- France

- /

- Diversified Financial

- /

- ENXTPA:EDEN

Will Edenred's (ENXTPA:EDEN) Visa Partnership and Certification Redefine Its Digital Expansion Narrative?

Reviewed by Sasha Jovanovic

- Edenred and Visa announced a partnership to expand digital payment solutions, with Edenred certifying its in-house issuing infrastructure for Visa across multiple business lines and gaining access to new payment capabilities.

- This collaboration, alongside Edenred's reported third quarter revenue of €726 million, reflecting continued growth, signals the company's focus on accelerating its technology leadership and international expansion.

- We'll explore how Edenred's Visa partnership and technology certification could impact its investment narrative and digital ambitions going forward.

Find companies with promising cash flow potential yet trading below their fair value.

Edenred Investment Narrative Recap

To be an Edenred shareholder, you need to believe in the company’s ability to drive growth through digital payments innovation, international expansion, and recurring fee-based revenues. The recent partnership with Visa strengthens Edenred’s technological infrastructure and market positioning, but does not remove the near-term risk around margin pressure from heavy technology investments and regulatory changes, especially in key European and Latin American markets.

Of the recent announcements, the Q3 revenue results (EUR 726 million, up 7.3% like-for-like) are most relevant here, indicating that Edenred’s digital and international strategies are delivering tangible top-line growth, a key catalyst supporting analyst expectations for continued expansion, even as operational costs and regulatory headwinds require monitoring.

In contrast, investors should be aware that persistent margin compression risk, as Edenred scales its technology and meets new compliance demands, could impact...

Read the full narrative on Edenred (it's free!)

Edenred's projections indicate revenue of €3.5 billion and earnings of €706.1 million by 2028. This outlook is based on a 9.3% annual revenue growth rate and an increase in earnings of approximately €199 million from the current level of €507.0 million.

Uncover how Edenred's forecasts yield a €35.28 fair value, a 35% upside to its current price.

Exploring Other Perspectives

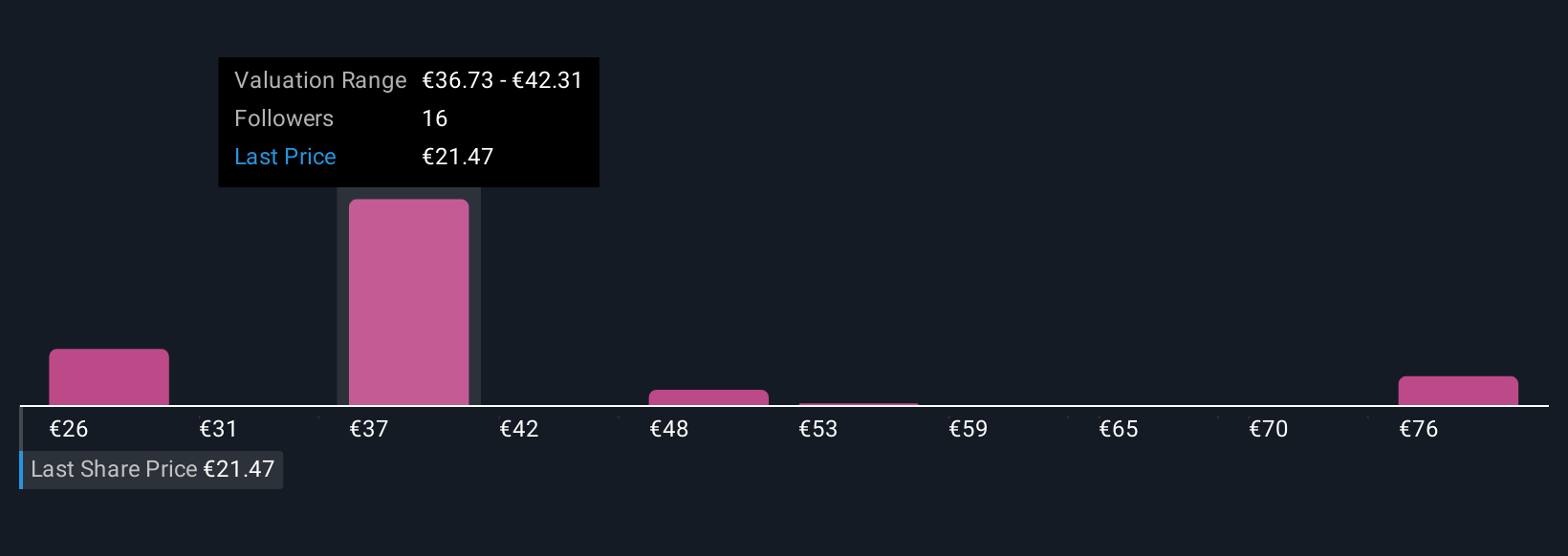

Simply Wall St Community members offered seven fair value estimates for Edenred, spanning €25.56 to €85.49. While analyst consensus sees growth from digital platform initiatives, opinions on future performance remain far apart.

Explore 7 other fair value estimates on Edenred - why the stock might be worth over 3x more than the current price!

Build Your Own Edenred Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Edenred research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Edenred research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Edenred's overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Edenred might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:EDEN

Edenred

Provides digital platform for services and payments for companies, employees, and merchants worldwide.

Undervalued with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives