- France

- /

- Diversified Financial

- /

- ENXTPA:EDEN

3 Euronext Paris Stocks Estimated To Be Trading At Up To 40% Below Intrinsic Value

Reviewed by Simply Wall St

As the French CAC 40 Index recently experienced a decline of 1.52%, reflecting broader European market trends amid expectations of slower monetary policy easing by the Federal Reserve, investors are increasingly focused on identifying opportunities within undervalued stocks. In such an environment, finding stocks trading below their intrinsic value can be a strategic approach for investors looking to capitalize on potential market inefficiencies and long-term growth prospects.

Top 10 Undervalued Stocks Based On Cash Flows In France

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Antin Infrastructure Partners SAS (ENXTPA:ANTIN) | €10.46 | €15.97 | 34.5% |

| SPIE (ENXTPA:SPIE) | €34.34 | €53.79 | 36.2% |

| NSE (ENXTPA:ALNSE) | €29.10 | €57.61 | 49.5% |

| Vivendi (ENXTPA:VIV) | €10.225 | €17.90 | 42.9% |

| EKINOPS (ENXTPA:EKI) | €4.05 | €6.99 | 42% |

| Groupe Berkem Société anonyme (ENXTPA:ALKEM) | €3.07 | €5.10 | 39.9% |

| Solutions 30 (ENXTPA:S30) | €1.162 | €2.31 | 49.6% |

| Vogo (ENXTPA:ALVGO) | €3.16 | €6.23 | 49.3% |

| Exail Technologies (ENXTPA:EXA) | €18.00 | €30.63 | 41.2% |

| OVH Groupe (ENXTPA:OVH) | €8.735 | €14.57 | 40% |

Let's take a closer look at a couple of our picks from the screened companies.

Edenred (ENXTPA:EDEN)

Overview: Edenred SE operates a digital platform offering services and payment solutions for companies, employees, and merchants globally, with a market cap of €7.06 billion.

Operations: The company's revenue from Business Services amounts to €2.50 billion.

