- France

- /

- Diversified Financial

- /

- ENXTPA:RF

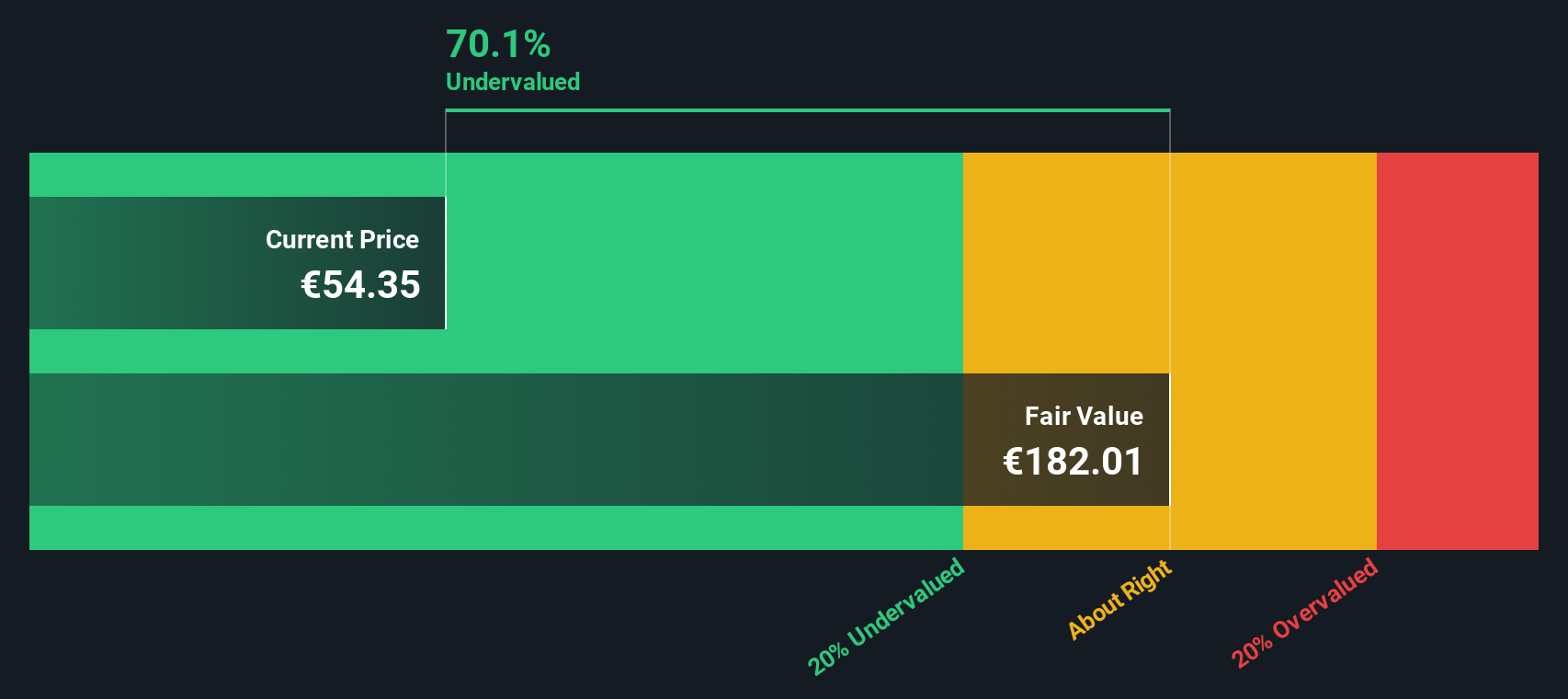

Eurazeo (ENXTPA:RF) Valuation: Exploring Updated Market Discounts and Recovery Potential

Reviewed by Simply Wall St

Eurazeo (ENXTPA:RF) shares have seen some recent movement, catching investor interest after the stock's month performance declined around 1%, even as the past 3 months delivered a 10% gain. Investors are weighing those shifts in the context of Eurazeo’s longer-term value trends.

See our latest analysis for Eurazeo.

The recent 10% rise in Eurazeo’s share price over the past three months stands out, even as this year’s overall share price return remains in negative territory. With the 1-year total shareholder return still down 10.8%, short-term momentum is building after earlier losses. This highlights a shift in risk and return expectations as the market reassesses the outlook.

If Eurazeo’s turnaround has you watching for new trends, this could be a great moment to broaden your horizons and discover fast growing stocks with high insider ownership

With shares still trading at a sizeable discount to analyst price targets and strong underlying growth figures, the question now is whether Eurazeo remains undervalued or if the market has already fully accounted for its future upside.

Price-to-Book Ratio of 0.6x: Is it justified?

Eurazeo is trading at a price-to-book ratio of just 0.6x, while the last close came in at €58.65. This compares to a European industry average of 1x and signals that the stock is currently valued at a sharp discount to sector peers.

The price-to-book ratio reveals how much the market is willing to pay versus the book value of assets. For companies like Eurazeo, which operates in the diversified financials sector, this ratio is commonly used by investors to assess whether the stock is undervalued or overvalued relative to its net asset position.

At 0.6x, Eurazeo’s multiple implies that investors are paying just 60 cents on the euro of book value, well below industry norms. This discount may reflect the company’s recent unprofitability or market skepticism about its future earnings potential, even as forecasts now point toward a turnaround.

The company’s ratio is also lower than the average of its peer group (0.9x). This further highlights its undervalued status by this metric.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 0.6x (UNDERVALUED)

However, persistent negative net income and a sharp year-to-date loss could present challenges to the current turnaround momentum and investor sentiment.

Find out about the key risks to this Eurazeo narrative.

Another View: Discounted Cash Flow Model Suggests Deeper Undervaluation

Looking at the SWS DCF model, things get even more interesting. The model estimates Eurazeo's fair value at €172.27 per share. This means the current price is nearly 66% below this level. This could indicate the market has overlooked some longer-term potential or is pricing in significant risks. Where does the true value lie?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Eurazeo for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 843 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Eurazeo Narrative

If you have your own perspective on Eurazeo or want to dive deeper into the numbers, you can develop your own narrative in just a few minutes. Put the data to the test yourself with Do it your way.

A great starting point for your Eurazeo research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

There’s a world of smart opportunities beyond this one. Stretch your strategy and target new market themes before everyone else catches on. Here are three screens to get you started now:

- Capitalize on growth in artificial intelligence by scanning these 26 AI penny stocks for companies setting the pace in this transformative field.

- Boost your income potential and stability with these 18 dividend stocks with yields > 3%, featuring top picks that offer attractive yields above 3%.

- Tap into fast-moving trends and volatility with these 3598 penny stocks with strong financials, uncovering significant upside among small-cap stocks showing real financial strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eurazeo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:RF

Eurazeo

A private equity and venture capital firm specializing in growth capital, series C, acquisitions, leveraged buyouts, and buy-ins of a private company, and investments in upper mid-market, mid-market and listed public companies, small- and mid-cap healthcare companies, equity in the small-mid and mid-large buyout segments.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives