Stock Analysis

3 Top Euronext Paris Dividend Stocks With Yields From 4% To 5.1%

Reviewed by Simply Wall St

Amid a backdrop of modestly rising European markets and easing monetary policies, investors are increasingly looking for stable returns in a fluctuating economic landscape. In this context, dividend stocks listed on Euronext Paris offer an appealing blend of yield and potential resilience, making them worthy of consideration for those seeking income-generating investments.

Top 10 Dividend Stocks In France

| Name | Dividend Yield | Dividend Rating |

| Samse (ENXTPA:SAMS) | 9.41% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.38% | ★★★★★★ |

| CBo Territoria (ENXTPA:CBOT) | 6.82% | ★★★★★★ |

| Arkema (ENXTPA:AKE) | 4.23% | ★★★★★☆ |

| VIEL & Cie société anonyme (ENXTPA:VIL) | 4.07% | ★★★★★☆ |

| Sanofi (ENXTPA:SAN) | 4.18% | ★★★★★☆ |

| Teleperformance (ENXTPA:TEP) | 3.80% | ★★★★★☆ |

| Carrefour (ENXTPA:CA) | 6.50% | ★★★★★☆ |

| Exacompta Clairefontaine (ENXTPA:ALEXA) | 4.09% | ★★★★★☆ |

| Piscines Desjoyaux (ENXTPA:ALPDX) | 7.87% | ★★★★★☆ |

Click here to see the full list of 34 stocks from our Top Euronext Paris Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Société BIC (ENXTPA:BB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Société BIC SA, a global company, manufactures and sells stationery, lighters, shavers, and other products with a market capitalization of €2.30 billion.

Operations: Société BIC SA generates revenue primarily through three segments: Blade Excellence - Razors (€544.80 million), Flame for Life - Lighters (€830.60 million), and Human Expression - Stationery (€842.30 million).

