- France

- /

- Capital Markets

- /

- ENXTPA:ANTIN

Investor Optimism Abounds Antin Infrastructure Partners SAS (EPA:ANTIN) But Growth Is Lacking

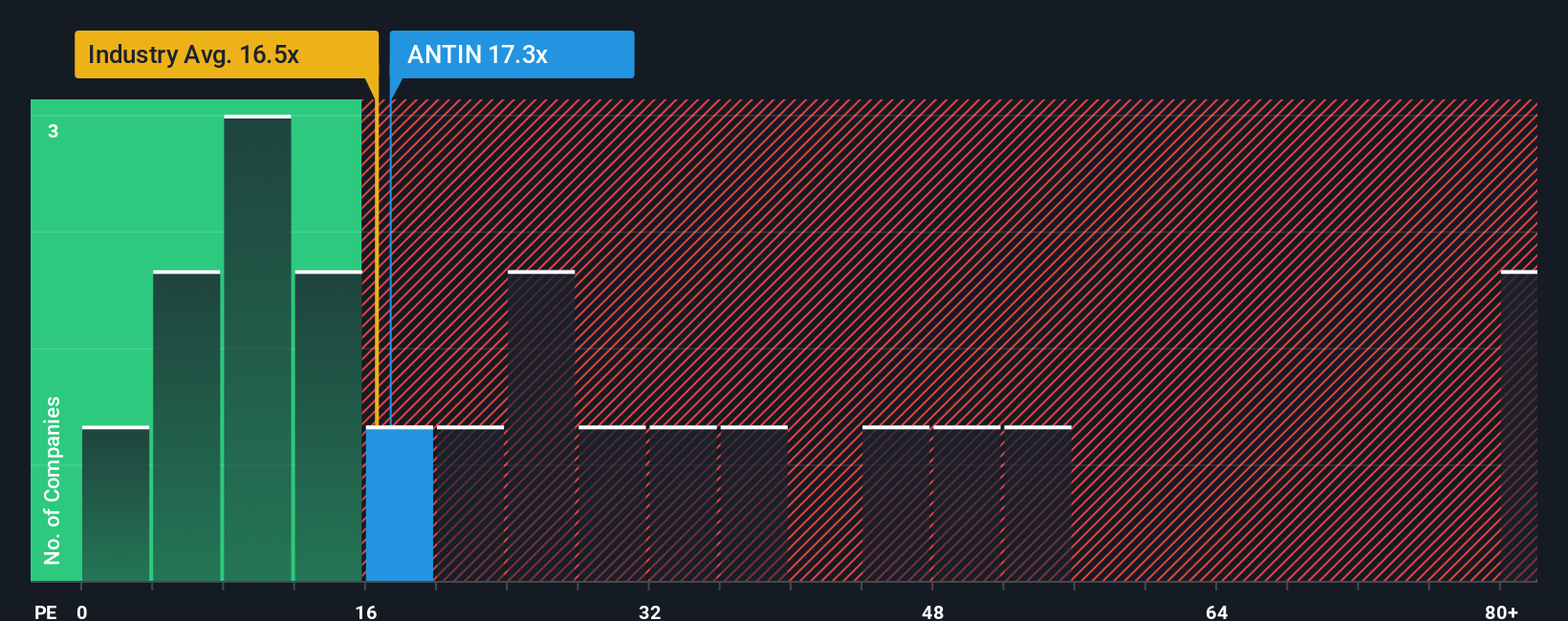

With a median price-to-earnings (or "P/E") ratio of close to 16x in France, you could be forgiven for feeling indifferent about Antin Infrastructure Partners SAS' (EPA:ANTIN) P/E ratio of 17.3x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

With earnings growth that's superior to most other companies of late, Antin Infrastructure Partners SAS has been doing relatively well. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

View our latest analysis for Antin Infrastructure Partners SAS

What Are Growth Metrics Telling Us About The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Antin Infrastructure Partners SAS' to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 73% last year. Pleasingly, EPS has also lifted 270% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Shifting to the future, estimates from the nine analysts covering the company suggest earnings should grow by 2.6% each year over the next three years. With the market predicted to deliver 14% growth each year, the company is positioned for a weaker earnings result.

With this information, we find it interesting that Antin Infrastructure Partners SAS is trading at a fairly similar P/E to the market. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Bottom Line On Antin Infrastructure Partners SAS' P/E

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Antin Infrastructure Partners SAS currently trades on a higher than expected P/E since its forecast growth is lower than the wider market. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You should always think about risks. Case in point, we've spotted 1 warning sign for Antin Infrastructure Partners SAS you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ANTIN

Antin Infrastructure Partners SAS

A private equity firm specializing in infrastructure investments.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026