- France

- /

- Capital Markets

- /

- ENXTPA:ENX

Is Euronext Fairly Priced After Expansion and Technology Investment News?

Reviewed by Bailey Pemberton

- Wondering if Euronext is trading at an attractive price right now? If you have questions about its current valuation, you are definitely not alone.

- While the stock dipped 1.3% over the last week, it is still up 24.0% in the past year and has climbed an impressive 93.9% over the last three years.

- Recent news has highlighted Euronext’s expanded role as a leading European market operator. This includes its ongoing integration of previously acquired bourses and strategic investments in technology infrastructure. These updates have influenced investor sentiment and have contributed to the recent price shifts.

- Our initial valuation check gives Euronext a score of 2/6 for being undervalued. However, there is more than one way to look at valuation. Stay with us as we break down the classic methods and guide you toward a smarter approach by the end of this article.

Euronext scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Euronext Excess Returns Analysis

The Excess Returns model estimates a company's intrinsic value by evaluating how much profit is earned above the minimum required return for shareholders. For Euronext, this method focuses on the firm's return on equity and how efficiently it grows book value over time.

Euronext’s average Return on Equity stands at 16.03%, suggesting the company is generating strong returns on every euro of shareholder capital. With a current book value of €42.45 per share and an anticipated stable book value of €48.82 per share (according to consensus from seven analysts), the company is showing healthy growth potential. Estimated stable earnings per share are €7.83, based on weighted projections from eleven analysts.

The cost of equity is €3.41 per share, which means Euronext is delivering an excess return of €4.42 per share over what investors typically demand for their capital. This outperformance underpins the valuation generated by this model.