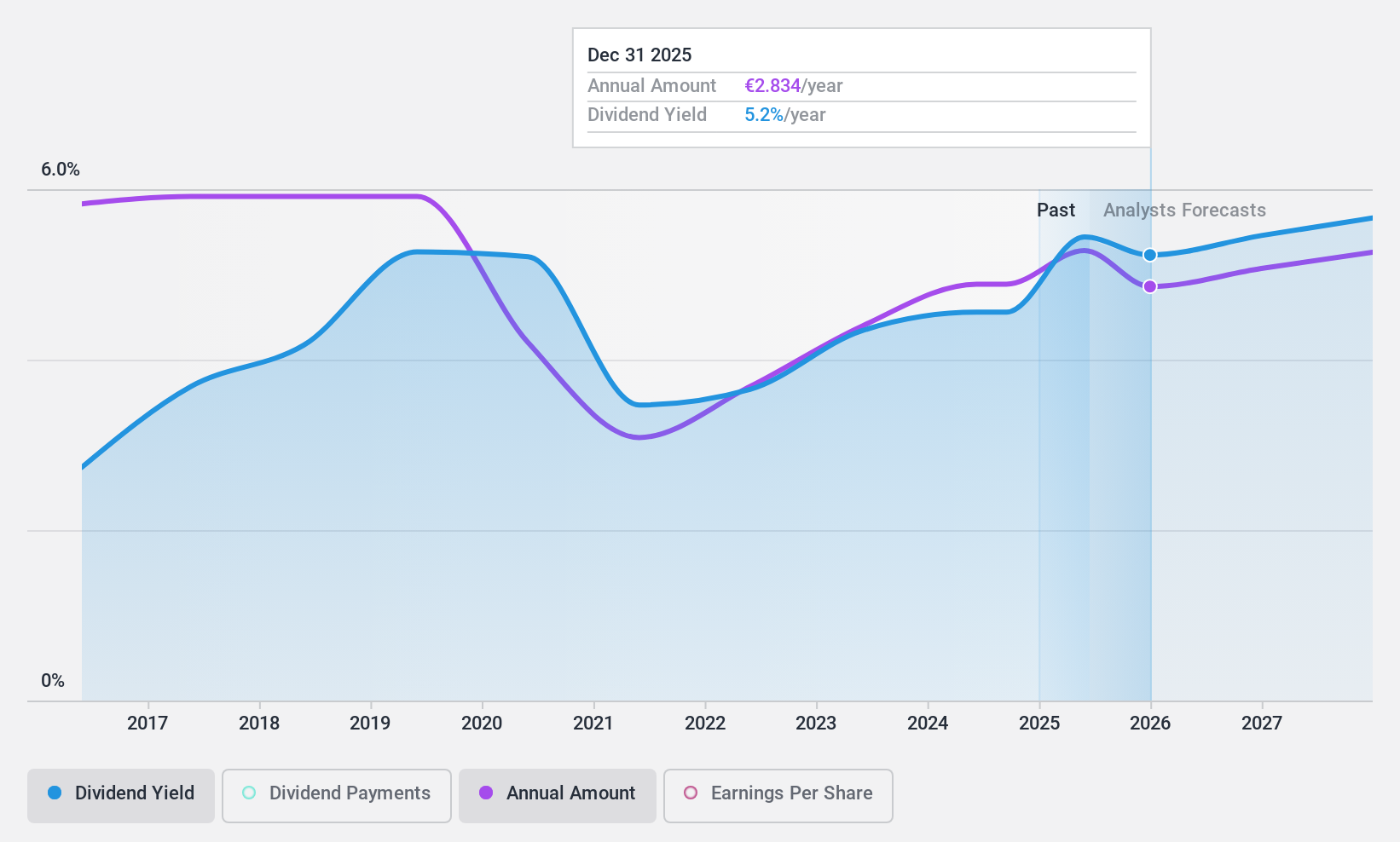

Dividend Yield: 5.2%

Société BIC's dividend history shows volatility with an unstable track record over the past decade, despite a recent 11% increase in its annual ordinary dividend to €2.85 per share and an additional extraordinary dividend of €1.42 per share as of May 2024. The dividends are financially supported by a reasonable payout ratio of 57.5% and a cash payout ratio of 47.7%, suggesting coverage by both earnings and cash flows, yet the overall yield remains low compared to top French dividend payers. Recent adjustments in sales guidance indicate modest growth expectations, potentially impacting future profitability and dividend sustainability.

- Take a closer look at Société BIC's potential here in our dividend report.

- Upon reviewing our latest valuation report, Société BIC's share price might be too pessimistic.

Sanofi (ENXTPA:SAN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sanofi is a global healthcare company involved in researching, developing, manufacturing, and marketing therapeutic solutions, with a market capitalization of approximately €112.34 billion.

Operations: Sanofi generates €38.12 billion from its Biopharma segment and €5.21 billion from Consumer Healthcare.

