- France

- /

- Diversified Financial

- /

- ENXTPA:PLX

Pluxee's (EPA:PLX) Shareholders Will Receive A Bigger Dividend Than Last Year

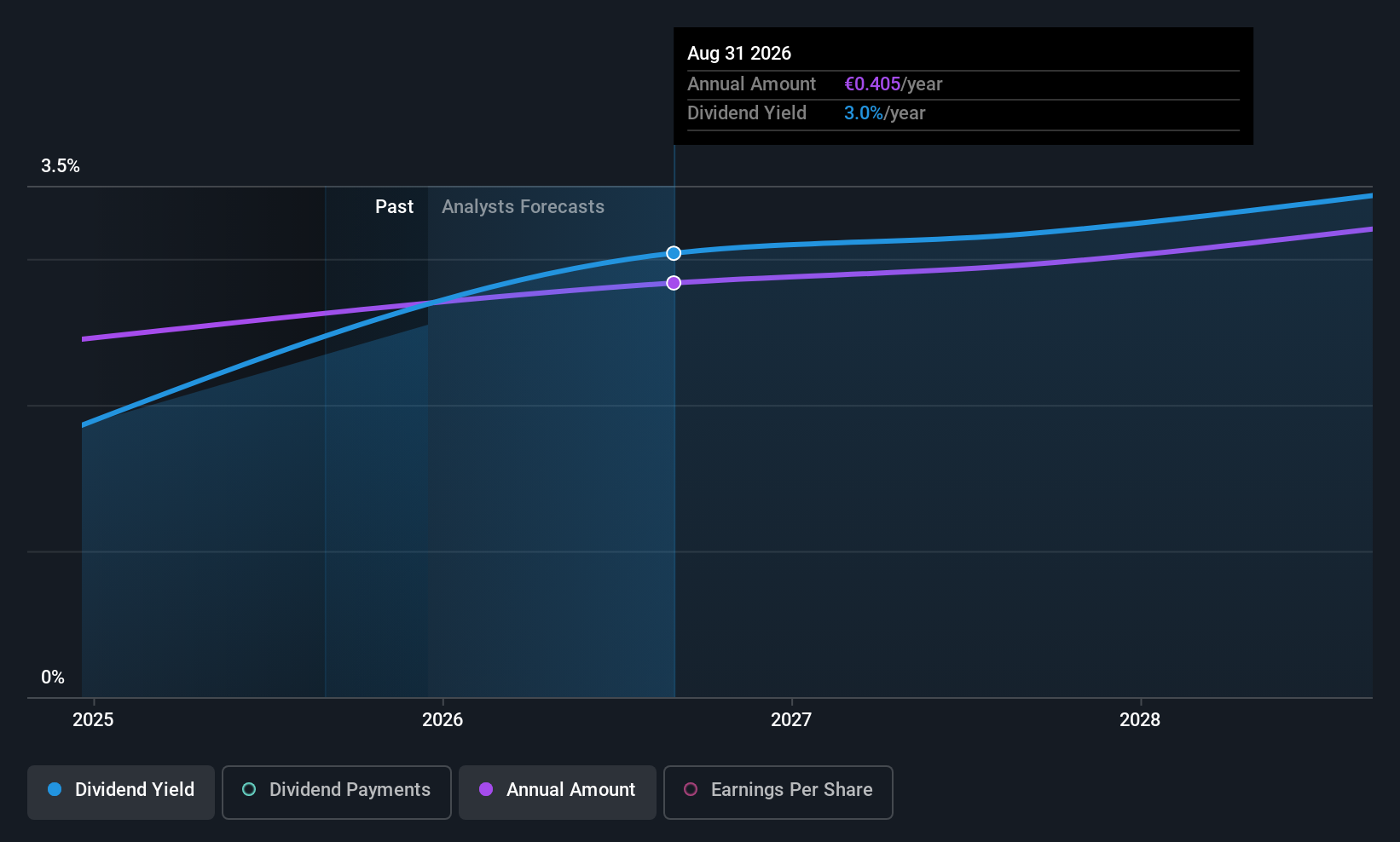

Pluxee N.V. (EPA:PLX) has announced that it will be increasing its dividend from last year's comparable payment on the 23rd of December to €0.38. The payment will take the dividend yield to 2.9%, which is in line with the average for the industry.

Pluxee's Future Dividend Projections Appear Well Covered By Earnings

We like to see a healthy dividend yield, but that is only helpful to us if the payment can continue. However, Pluxee's earnings easily cover the dividend. As a result, a large proportion of what it earned was being reinvested back into the business.

The next year is set to see EPS grow by 30.9%. If the dividend continues along recent trends, we estimate the payout ratio will be 21%, which is in the range that makes us comfortable with the sustainability of the dividend.

See our latest analysis for Pluxee

Pluxee Is Still Building Its Track Record

The company hasn't been paying a dividend for very long at all, so we can't really make a judgement on how stable the dividend has been. This doesn't mean that the company can't pay a good dividend, but just that we want to wait until it can prove itself.

Pluxee May Find It Hard To Grow The Dividend

Investors could be attracted to the stock based on the quality of its payment history. Earnings have grown at around 4.7% a year for the past three years, which isn't massive but still better than seeing them shrink. While EPS growth is quite low, Pluxee has the option to increase the payout ratio to return more cash to shareholders.

Our Thoughts On Pluxee's Dividend

Overall, this is a reasonable dividend, and it being raised is an added bonus. The dividend has been at reasonable levels historically, but that hasn't translated into a consistent payment. This looks like it could be a good dividend stock going forward, but we would note that the payout ratio has been at higher levels in the past so it could happen again.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Earnings growth generally bodes well for the future value of company dividend payments. See if the 12 Pluxee analysts we track are forecasting continued growth with our free report on analyst estimates for the company. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:PLX

Pluxee

Offers employee benefits and engagement solutions services in France, Latin America, Continental Europe, and internationally.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion