- France

- /

- Capital Markets

- /

- ENXTPA:IDIP

IDI's (EPA:IDIP) three-year total shareholder returns outpace the underlying earnings growth

IDI (EPA:IDIP) shareholders might be concerned after seeing the share price drop 13% in the last month. But that shouldn't obscure the pleasing returns achieved by shareholders over the last three years. In the last three years the share price is up, 51%: better than the market.

While this past week has detracted from the company's three-year return, let's look at the recent trends of the underlying business and see if the gains have been in alignment.

Check out our latest analysis for IDI

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

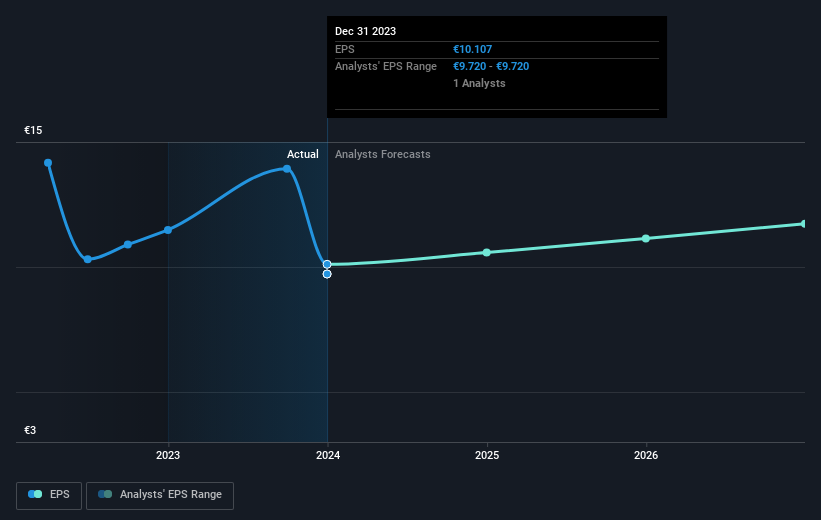

During three years of share price growth, IDI achieved compound earnings per share growth of 30% per year. This EPS growth is higher than the 15% average annual increase in the share price. So one could reasonably conclude that the market has cooled on the stock. This cautious sentiment is reflected in its (fairly low) P/E ratio of 6.65.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We know that IDI has improved its bottom line over the last three years, but what does the future have in store? It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for IDI the TSR over the last 3 years was 90%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

It's good to see that IDI has rewarded shareholders with a total shareholder return of 24% in the last twelve months. That's including the dividend. Since the one-year TSR is better than the five-year TSR (the latter coming in at 15% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand IDI better, we need to consider many other factors. Case in point: We've spotted 1 warning sign for IDI you should be aware of.

Of course IDI may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on French exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:IDIP

IDI

A private equity firm specializing in leveraged buyouts, expansion capital, middle market, growth capital, acquisition of significant holdings in listed small and medium companies and secondary private equity portfolios, mezzanine financing, loans senior to senior debt, mergers and acquisitions, LBO, development capital, discounted leveraged buyouts loans in mature companies and through co-investments in pre-IPO financing.

Undervalued with excellent balance sheet.