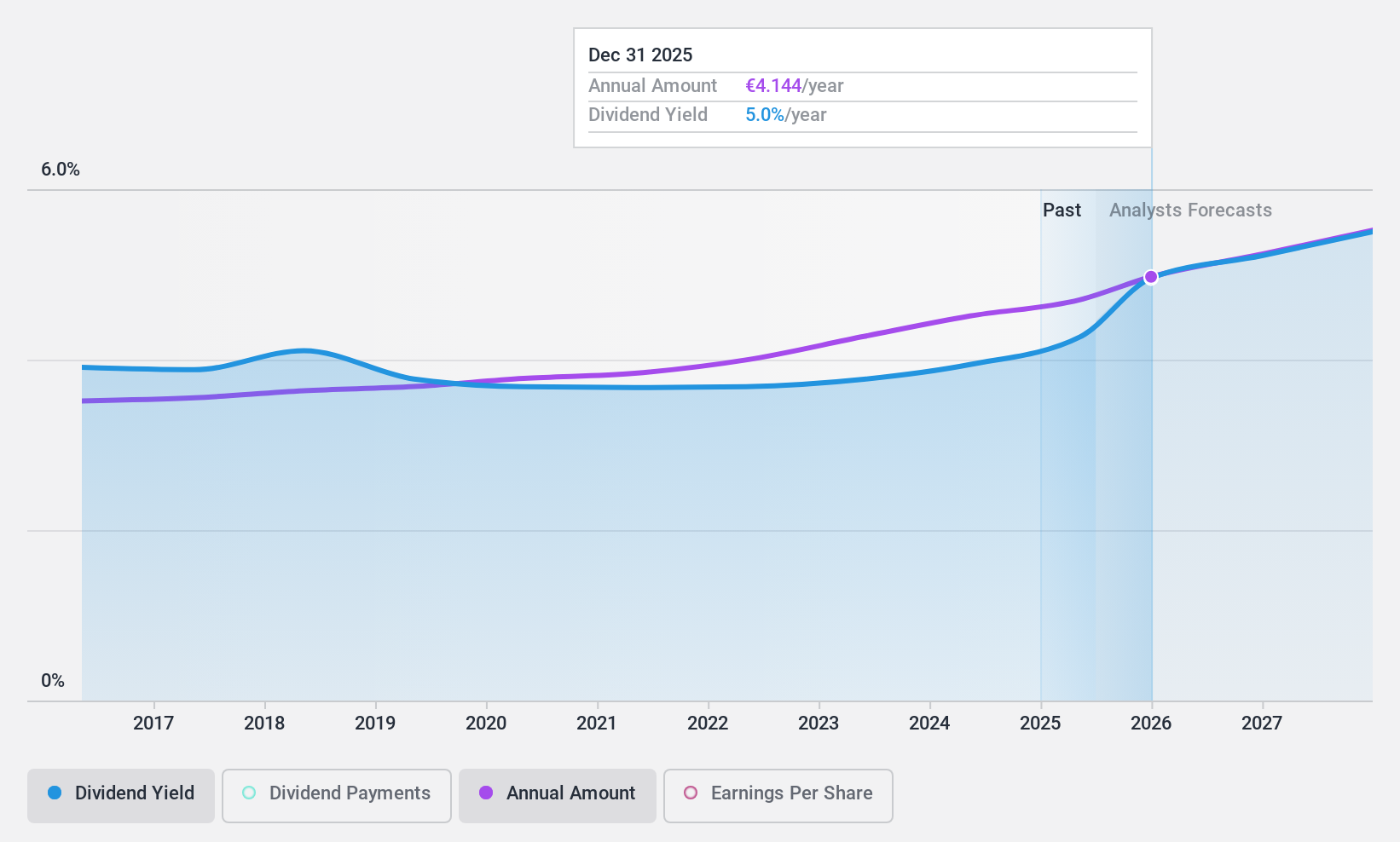

Dividend Yield: 4.2%

Sanofi, a notable player in the French pharmaceutical industry, declared an ordinary annual dividend of €3.76 per share at its AGM on April 30, 2024, with payment due on May 15. Despite a lower profit margin this year (9.8% compared to last year's 18.1%), Sanofi maintains a stable dividend track record supported by a reasonable payout ratio (87.2%) and cash flow coverage (65%). Analysts predict potential stock price growth of 20.4%, reflecting confidence in its financial health and market position.

- Delve into the full analysis dividend report here for a deeper understanding of Sanofi.

- In light of our recent valuation report, it seems possible that Sanofi is trading behind its estimated value.

VIEL & Cie société anonyme (ENXTPA:VIL)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: VIEL & Cie société anonyme operates as an investment company, offering interdealer broking, online trading, and private banking services across various global regions, with a market capitalization of approximately €0.60 billion.

Operations: VIEL & Cie société anonyme generates revenue primarily through professional intermediation and stock exchange online services, reporting €1.01 billion and €65.12 million respectively in these segments.