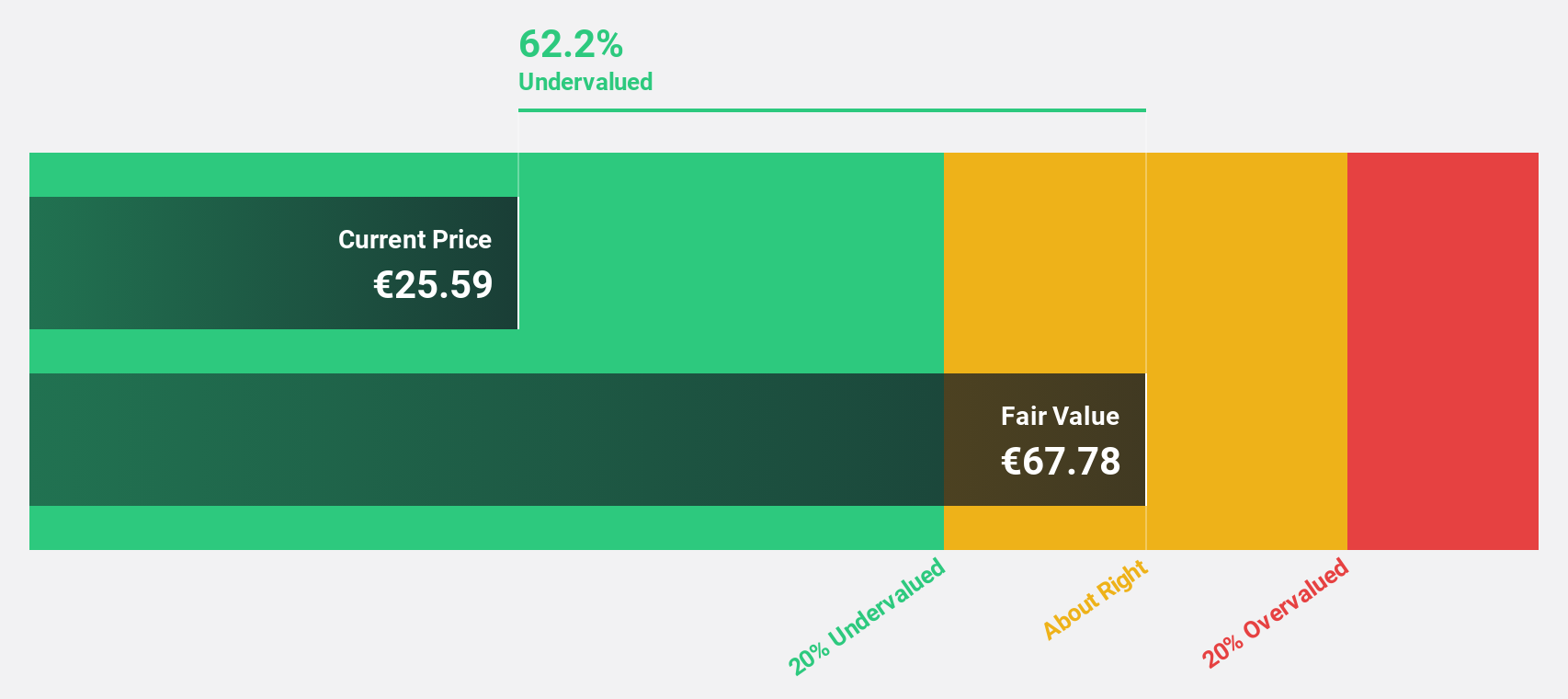

Estimated Discount To Fair Value: 28.0%

Edenred is trading at €28.93, significantly below its estimated fair value of €40.18, suggesting it may be undervalued based on cash flows. Despite a decline in profit margins from 19.6% to 12%, earnings are projected to grow at 18.7% annually, outpacing the French market's growth rate of 12%. However, the dividend yield of 3.8% isn't well covered by earnings and high debt levels pose financial risk despite promising revenue growth forecasts.

- The analysis detailed in our Edenred growth report hints at robust future financial performance.

- Click here to discover the nuances of Edenred with our detailed financial health report.

Exclusive Networks (ENXTPA:EXN)

Overview: Exclusive Networks SA is a global cybersecurity specialist focused on digital infrastructure, with a market cap of €2.14 billion.

Operations: The company's revenue is derived from three primary segments: €480 million from APAC, €4.19 billion from EMEA, and €705 million from the Americas.

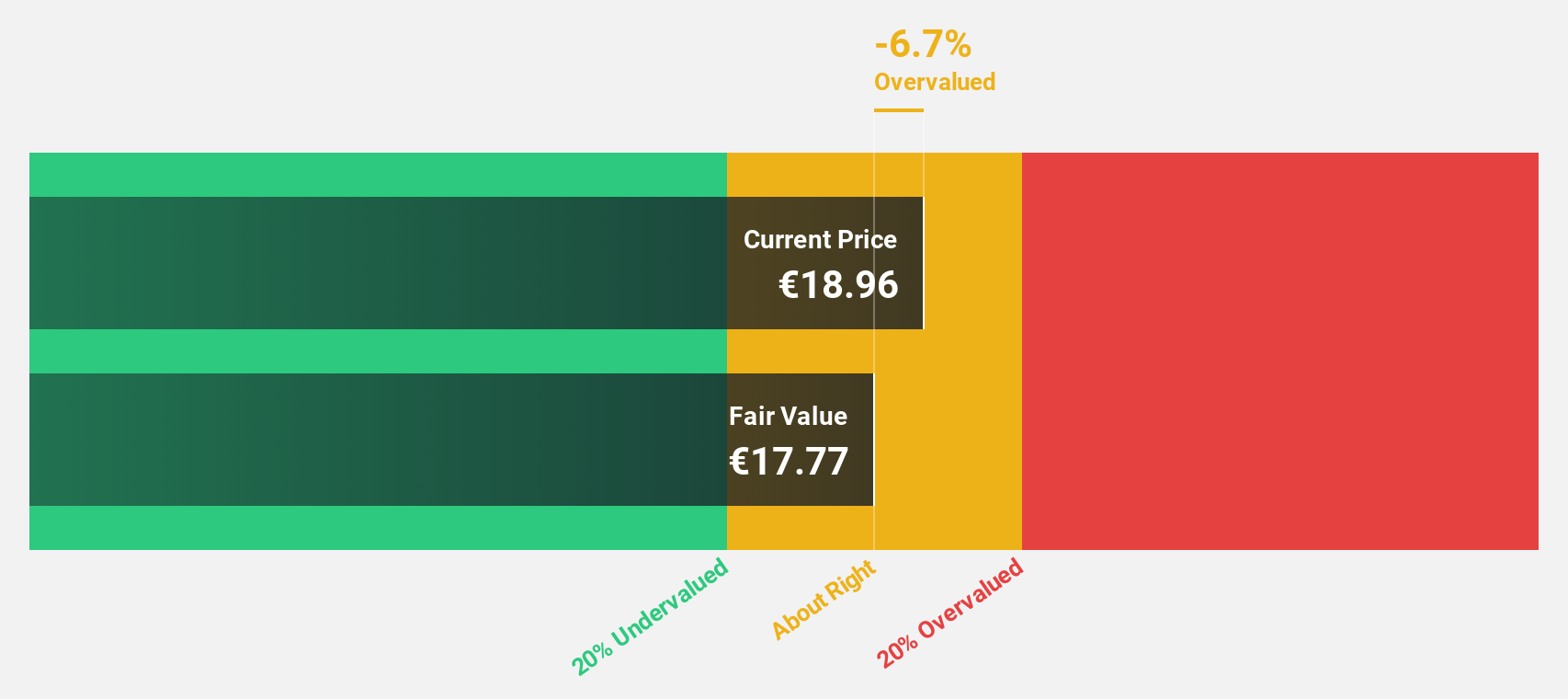

Estimated Discount To Fair Value: 14.4%

Exclusive Networks is trading at €23.65, slightly below its fair value estimate of €27.63, indicating potential undervaluation based on cash flows. While revenue growth is expected to be moderate at 13.1% annually, earnings are forecast to rise significantly by 33.5% per year, surpassing the French market's average growth rate of 12%. However, profit margins have declined from 5.5% to 2.7%, and return on equity remains low at a projected 13.3%.

