marketing automation solutions, machining systems, and cutting tools across Switzerland, Europe, North America, the Asia Pacific, and internationally with a market cap of CHF273.94 million.

Operations: Mikron Holding AG's revenue is primarily derived from its Automation segment, which accounts for CHF233.34 million, and its Machining Solutions segment, contributing CHF140.81 million.

Dividend Yield: 3%

Mikron Holding's dividend yield of 3.04% is below the top quartile in Switzerland, and its dividend history has been volatile over the past decade. However, dividends are well covered by earnings and cash flows, with payout ratios of 29.8% and 17.3%, respectively. Recently, Mikron affirmed a CHF 0.50 per share distribution at its AGM, split between retained earnings and tax-free capital contributions reserves, indicating a commitment to shareholder returns despite past volatility.

- Unlock comprehensive insights into our analysis of Mikron Holding stock in this dividend report.

- Our expertly prepared valuation report Mikron Holding implies its share price may be lower than expected.

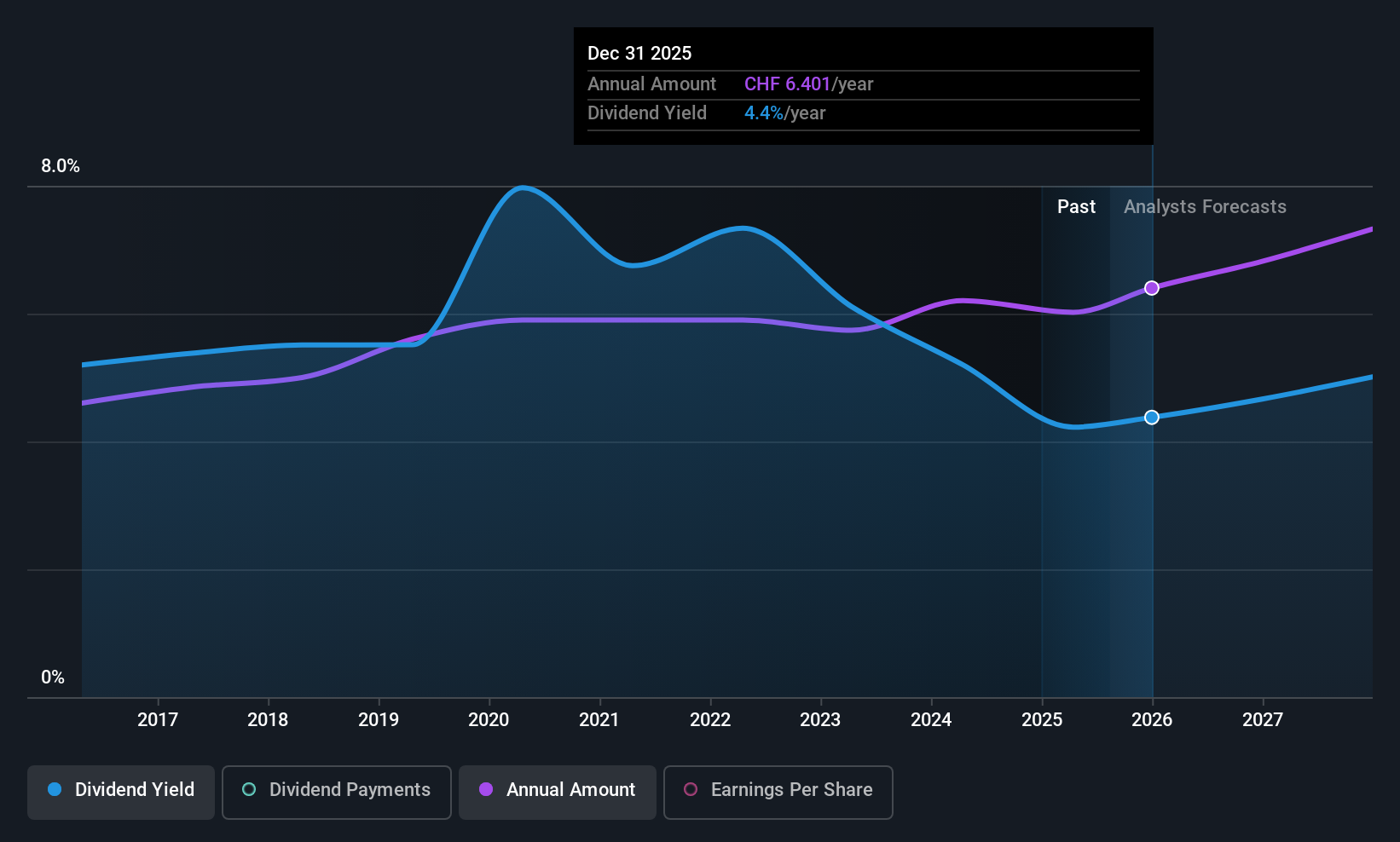

Swiss Re (SWX:SREN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Swiss Re AG, with a market cap of CHF42.29 billion, operates globally through its subsidiaries to offer reinsurance, insurance, various risk transfer solutions, and related services.

Operations: Swiss Re AG generates revenue primarily from its global operations in reinsurance, insurance, and various risk transfer solutions.

Dividend Yield: 4.1%

Swiss Re's dividend yield of 4.13% ranks in the top quartile of Swiss dividend payers, though its history has been volatile over the past decade. Despite this, dividends are well-covered by earnings and cash flows, with payout ratios of 67.5% and 70.2%, respectively. Recently approved at an AGM, a USD 7.35 per share dividend reflects strong capital management priorities, although past payment reliability remains a concern for some investors seeking stability.

- Click here to discover the nuances of Swiss Re with our detailed analytical dividend report.

- Our valuation report unveils the possibility Swiss Re's shares may be trading at a discount.

Key Takeaways

- Delve into our full catalog of 228 Top European Dividend Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:SREN

Swiss Re

Provides reinsurance, insurance, other insurance-based forms of risk transfer, and other insurance-related services worldwide.

Outstanding track record, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success