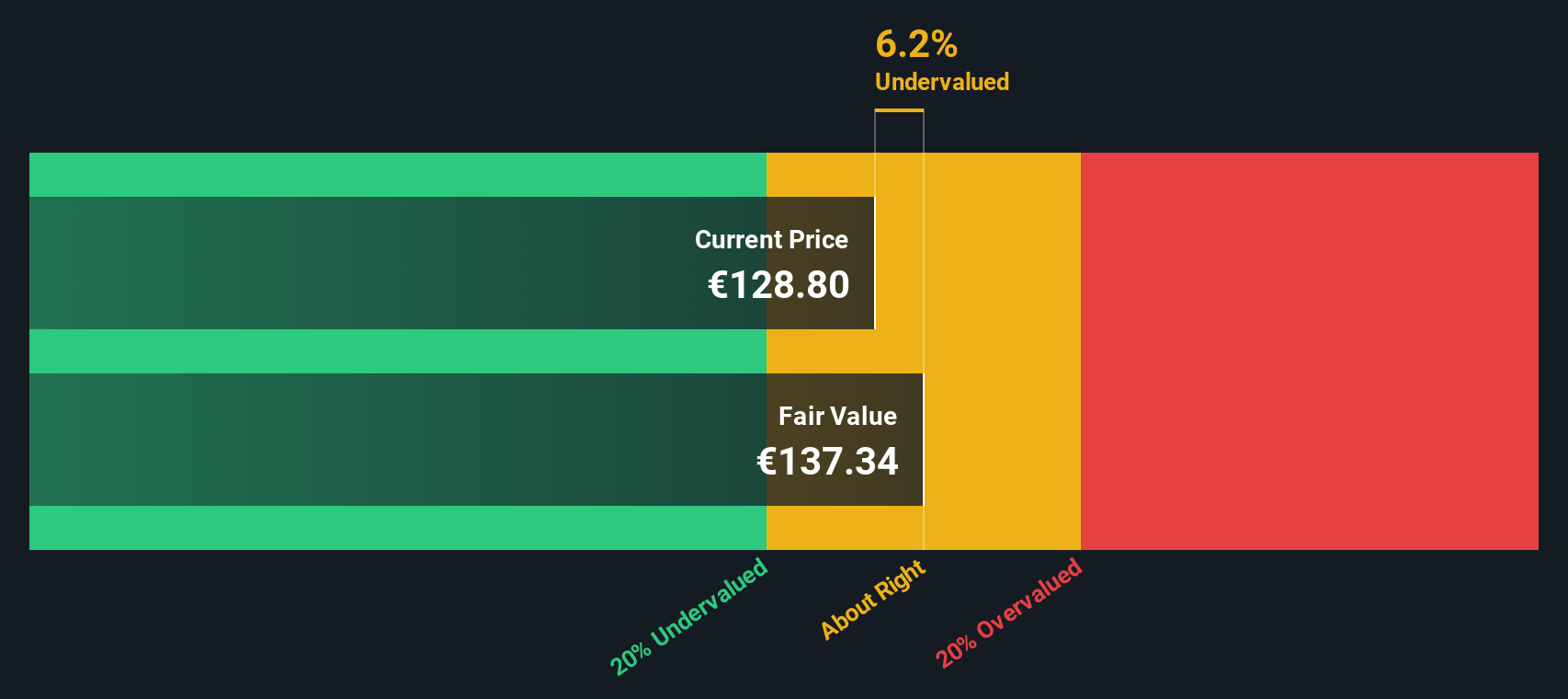

Based on the Excess Returns approach, Euronext’s estimated intrinsic value is about 9.3% higher than its current share price. Because this difference is just under the 10% threshold, it suggests the stock is fairly valued for now.

Result: ABOUT RIGHT

Euronext is fairly valued according to our Excess Returns, but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: Euronext Price vs Earnings

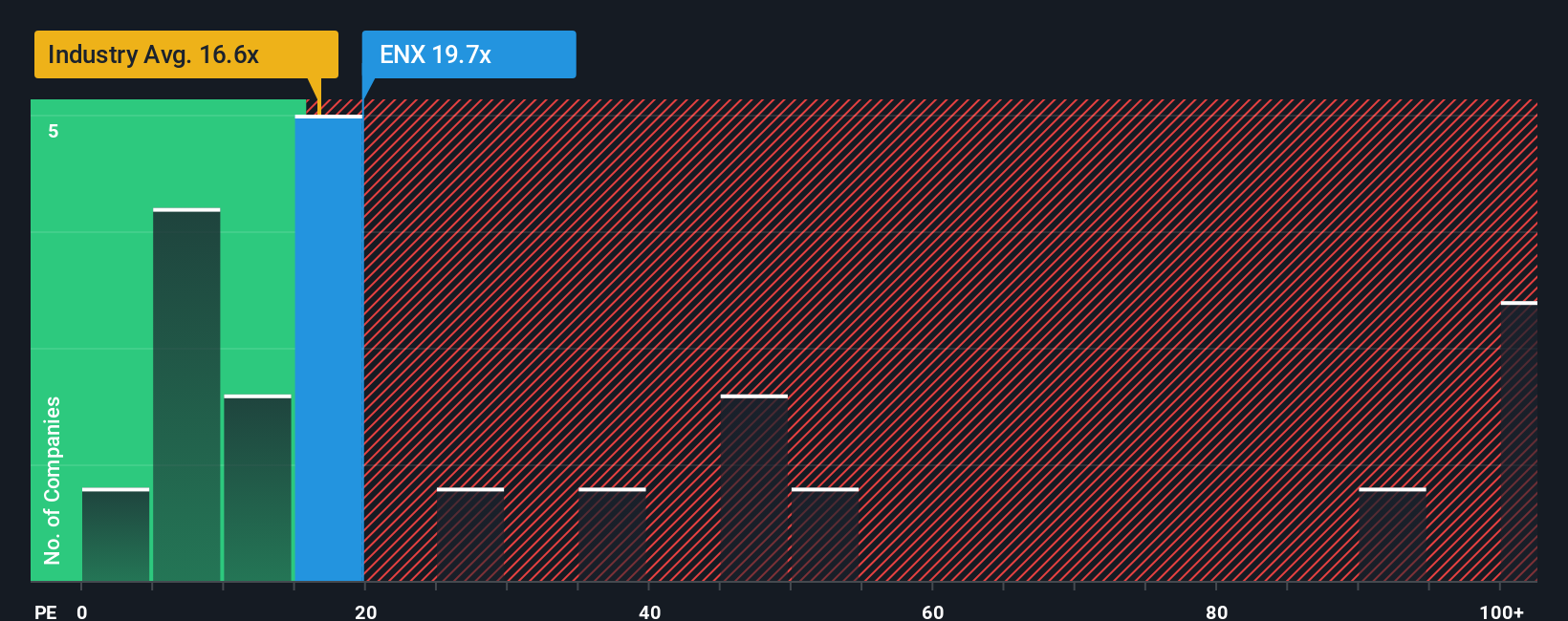

The Price-to-Earnings (PE) ratio is a widely used valuation tool for profitable companies like Euronext. It helps investors gauge how much they are paying for each euro of the company's earnings, making it especially useful for firms with stable and predictable profit streams.

A "normal" or fair PE ratio is influenced by the company’s future growth potential and its risk profile. Companies expected to grow quickly or offer lower investment risk typically justify a higher PE, while slower-growing or riskier businesses should trade at a lower multiple.