- The growth report we've compiled suggests that Exclusive Networks' future prospects could be on the up.

- Get an in-depth perspective on Exclusive Networks' balance sheet by reading our health report here.

OVH Groupe (ENXTPA:OVH)

Overview: OVH Groupe S.A. operates globally, offering public and private cloud services, shared hosting, and dedicated server solutions with a market capitalization of €1.66 billion.

Operations: The company's revenue is primarily derived from its Private Cloud segment at €589.61 million, followed by Public Cloud at €169.01 million, and Web cloud & Other services contributing €185.43 million.

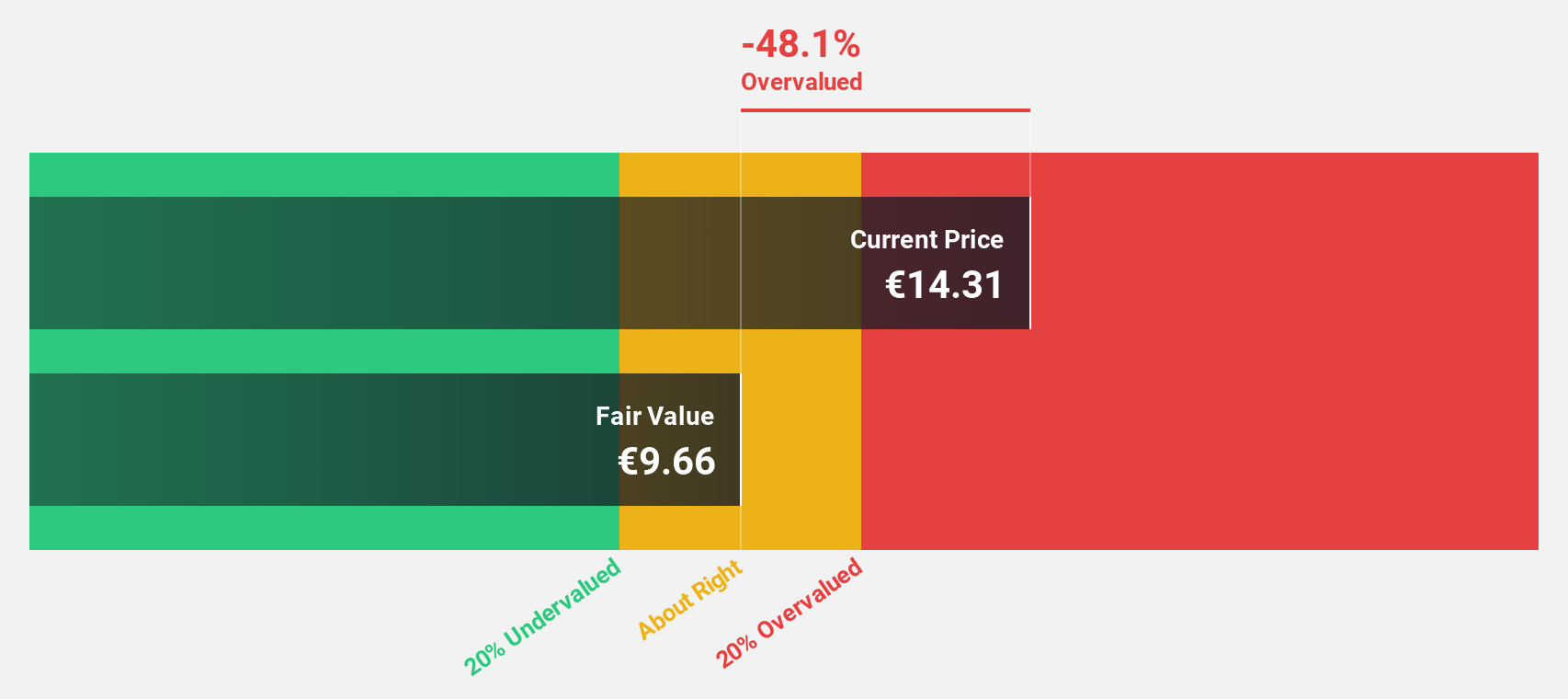

Estimated Discount To Fair Value: 40%

OVH Groupe is trading at €8.74, significantly below its fair value estimate of €14.57, suggesting it is undervalued based on cash flows. Revenue growth is forecasted at 10.2% annually, outpacing the French market's average of 5.5%. Earnings are expected to grow substantially by over 100% per year as the company moves towards profitability in three years. However, its return on equity remains low with a volatile share price recently observed.

- According our earnings growth report, there's an indication that OVH Groupe might be ready to expand.

- Click to explore a detailed breakdown of our findings in OVH Groupe's balance sheet health report.

Make It Happen

- Get an in-depth perspective on all 20 Undervalued Euronext Paris Stocks Based On Cash Flows by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Edenred might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:EDEN

Edenred

Provides digital platform for services and payments for companies, employees, and merchants worldwide.

Reasonable growth potential slight.