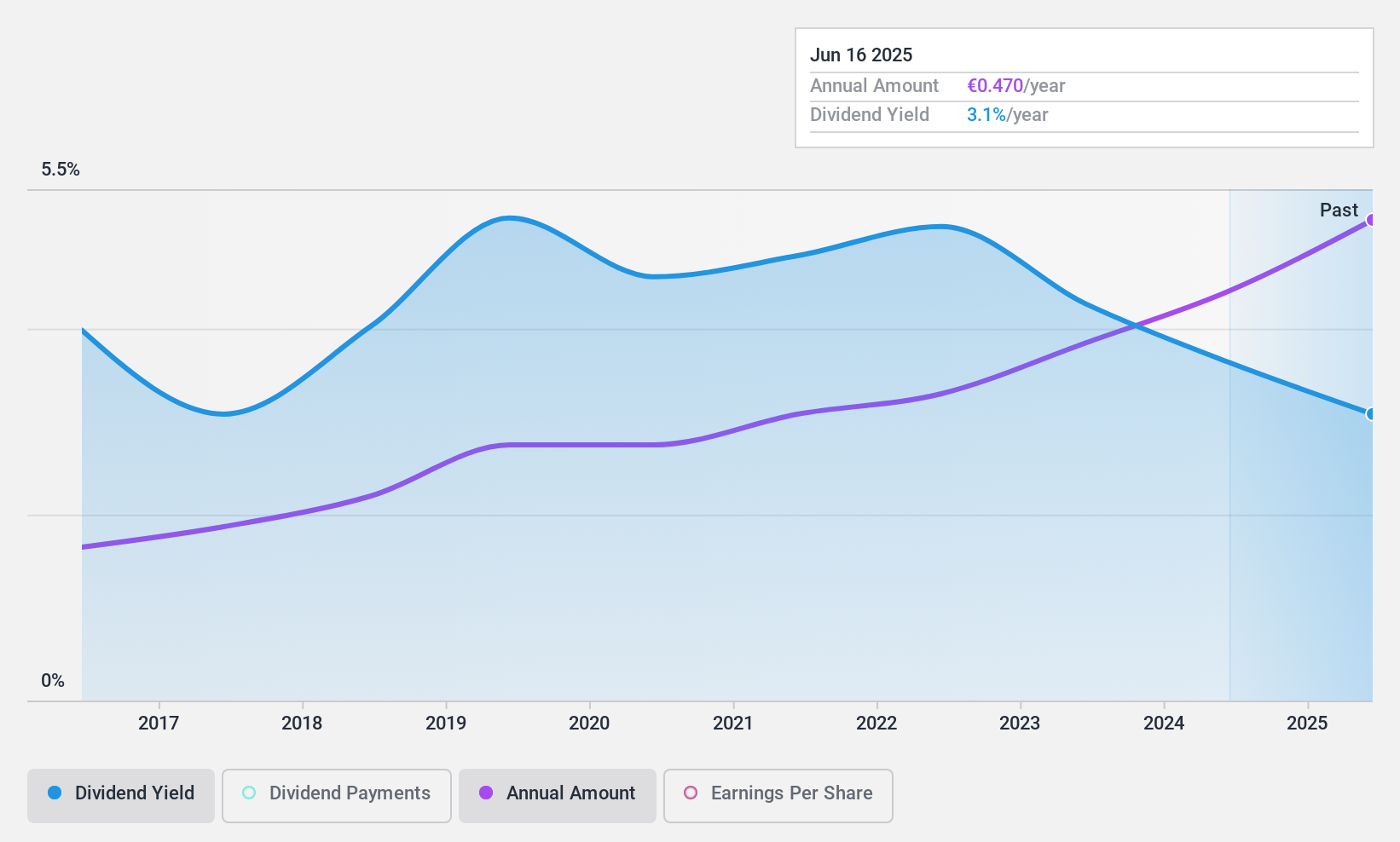

Dividend Yield: 4.1%

VIEL & Cie société anonyme offers a consistent dividend yield of 4.07%, underpinned by a stable 10-year history of payouts and growth in dividend amounts. The dividends are well-supported with a payout ratio of 25.8% and cash payout ratio of 20.1%, ensuring sustainability from both earnings and cash flow perspectives. Despite its reliable performance, VIEL's yield remains below the top quartile in the French market, trading at a significant discount to estimated fair value, suggesting potential undervaluation.

- Click here to discover the nuances of VIEL & Cie société anonyme with our detailed analytical dividend report.

- Our valuation report here indicates VIEL & Cie société anonyme may be undervalued.

Where To Now?

- Unlock our comprehensive list of 34 Top Euronext Paris Dividend Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Sanofi is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:SAN

Sanofi

A healthcare company, engages in the research, development, manufacture, and marketing of therapeutic solutions in the United States, Europe, Canada, and internationally.

Flawless balance sheet established dividend payer.