Euronext’s current PE ratio stands at 19.6x. This compares to an industry average PE of 17.9x and a peer average of 11.4x, indicating the market is placing a premium on the company relative to its sector. However, Simply Wall St’s proprietary Fair Ratio for Euronext is 20.3x. The Fair Ratio incorporates not only peer and industry figures, but also factors in Euronext’s earnings growth, profit margins, market capitalization, and the specific risks the company faces. This makes it a more comprehensive benchmark than standalone industry or peer comparisons.

With a Fair Ratio of 20.3x and an actual PE of 19.6x, Euronext’s valuation is almost perfectly aligned with what fundamentals suggest is reasonable. This points to a stock that is neither overvalued nor underappreciated in the current market.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1413 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Euronext Narrative

Earlier, we mentioned there is an even better way to understand valuation. Let’s introduce you to Narratives, a dynamic, story-driven method that empowers investors like you to go beyond the numbers by expressing your own perspective on a company’s future, such as your fair value estimate or expectations for revenue, earnings, and profit margins.

Rather than relying solely on ratios or models, a Narrative links your understanding of Euronext’s business story directly to your financial forecasts and then to a fair value, giving you a more holistic decision-making tool. Narratives are easy to use and available right on Simply Wall St’s Community page, where millions of investors can craft and share how they see the future playing out for companies like Euronext.

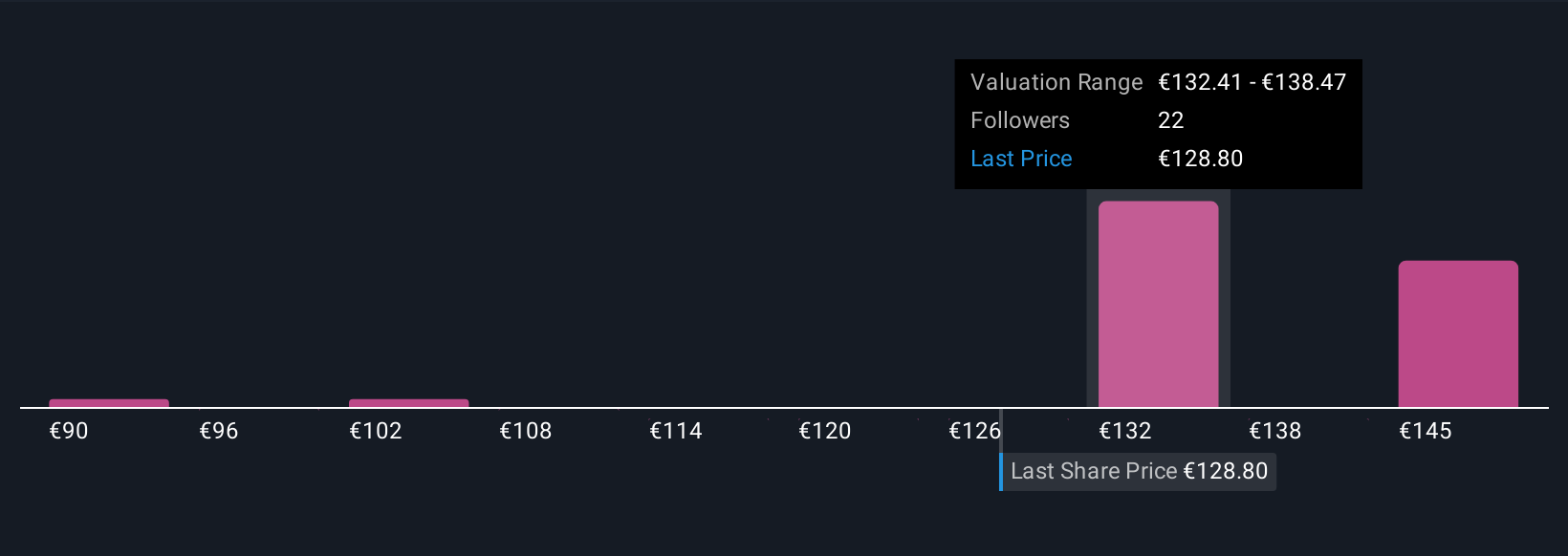

They are also kept up to date as the company releases news or earnings, helping you quickly decide if there's an opportunity to buy or sell by letting you compare your view of Fair Value to the current Price. For Euronext, you might find one investor’s Narrative sees massive upside thanks to new digital offerings and its inclusion in the CAC 40 index, aiming for a bullish €174 target. Another could take a more cautious view, citing integration risks and increased competition, with a conservative €114 price target.

Do you think there's more to the story for Euronext? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Euronext might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ENX

Euronext

Operates securities and derivatives exchanges in the Netherlands, France, Italy, Belgium, Portugal, Ireland, the United States, Norway, Denmark, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives